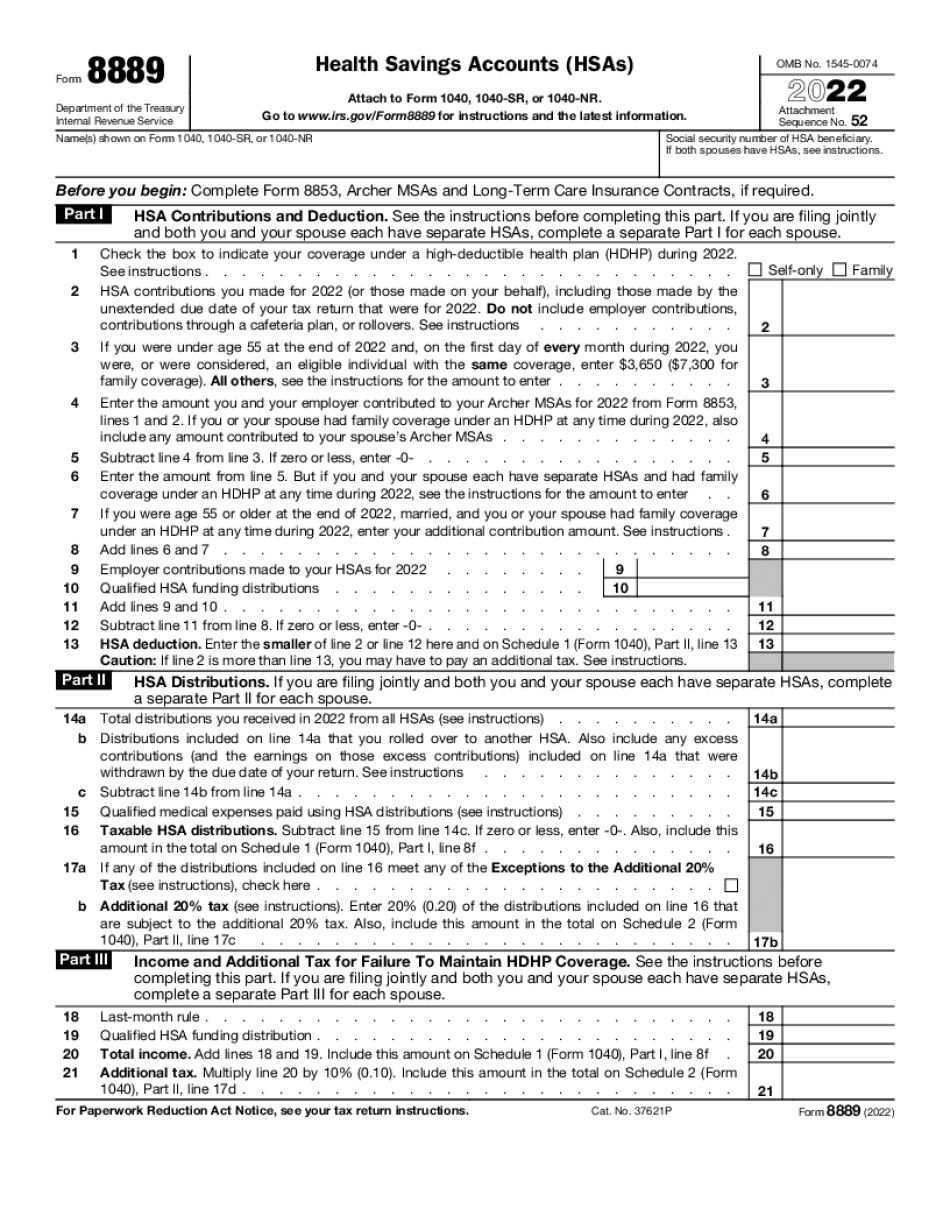

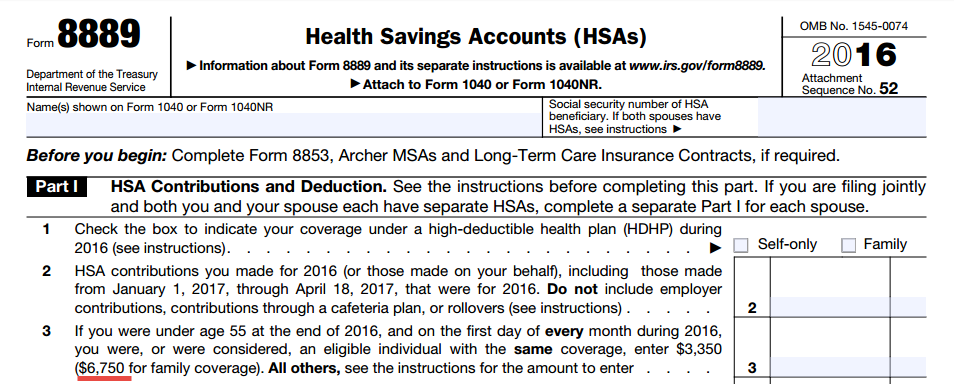

what is the 8889 t form File Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction

