what is gstr 1 2 3 4 5 6 GSTR 1 GSTR 1 is the return to be furnished for reporting details of all outward supplies of goods and services made In other words it contains the invoices and debit credit notes raised on the sales transactions for a tax period GSTR 1 is to be filed by all normal taxpayers who are registered under GST including casual taxable persons

GSTR 1 is a monthly or quarterly return that should be filed by every registered GST taxpayer except a few as given in further sections It contains details of all outward supplies i e sales The return has a total of 13 sections listed down as follows Tables 1 2 3 GSTIN legal and trade names and aggregate turnover in the previous year Under GST there are 13 returns The GSTR 1 GSTR 3B GSTR 4 GSTR 5 GSTR 5A GSTR 6 GSTR 7 GSTR 8 GSTR 9 GSTR 10 GSTR 11 CMP 08 and ITC 04 Filing requirements change according to the type of taxpayer and registration Companies with more than Rs 5 crore in revenue are required to submit Form GSTR 9C

what is gstr 1 2 3 4 5 6

what is gstr 1 2 3 4 5 6

https://ebizfiling.com/wp-content/uploads/2022/12/Difference-between-GSTR-1-and-GSTR-3B.jpg

What Is GSTR 2B I Difference Between GSTR 2A GSTR 2B I ITC Matching Tool YouTube

https://i.ytimg.com/vi/p1CY3kqR1nU/maxresdefault.jpg

What Is GSTR 1 Format How To File GSTR 1 Tally Solutions

https://resources.tallysolutions.com/wp-content/uploads/2019/11/gstr-1-format-other-details.jpg

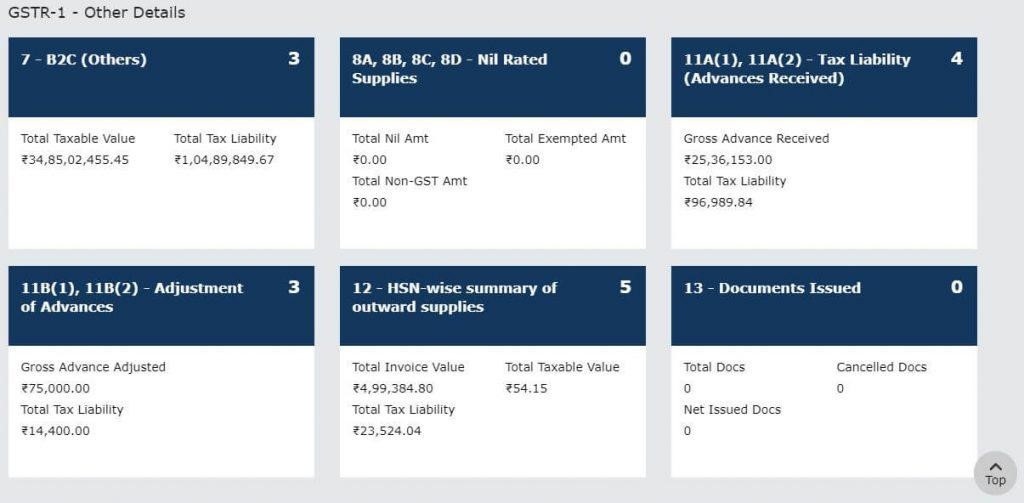

The GSTR 1 format in GST portal is as follows How to file GSTR 1 form The GSTR 1 form consists of the following tables in which the details of outward supplies need to be furnished by the registered businesses Table 1 2 3 Details of GSTIN and aggregate turnover in the preceding year 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

