what is medical treatment of specified diseases 80ddb Section 80DDB of the Income Tax Act in India provides deductions for expenses incurred on the medical treatment of specified diseases like cancer dementia motor neuron diseases Parkinson s disease AIDS and chronic

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been Medical Treatments Allowed Under Section 80DDB Section 80DDB specifies the following medical ailments and diseases for which tax deductions can be availed Diseases that are neurological in nature such as Ataxia Dementia Aphasia

what is medical treatment of specified diseases 80ddb

what is medical treatment of specified diseases 80ddb

https://www.mastersindia.co/_next/image/?url=https:%2F%2Fcdn.mastersindia.co%2Fwebsite%2Fauthors%2FWhatsApp_Image_2022-01-21_at_12.21.18_PM.jpeg&w=828&q=75

What Are Sections 80DD 80DDB And 80U All About Rupiko

https://rupiko.in/wp-content/uploads/2023/01/Section-80DD-80DDB-80U-1024x510.png

Seven Income Tax Benefits For Senior Citizens Only Chandan Agarwal

https://cachandanagarwal.com/wp-content/uploads/2022/06/income-tax-benefits-for-super-senior-citizens-1024x538.jpeg

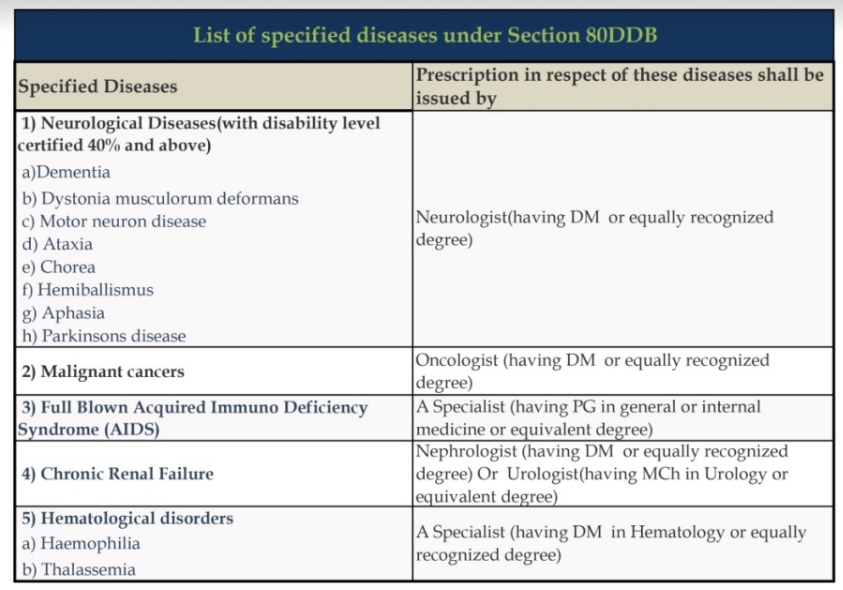

Deduction under Section 80DDB is allowed for Medical Treatment of the following specified diseases Neurological Diseases Malignant Cancers Full blown Acquired Immuno Deficiency Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable

As per rule 11DD of the Income Tax Rules medical treatment of only the following specified disease or ailments is allowed as a deduction under section 80DDB a Tax saving What is Section 80DDB Section 80DDB offers a beneficial tax deduction for medical expenses for treatment of specified diseases

More picture related to what is medical treatment of specified diseases 80ddb

Section 80DDB Deductions For Specified Diseases And Ailments

https://moneytek.in/wp-content/uploads/2023/01/income-tax-exemption-under-80ddb.jpg

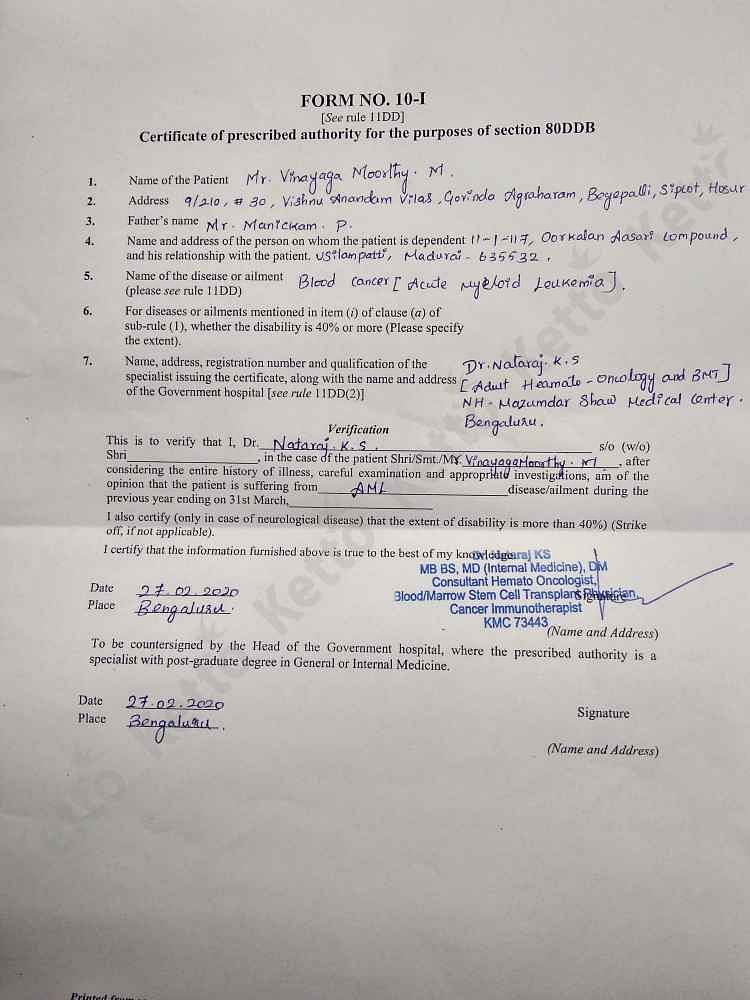

Medical Treatment 80DDB PDF

https://imgv2-1-f.scribdassets.com/img/document/620916218/original/b6f6c966b6/1687754728?v=1

Understanding The 80DDB Medical Treatment Of Specified Disease List A

https://www.knbbs.com/wp-content/uploads/2023/05/5-Hidden-Gems-to-Discover-in-Europe.jpg

Section 80DDB of the Income Tax Act 1961 provides for deductions for expenditure incurred towards medical treatment for specified diseases in case of individual or HUF Section 80DDB of the Income Tax Act talks about deduction from total income for expenditures incurred on medical treatment of self or a dependent relative The tax relief under this section

Section 80DDB of Income Tax Act covers deductions on expenses incurred while availing medical treatment for specific ailments or disorders It states that if an individual or HUF has incurred Section 80DDB of the Income Tax Act in India provides a deduction for individuals and Hindu Undivided Families HUFs in respect of expenses incurred for the medical treatment of

I Need Your Urgent Support For My Acute Myelomonocytic Leukemia

https://d1vdjc70h9nzd9.cloudfront.net/media/campaign/212000/212733/image/5efd8f328c4c8.jpeg

Benefits Available For Senior Citizens Under IT Act 1961

https://www.caclubindia.com/editor_upload/671907_20230411095849_screenshot_2_.png

what is medical treatment of specified diseases 80ddb - Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while computing the taxable