Use Form 8889 to Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual Additional information See Pub 969 Health Savings Accounts and Other Tax Favored Health Plans for If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make contributions to your

what is the 8889 t form

what is the 8889 t form

https://i.ytimg.com/vi/f0ldHvce_24/maxresdefault.jpg

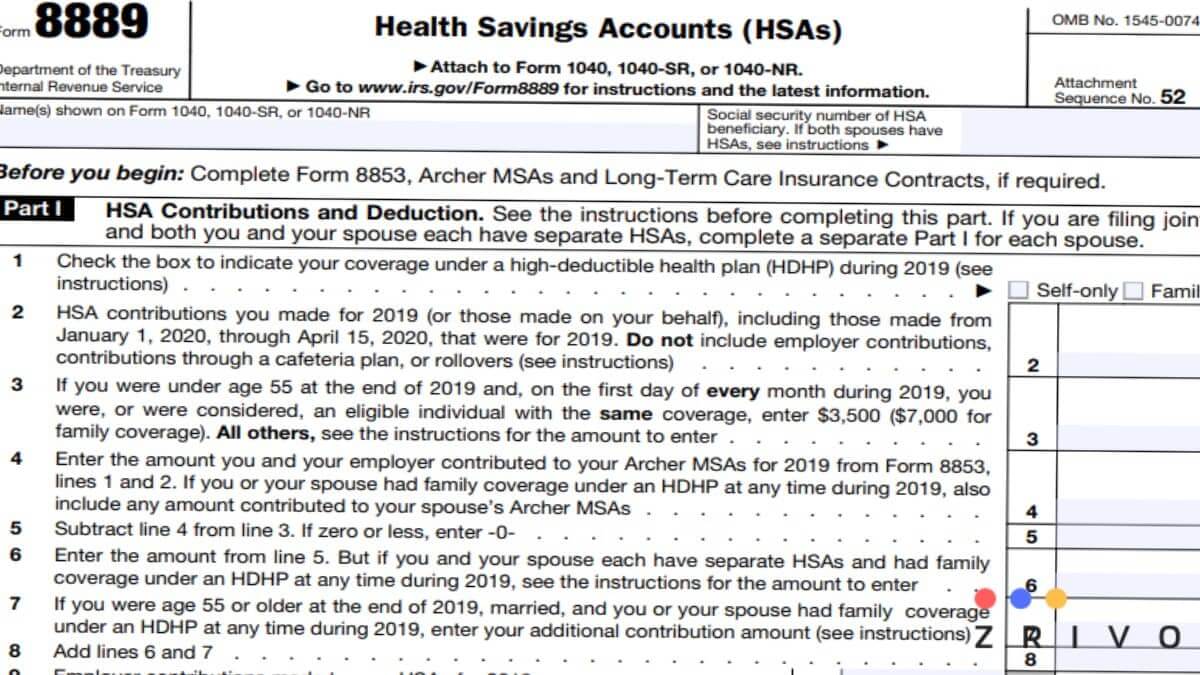

Form 8889 t Line 12 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/620/588/620588758/big.png

ng H Franck Muller Giga Tourbillon 8889 T G SQT BR

https://24kara.com/files/sanpham/22128/1/jpg/dong-ho-franck-muller-giga-tourbillon-8889-t-g-sqt-br.jpg

Form 8889 is the IRS form that helps you to do the following Report contributions to a Health Savings Account HSA Calculate your tax deduction from making HSA contributions Report distributions you took from The IRS has released the 2021 version of Form 8889 Health Savings Accounts HSAs and its instructions HSA holders and beneficiaries of deceased HSA holders must attach Form 8889 to their Forms 1040 1040

What is Form 8889 Put simply the IRS uses Form 8889 for HSA reporting If you hold an HSA account or are the beneficiary of a deceased HSA holder you re required to attach Form 8889 to your Form 1040 when filing your Form 8889 is for people with high deductible health plans to report Health Savings Account HSA contributions and distributions on their federal tax returns TurboTax

More picture related to what is the 8889 t form

8889 Form 2023 2024

https://www.zrivo.com/wp-content/uploads/2020/10/8889-Form-2021.jpg

2023 Form 8889 Printable Forms Free Online

https://hsaedge.com/wp-content/uploads/2017/03/HSA_excess_contribution_form_8889_1.png

What Is The W 8BEN e Form In Canada Blueprint Accounting

https://www.experienceyourblueprint.com/wp-content/uploads/What-is-a-W-8BEN-E-Form-Blog-Feature-IMG.png

Purpose of Form Use Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA Form 8889 T is the TurboTax designated form where the taxpayer would report the activity on his Health Savings Account HAS The spouse s activity would be reported on