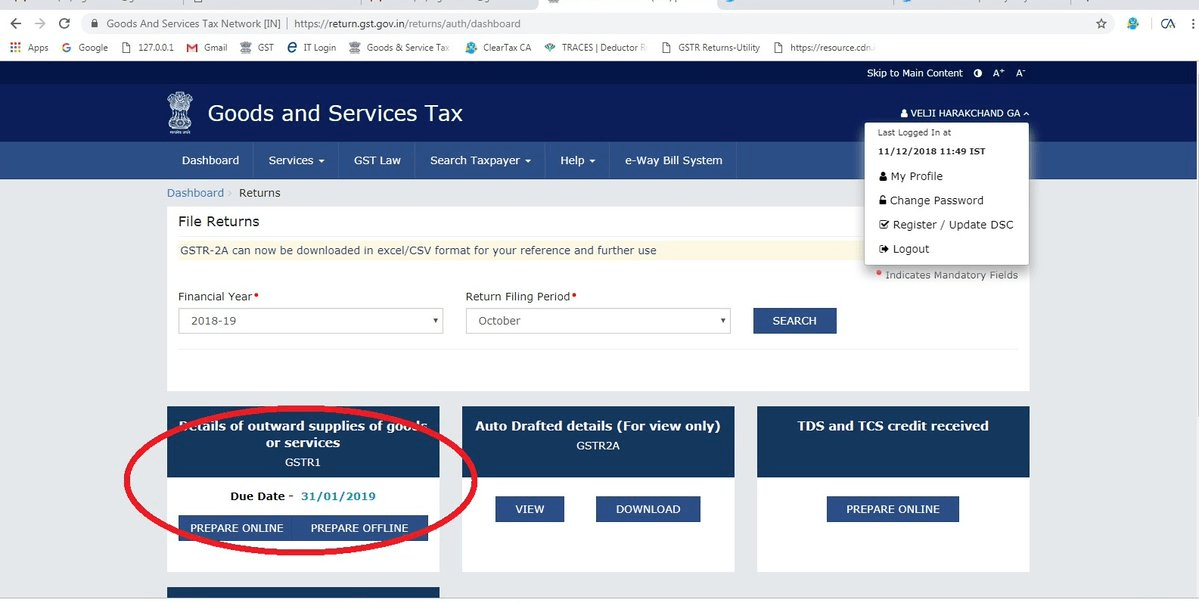

4 EM Signer version 2 6 must be installed on the computer 5 The DSC Dongle must be connected to the computer 41 Will a taxpayer receive notice if he does not file Form GSTR 1 by due date Yes he will receive a system generated return defaulter notice in format 3A if he fails to file Form GSTR 1 by due date 42 GSTR 1 is a sales return in which every GST registered dealer has to file the details of sales outward supplies Find out when how to file GSTR 1 more

More picture related to what is gstr 1 2 3 4 5 6

GSTR 4 What Is GSTR 4 In GST Computerguidehindi India s No 1 Computer Educational

https://1.bp.blogspot.com/-j8D2iNyJtxQ/YDUeEH7rDQI/AAAAAAAAb3M/5obTgWTTIEYb_XQFxblvEvyDMfzJKtjDwCLcBGAsYHQ/s1280/what%2Bis%2Bgstr%2B4%2Bin%2Bhindi.jpg

What Is GSTR 1 Sharda Associates

https://shardaassociates.in/wp-content/uploads/2021/03/What-is-GSTR-1-1024x576.jpg

Difference Between GSTR1A And GSTR 3A

https://howtoexportimport.com/UserFiles/Windows-Live-Writer/Difference-between-GSTR1A-and-GSTR-3A_827B/Difference between GSTR1A and GSTR 3A_2.jpg

GSTR 1 or the Goods and Service Tax Return 1 is to be filed by each registered taxpayer every month or quarterly Details relevant to taxpayers sales outward supplies must be entered in the GSTR 1 sales return GSTR 1 or Goods and Service Tax Return 1 represents the details of all outward supplies or sales made by a business in a given month quarter Every registered entity is required to file GSTR 1 even if their sales or outward supplies amount to zero Filing Period Deadlines

GSTR 6 Return for input service distributors This return contains the details of ITC received by an Input Service Distributor and distribution of ITC GSTR 6 is to be filed before13th of next month 8 GSTR 6A Detail of supplies auto drafted from GSTR 1 and GSTR 5 to Input service distributor GSTR 1 is a monthly or quarterly return that needs to be filed by registered taxpayers under the Goods and Services Tax GST system in India The purpose of this return is to provide details of all outward supplies or sales made by the taxpayer during the return period

GSTR 1 Due Date Extended Taxscan

http://www.taxscan.in/wp-content/uploads/2018/12/GSTR-1.png

GSTR 2B Return Filing Benefits Features Comparison With GSTR 2A

https://assets1.cleartax-cdn.com/s/img/2020/08/07144325/GSTR-2B-1024x534.png

what is gstr 1 2 3 4 5 6 - The GSTR 2 is a monthly tax return showing the purchases you ve made for that month When you make purchases from registered vendors the information from their sales returns GSTR 1 will be available in the GSTN portal as GSTR 2A for you to use in your GSTR 2