what is form 8889 t turbotax You don t receive form 8889 in the mail or online it is created by TurboTax as part of your tax return process TurboTax creates one or two forms 8889 T for the primary taxpayer and 8889 S for the spouse if necessary

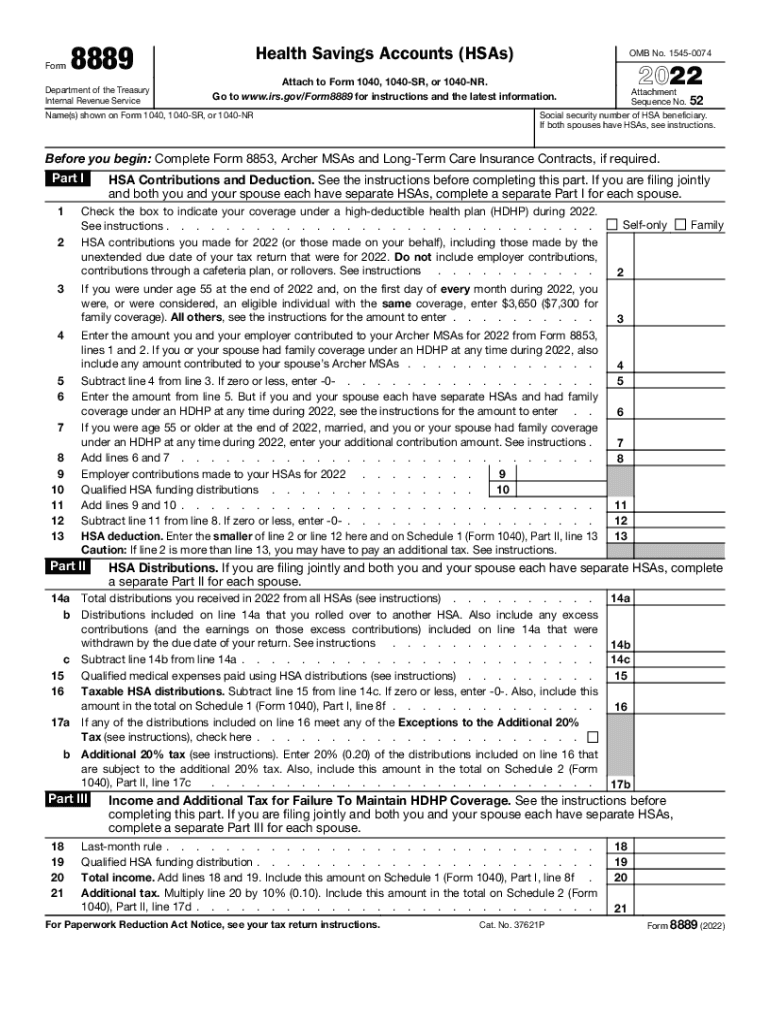

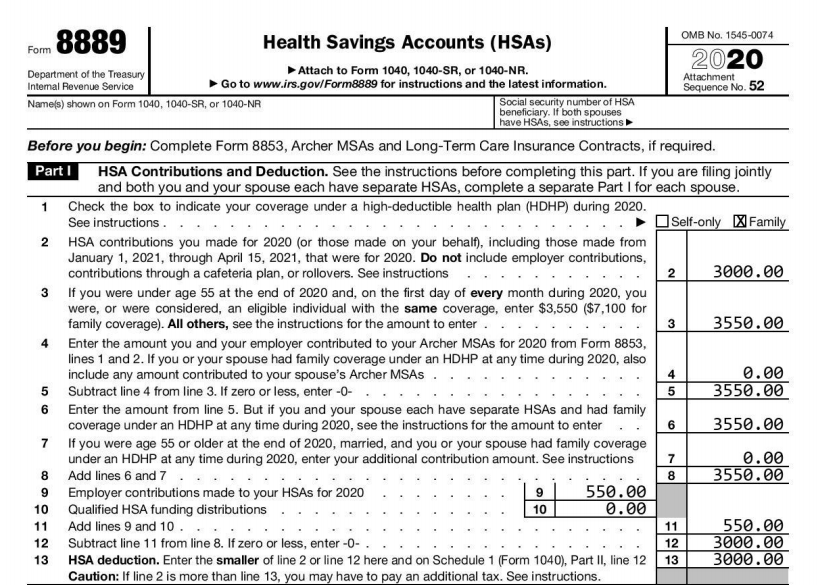

Use Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions File Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction

what is form 8889 t turbotax

what is form 8889 t turbotax

https://www.pdffiller.com/preview/620/588/620588758/large.png

TurboTax 2022 Form 1040 How To Record HSA Contributions Form 8889

https://i.ytimg.com/vi/UQOvWqjAcPE/maxresdefault.jpg

How To Complete IRS Form 8889 For Health Savings Accounts HSA YouTube

https://i.ytimg.com/vi/f0ldHvce_24/maxresdefault.jpg

First you need to clarify if you were enrolled in an FSA an HSA or both in 2020 These medical expense vehicles are separate and distinct so you can t mix match the terms as if they are equivalent Also Form 8889 is specific to What is IRS Form 8889 IRS Form 8889 Health Savings Accounts is the IRS tax form that a taxpayer will use when reporting certain activities to the Internal Revenue Service within their HSA from the prior year

What is Form 8889 Put simply the IRS uses Form 8889 for HSA reporting If you hold an HSA account or are the beneficiary of a deceased HSA holder you re required to attach Form 8889 to your Form 1040 when filing your TurboTax fills in form 8889 based on your entries in the HSA interview You get to the HSA interview by doing a Search upper right for hsa lower case and without the double quotes

