what is subsistence allowance A dispensation needs to be in place to use these rates otherwise you claim for receipts Even with the benchmark rates a meal needs to have been purchased to qualify Claims are restricted to three meals per day i e 6AM 5 10 hours 10 or 10 hours 10 8pm 15 Where the 6AM and 8PM form any regular pattern they will be disallowed

In the case of fuel there is specific provision for VAT to be claimed based on a rate related to engine size The employees still need to provide receipts though For things like subsistence payments and incidental overnight expenses you can claim the VAT but only based on actual expenditure supported by receipts Edit the reasonableness test is for the subsistence as the OP rightly stated in the heading I ve realised you re talking about the hotel itself That s just the standard W E test still talking about sole trader 2 or 5 doesn t matter if the cost is W E it s deductible Thanks 0

what is subsistence allowance

what is subsistence allowance

https://s2.studylib.net/store/data/012300223_1-11808a9da8e282c8cb9ed0450e36e1bd.png

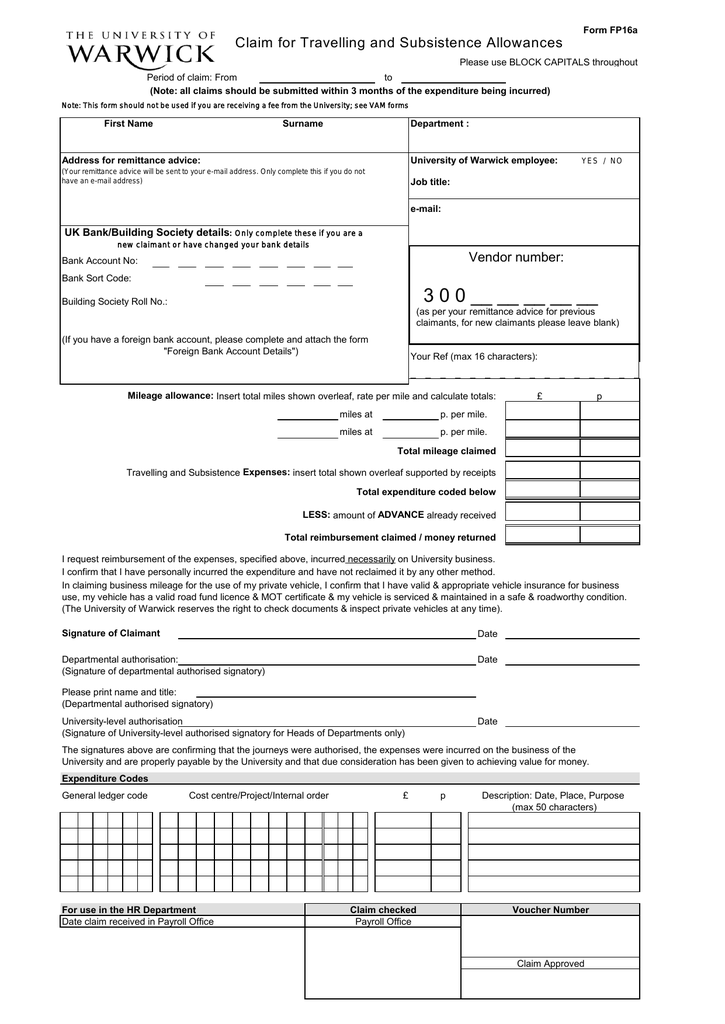

Subsistence Allowance

https://imgv2-2-f.scribdassets.com/img/document/62405930/original/68e9a512e7/1572647395?v=1

Subsistence Allowance During Suspension Is Part Of Article 21 YouTube

https://i.ytimg.com/vi/XV7HL9fl0ik/maxresdefault.jpg

05th Dec 2012 15 19 subsistence allowance Unfortunately HMRC s view is that there is no such allowance for the self employed They rely heavily on the tax case of Caillebotte v Quinn see HMRC s guidance at BIM37920 that the meal is in order to live not to work so fails the wholly and exclusively test A client who is the sole director of a limited company which will probably be caught by the IR35 rules pays himself 5 per day subsistence allowance for the three days a week he works away in London on his main contract I know under the IR35 rules subsistence will be an allowable expense

A deduction is however allowable for reasonable expenses on food and drink for consumption by the trader either at a place to which the trader travels in the course of the trade or while travelling in the course of the trade if certain conditions are satisfied A deduction must be allowable for the cost of travelling to the place or would Section 57A basically says that if your travel expenses are allowable then your subsistence is allowable The supermarket shop is highly suspect though as you can t claim for home prepared food it s not subsistence It s called taking a packed lunch Thanks 2 Replying to The Dullard By Finding Accounting

More picture related to what is subsistence allowance

1 ADAPTATION SUBSISTENCE ALLOWANCE Download Table

https://www.researchgate.net/profile/Gerlinde_Verbist/publication/242585931/figure/tbl16/AS:668849351434241@1536477520180/1-ADAPTATION-SUBSISTENCE-ALLOWANCE.png

BAS Rates Basic Allowance For Subsistence

https://collegerecon.com/wp-content/uploads/2018/10/basic-allowance-for-subsistence.jpg

Daily Subsistence Allowance

https://euemployment.eu/wp-content/uploads/2022/05/European-Commission-daily-subsistence-allowance-768x432.jpg

Is claim meant to mean claim tax relief for real expenditure or just write down 10 a day because the employees claim 10 a day with no proof from the employer Is he running a company MAKES A DIFFERENCE Ask a question with real detail you may get a Subsistence allowances are debatable unless the employee is working a significant distance away from their base whether base is home or business premises I would not claim subsistence There is always a gamble because of the case law which excludes claims for expenses where there is a duality of purpose

[desc-10] [desc-11]

Subsistence Farming

https://cff2.earth.com/uploads/2019/08/05173747/woman-2606803_1280.jpg

6 Subsistence Allowance Synonyms Similar Words For Subsistence Allowance

https://thesaurus.plus/img/synonyms/860/subsistence_allowance.png

what is subsistence allowance - [desc-13]