What Is Section 269t Of Income Tax Act - Worksheets have actually progressed right into functional and necessary tools, accommodating varied demands throughout education and learning, business, and personal monitoring. They supply organized styles for various activities, ranging from fundamental math drills to complex business assessments, hence simplifying understanding, planning, and decision-making processes.

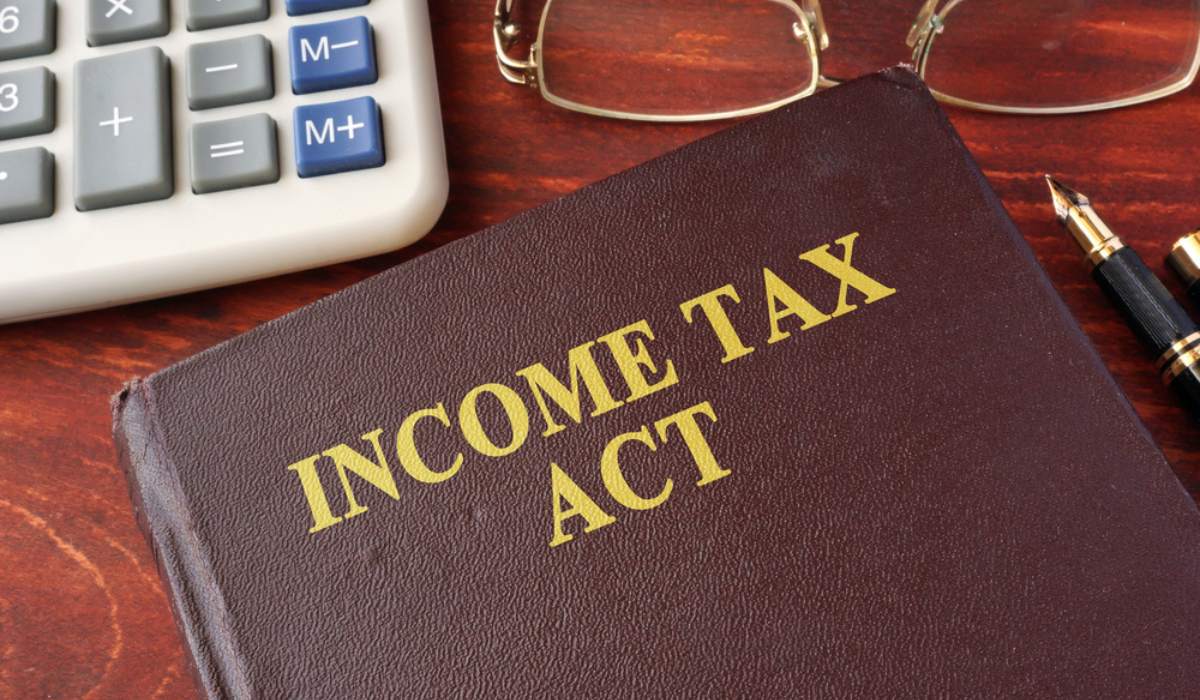

Section 13 OF THE INCOME TAX ACT

Section 13 OF THE INCOME TAX ACT

Worksheets are structured papers used to arrange information, info, or tasks systematically. They use a visual representation of principles, permitting individuals to input, adjust, and assess data successfully. Whether in the class, the boardroom, or in your home, worksheets simplify processes and improve performance.

Kinds of Worksheets

Educational Worksheets

Worksheets play a crucial role in education, acting as valuable devices for both teachers and students. They incorporate a range of activities such as math issues and language jobs, enabling practice, reinforcement, and examination.

Company Worksheets

In the business world, worksheets offer multiple functions, including budgeting, task planning, and information analysis. From monetary statements to SWOT analyses, worksheets assist organizations make notified choices and track development towards objectives.

Personal Worksheets

Individual worksheets can be an important device for attaining success in various aspects of life. They can aid people set and work towards goals, handle their time efficiently, and check their development in locations such as fitness and finance. By providing a clear structure and feeling of responsibility, worksheets can aid individuals stay on track and attain their purposes.

Benefits of Using Worksheets

The advantages of using worksheets are manifold. They promote active knowing, improve understanding, and foster essential thinking skills. Additionally, worksheets motivate organization, enhance productivity, and assist in cooperation when used in team settings.

What Is Section 10AA Of Income Tax Act Ebizfiling

Section 269T Of Income Tax Act 1961

Know About Section 43B In Income Tax Act 1961

Section 143 2 Of Income Tax Act All You Need To Know

What Is Section 269SU Of The Income Tax Act Ebizfiling

Section 115A Of Income Tax Act A Comprehensive Guide Thetaxmaster in

What Is Section 269T Section 269SS Of The Income Tax Act

Section 27 Of The Income Tax Act Sorting Tax

Section 194Q Of Income Tax Act Applicability TDS Rate

PDF Section 194N Income Tax Act PDF Download InstaPDF