what is itr 1 2 3 4 5 6 and 7 ITR Filing is a legal requirement for all the assessee s who have income above basic exemption limit before claiming deduction u s 80C to 80U There are 7 forms to

The deadline to file Income Tax Returns ITR for FY 2022 23 is 31st July 2023 Online filing for ITRs 1 and 4 has been enabled Under presumptive scheme of taxation a taxpayer is presumed to have earned a minimum income expressed as percentage of gross receipts of business or profession or as a fixed amount based on number

what is itr 1 2 3 4 5 6 and 7

what is itr 1 2 3 4 5 6 and 7

https://emailer.tax2win.in/assets/guides/itr/itr-v-acknowledgement-1.jpg

Which ITR Form To File Types Of ITR ITR1 ITR2 ITR3 ITR4 ITR5 ITR6

https://i.ytimg.com/vi/Lie8SWmuEn0/maxresdefault.jpg

Types Of ITR Which ITR Should I File GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/cdn-uploads/20230210110107/TYPES-OF-ITR.png

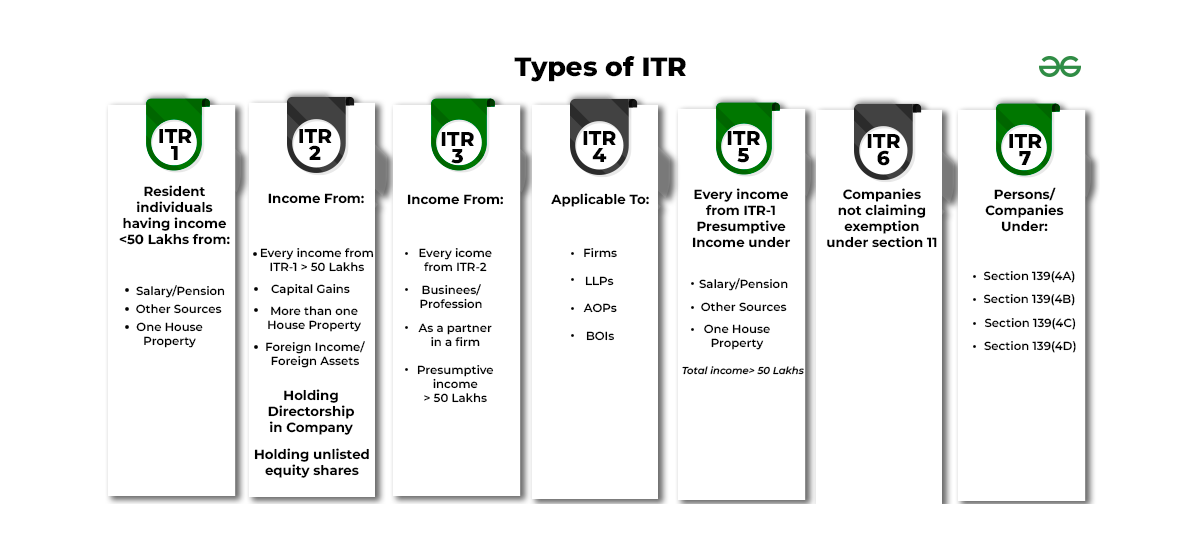

To make return filling easier the taxing authority has identified seven types of ITR forms They are ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7 Individuals should file using the suitable form depending on their income residential status and type of business they run Know Complete Information on All Seven types of Income Tax Return ITR Forms Also Know which ITR Form Should File when Filing for AY 2024 25

ITR 1 is for salaried individuals with an income up to Rs 50 lakh while ITR 2 is for a wider range of individuals like NRIs and HUFs Key differences between the two forms include income thresholds sources and property ownership ITR is a prescribed form through which you communicate the details of your income earned deductions claimed and taxes paid in a financial year to the Income Tax Department It also allows you to carry forward the losses and claim a refund from the Income Tax Department

More picture related to what is itr 1 2 3 4 5 6 and 7

Which ITR Should I File Types Of ITR Forms Which One Should You File

http://cleartax-media.s3.amazonaws.com/cleartax/images/1657091719_frame17.jpg

ITR 1 ITR 2 What Is The Difference Between ITR 1 And ITR 2

https://img.etimg.com/thumb/msid-93226496,width-1070,height-580,imgsize-681447,overlay-etwealth/photo.jpg

What Is ITR 1 ITR 2 ITR 3 And ITR 4 Leegaly

https://www.leegaly.com/wp-content/uploads/2020/11/Tax-returns.jpg

The article explains differences between ITR 1 and ITR 4 forms highlighting eligibility and ineligibility criteria Filing ITR is crucial for nation building loan processing loss carry forwards and TDS claims ITR 4 is used to report revenue from a company with a turnover of up to Rs 2 crore that is subject to section 44AD taxation In addition ITR 4 is for revenue from an occupation with a turnover of up to Rs 50 lakh that is subject to section 44ADA taxation

Currently these forms are named ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7 Which type of ITR needs to be filed depends on the taxpayer s income sources amount of income earned and the taxpayer s category Here is a brief explanation of different ITR types FAQs on ITR 7 Question 1 Who can file ITR 7 Clarification ITR 7 Form can be used by persons including companies who are required to furnish return under section 139 4A or section 139 4B or section 139 4C or section 139 4D The category of persons whose income is unconditionally exempt under various clauses of section 10 and who are not

Types Of Itr Forms My XXX Hot Girl

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/64d6f418-6dfb-4afa-86c7-135fe6aed4ed.jpg

Definition Meaning Of ITR Forms Tax2win

https://emailer.tax2win.in/assets/guides/itr-forms/itr-form.jpg

what is itr 1 2 3 4 5 6 and 7 - ITR 1 ITR 2 ITR 3 or ITR 7 Which form to use to file income tax return this year Jun 19 2024 By ET Online Choose the right ITR form The important part of ITR filing process is to identify the correct the income tax return form applicable to their incomes Filing income tax return using wrong ITR form will make the filed ITR as