what is taxable use percentage This percentage is known as the asset s taxable use percentage The cost or opening adjustable value of an asset must be less than 1 000 before taking into

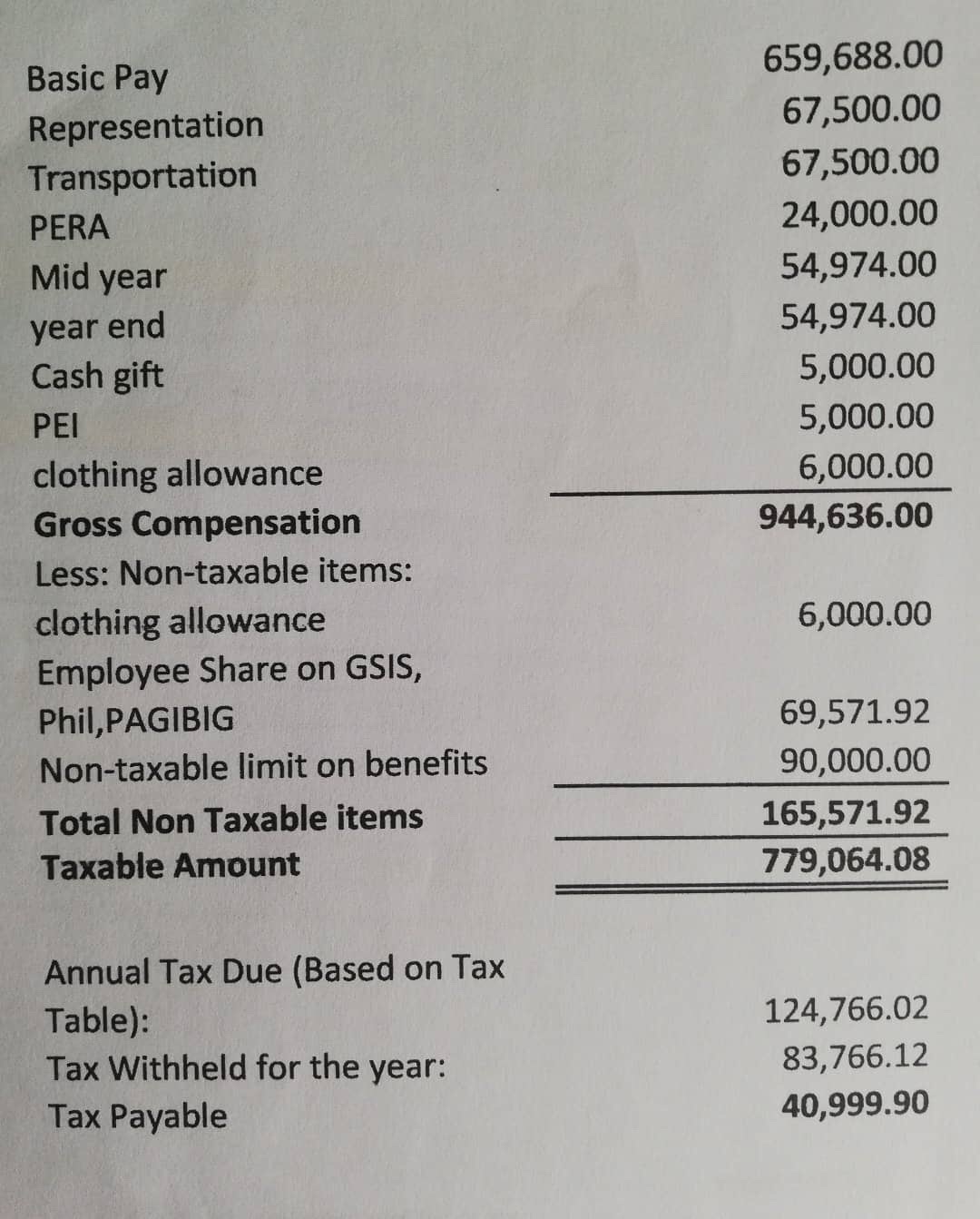

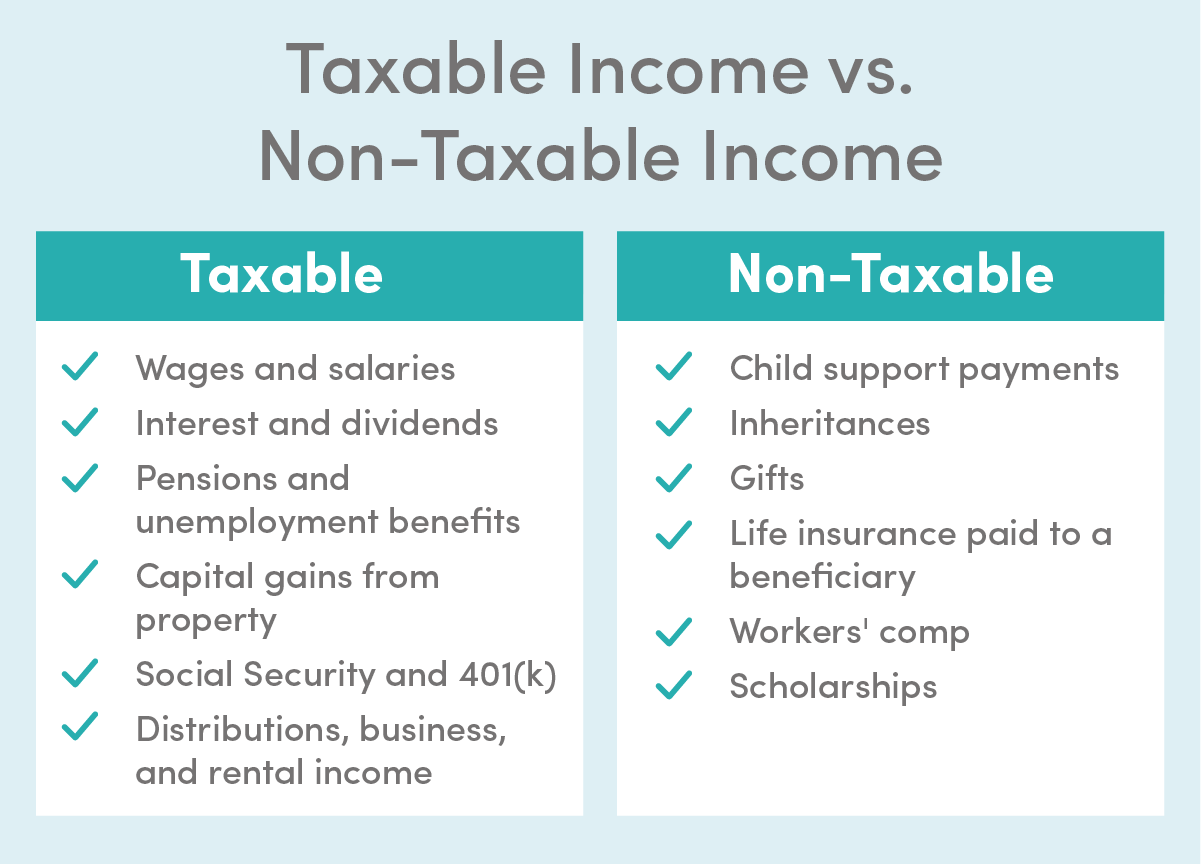

Step 1 Calculate Your Gross Income Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc To illustrate say your income for 2022 The Business Use Percentage has a direct impact on the amount of deductions that can be claimed and therefore on the amount of taxable income By maximizing their

what is taxable use percentage

what is taxable use percentage

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

IRS Tax Charts 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-chart-cmh-3.jpg

The taxable use percentage must be estimated and can t be varied Low Value Pool Depreciation rates Diminishing Value Method Only Low Cost First Year year of acquisition LCA 18 75 As she only partly uses the laptop for businesses purposes she calculates her deduction for the 2025 26 income year by multiplying the decline in value for the

This percentage is known as the asset s taxable use percentage It is this taxable use percentage of the cost or opening adjustable value that is written off Lucy intends to use the printer 80 for taxable purposes in the first year that she has it 70 in the second and 60 in the third A reasonable estimate of the

More picture related to what is taxable use percentage

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

What Business Income Is Not Taxable

https://bridefeed.com/wp-content/uploads/2021/08/What-business-income-is-not-taxable.jpg

How Federal Income Tax Rates Work Full Report Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

Yes both of the work from home expense methods actual cost method and 67 cents per hour fixed rate method allow you to claim your laptop or computer separately to boost your tax refund Read about claiming If you purchased a smartphone tablet or other electronic device outright you can also claim a deduction for a percentage of the cost based on your work related usage If the item

This estimate is known as the asset s taxable use percentage It is this taxable use percentage of the cost or opening adjustable value that is written off through the low A tax bracket is a range of taxable income that is subject to a specific tax percentage The brackets used to calculate your income tax depend on your filing

Taxable Income Formula Financepal

https://www.financepal.com/wp-content/uploads/2021/05/Taxable-Income-Formula-_Graphic-1.png

Federal Income Tax FIT Payroll Tax Calculation YouTube

https://i.ytimg.com/vi/Bpta4olQddw/maxresdefault.jpg

what is taxable use percentage - Lucy intends to use the printer 80 for taxable purposes in the first year that she has it 70 in the second and 60 in the third A reasonable estimate of the