What is IRS Form 8889 IRS Form 8889 Health Savings Accounts is the IRS tax form that a taxpayer will use when reporting certain activities to the Internal Revenue Service What is Form 8889 Form 8889 is used to report how your HSA will affect your taxes Here s what it covers Your HSA eligibility Total contributions made to your HSA by you

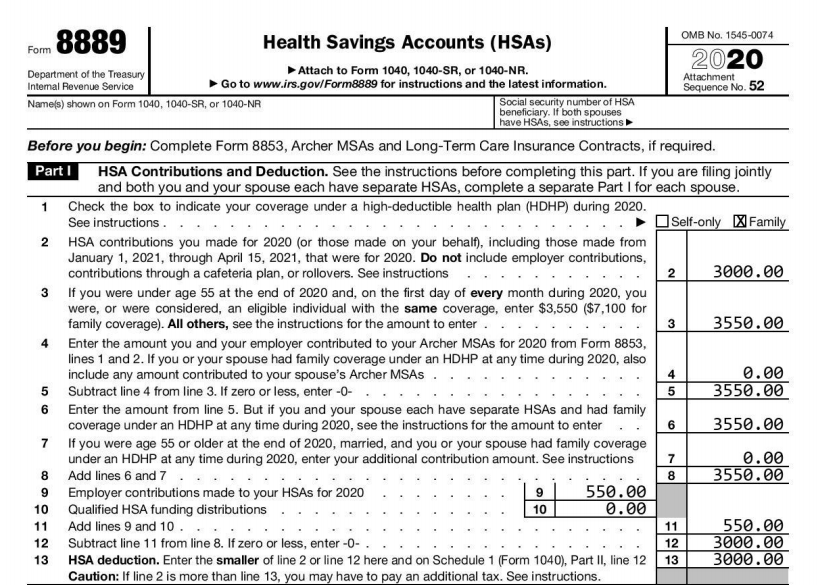

Form 8889 2023 Printable Forms Free Online

https://hsaedge.com/wp-content/uploads/2021/01/2020-form-8889-part-1-completed-easyform8889.png

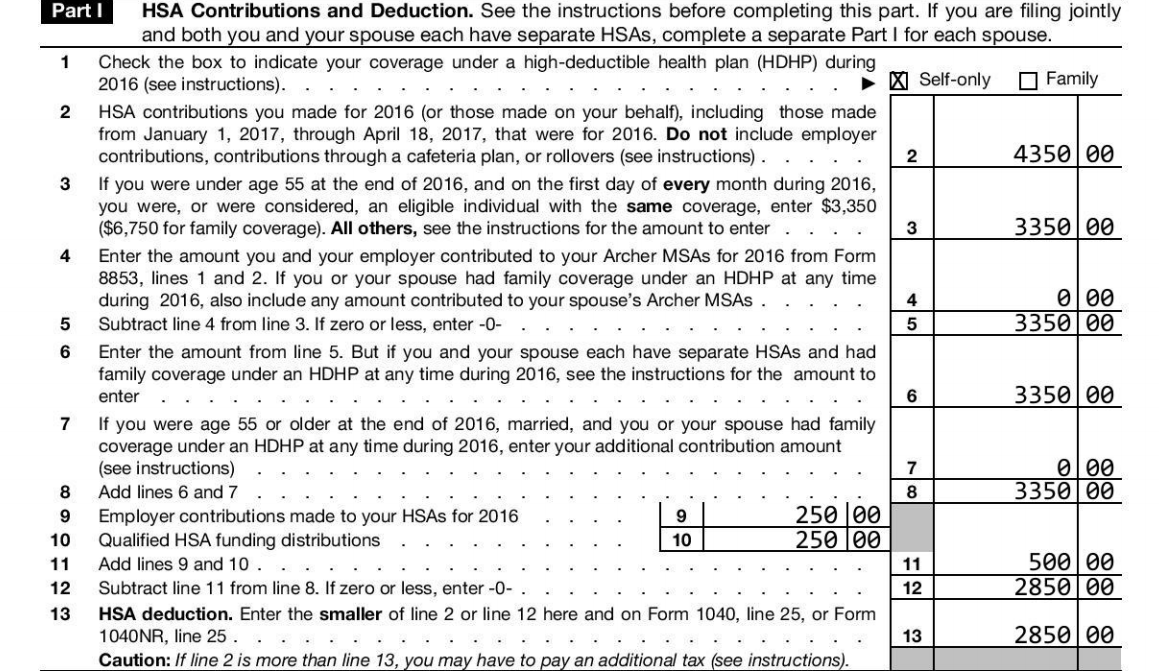

2016 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2017/01/2016_form_8889_family_contribution_amount.png

what is the 8889 t form - Form 8889 is for people with high deductible health plans to report Health Savings Account HSA contributions and distributions on their federal tax returns TurboTax