What Is Section 44ad - Worksheets are currently important tools utilized in a wide range of activities, consisting of education and learning, commerce, and personal administration. They provide structured layouts that support understanding, planning, and decision-making across various degrees of complexity, from basic math issues to elaborate organization examinations.

What Is Section 44AD Of Income Tax Act YouTube

What Is Section 44AD Of Income Tax Act YouTube

Worksheets are organized files that help systematically set up information or jobs. They supply a visual representation of ideas, enabling individuals to input, manage, and examine information properly. Whether used in school, conferences, or individual setups, worksheets simplify procedures and improve performance.

Worksheet Varieties

Understanding Equipment for Kids

Worksheets play a critical function in education, functioning as useful tools for both instructors and students. They include a range of activities such as math troubles and language tasks, allowing for practice, reinforcement, and evaluation.

Printable Company Tools

Worksheets in the corporate sphere have different purposes, such as budgeting, task monitoring, and evaluating information. They assist in notified decision-making and monitoring of goal achievement by companies, covering economic reports and SWOT evaluations.

Specific Activity Sheets

On a personal degree, worksheets can assist in goal setting, time management, and habit tracking. Whether preparing a budget, arranging a day-to-day timetable, or keeping an eye on health and fitness development, individual worksheets offer structure and responsibility.

Benefits of Using Worksheets

Worksheets offer countless benefits. They promote involved understanding, increase understanding, and nurture analytical thinking capacities. Moreover, worksheets support structure, rise efficiency and make it possible for teamwork in group scenarios.

SECTION 44AD TAX AUDIT IF PROFIT IS LOWER THAN 8 OR 6 TaxAware

FAQs Introduction Applicability Of Tax Audit A Y 2022 23

Section 44AD For Small Businesses Its Features Eligible

Role Of Designated Partner In LLP Vakilsearch Blog

5 Years Mandatory Audit Rule U s 44AD Is Not Applicable If The Person

Is Section 44AD Applicable To LLP

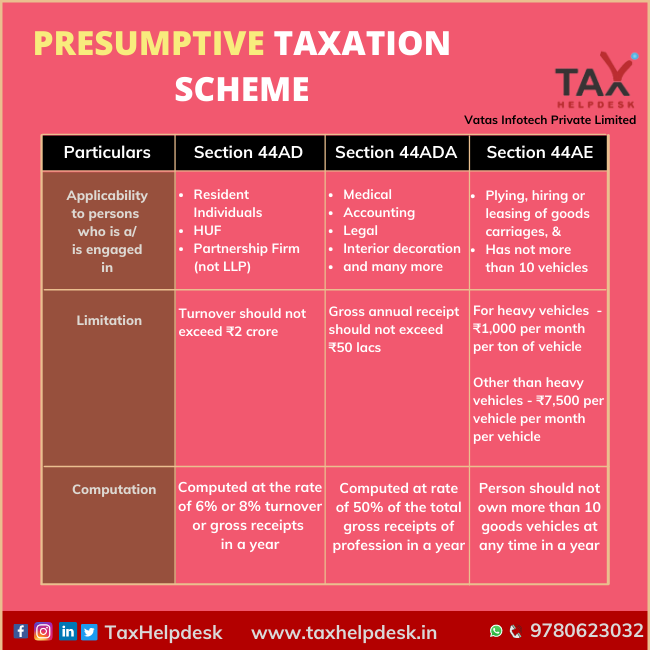

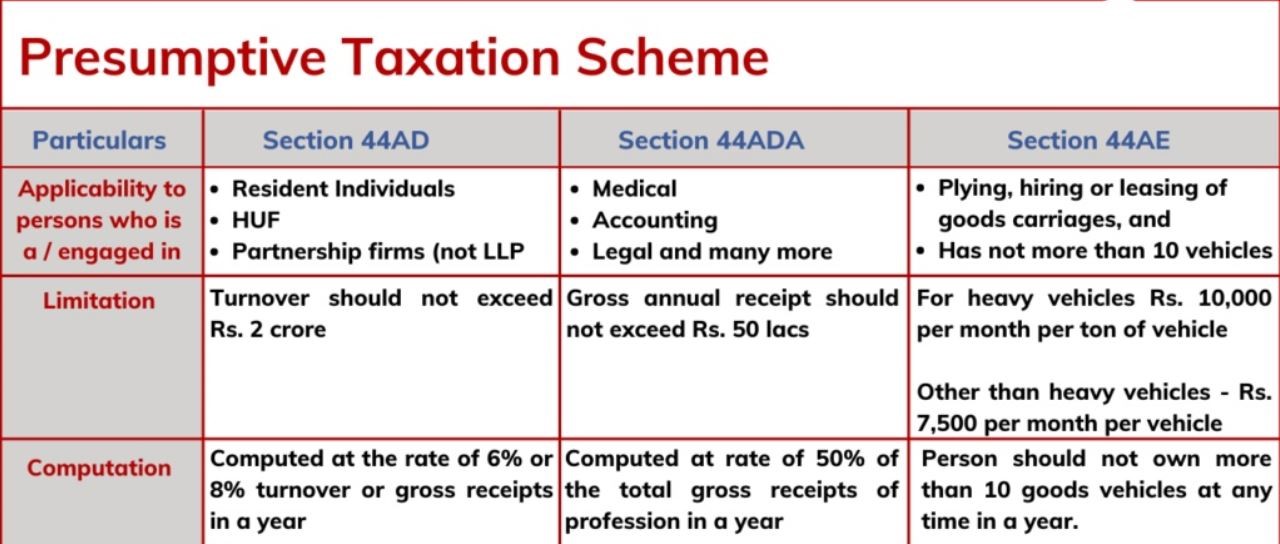

Presumptive Taxation Scheme All You Need To Understand

Section 44AD Presumptive Tax For Businesses Linkage With Tax Audit U

Presumptive Taxation Scheme U s 44AD 44ADA 44AE RJA

Section 44AD 44ADA Presumptive Taxation In 2023 Taxwink