More picture related to what is form 8889 t turbotax

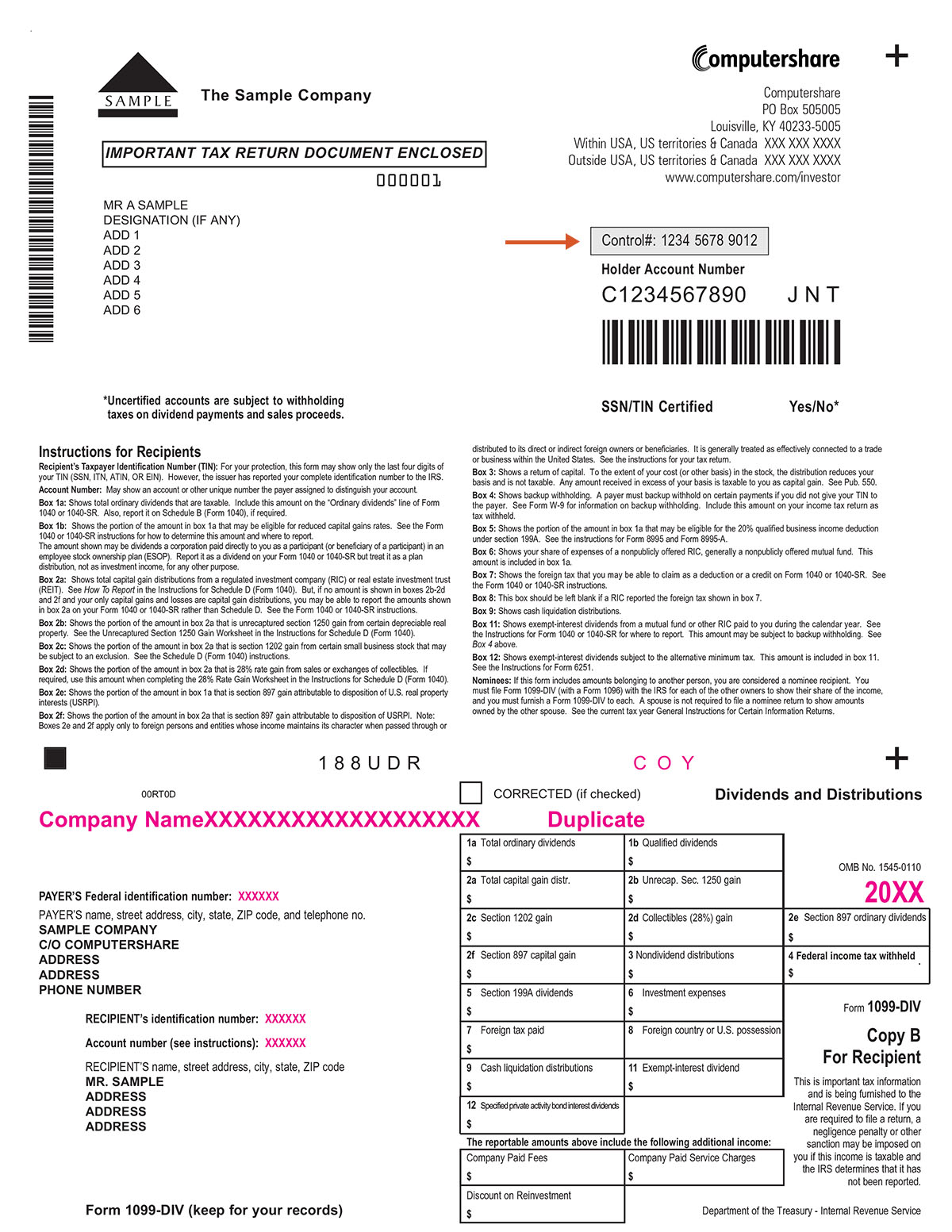

Importing Tax Data From Computershare Into TurboTax

https://content-images.computershare.com/eh96rkuu9740/194ebe9e3e7d4c3784992d4fb81a49e4/03490edb06cd780ac8d9b842f17fc806/1099.jpg

What Is An 8889 S Studio Apartment Hub

https://studioapartmenthub.com/wp-content/uploads/2022/04/What-is-an-8889-s-1536x1024.jpg

Form 8889 2023 Printable Forms Free Online

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/irs_form_8889_featured_image.png

If you contribute to an HSA or take a distribution you need to complete and file IRS Form 8889 with your tax return You have until April 15 2024 to make contributions to your Locate the Health Savings Accounts 8889 section Enter a 1 or 2 in Type of coverage 1 self only 2 family Scroll down to the Distributions section Enter the amount

What is Form 8889 Form 8889 is used to report how your HSA will affect your taxes Here s what it covers Your HSA eligibility Total contributions made to your HSA by you Getting stuck on Form 8889 T December plan type check box must have selection Question I had an HSA in 2021 high deductible insurance plan for my family and my employer and I

IRS Tax Form 8889 Explained Health Savings Accounts HSAs

https://www.dancingnumbers.com/tax/wp-content/uploads/2023/09/IRS-Tax-Form-8889-768x393.jpg

Form 8889 2023 Printable Forms Free Online

https://hsaedge.com/wp-content/uploads/2021/01/2020-form-8889-part-1-completed-easyform8889.png

what is form 8889 t turbotax - What is Form 8889 Put simply the IRS uses Form 8889 for HSA reporting If you hold an HSA account or are the beneficiary of a deceased HSA holder you re required to attach Form 8889 to your Form 1040 when filing your