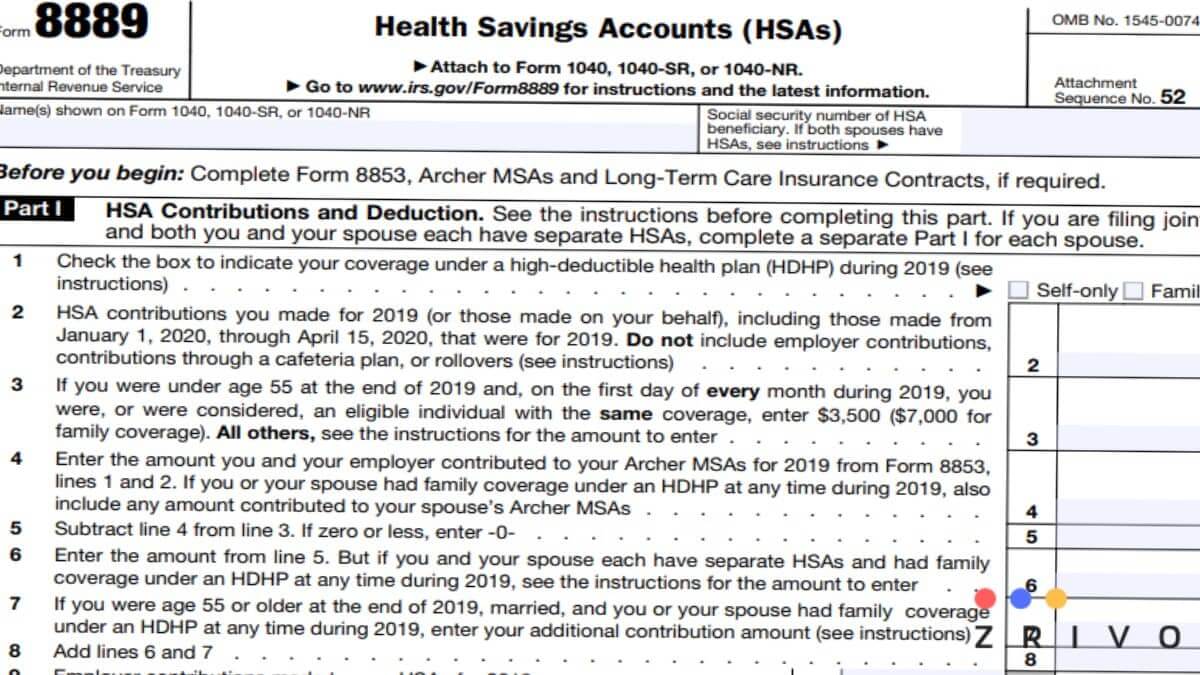

what is form 8889 t line 18 Line 18 You can use the Line 3 Limitation Chart and Worksheet in these instructions for the year the contribution was made to determine the contribution you could have made if the last month rule did not apply Enter on line 18 the

Form 8889 is the form that reports activity in your HSA Health Savings Account The answer for you depends on whether you have an HSA or not I do not have Form 8889 is the IRS form that helps you to do the following Report contributions to a Health Savings Account HSA Calculate your tax deduction from making

what is form 8889 t line 18

what is form 8889 t line 18

https://i.ytimg.com/vi/f0ldHvce_24/maxresdefault.jpg

What Is An 8889 S Studio Apartment Hub

https://studioapartmenthub.com/wp-content/uploads/2022/04/What-is-an-8889-s-1536x1024.jpg

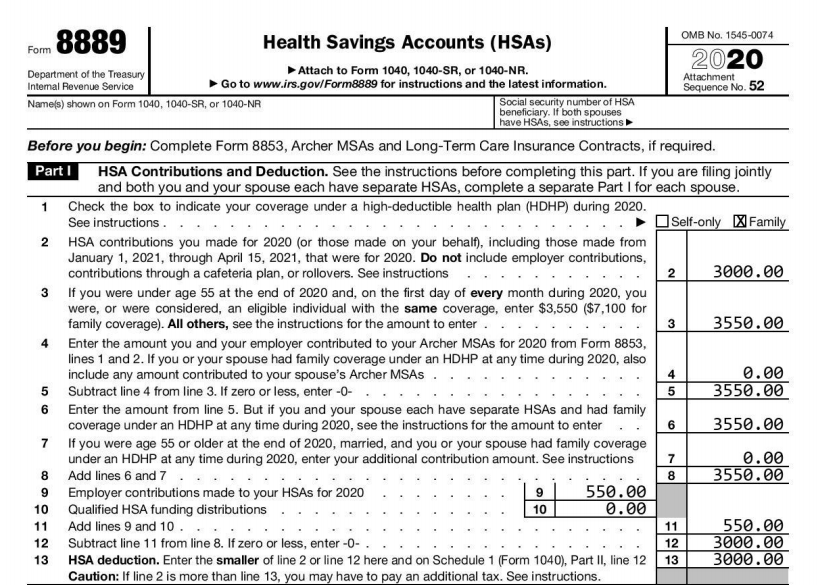

8889 Form 2023 2024

https://www.zrivo.com/wp-content/uploads/2020/10/8889-Form-2021.jpg

File Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction You can use the Health Savings Accounts 8889 section in the HSA MSA LTC Contracts 1099 SA 5498 SA screen to make entries for a health savings account in Intuit ProConnect See

If you have an HSA and HDHP coverage The section that Line 18 is in is on form 8889 in the section referring to Failure to maintain HDHP coverage TurboTax is asking for Tax form 8889 is an essential form you need to submit with your income taxes for HSA reporting Learn more here

More picture related to what is form 8889 t line 18

IRS Tax Form 8889 Explained Health Savings Accounts HSAs

https://www.dancingnumbers.com/tax/wp-content/uploads/2023/09/IRS-Tax-Form-8889-768x393.jpg

Form 8889 2023 Printable Forms Free Online

https://hsaedge.com/wp-content/uploads/2021/01/2020-form-8889-part-1-completed-easyform8889.png

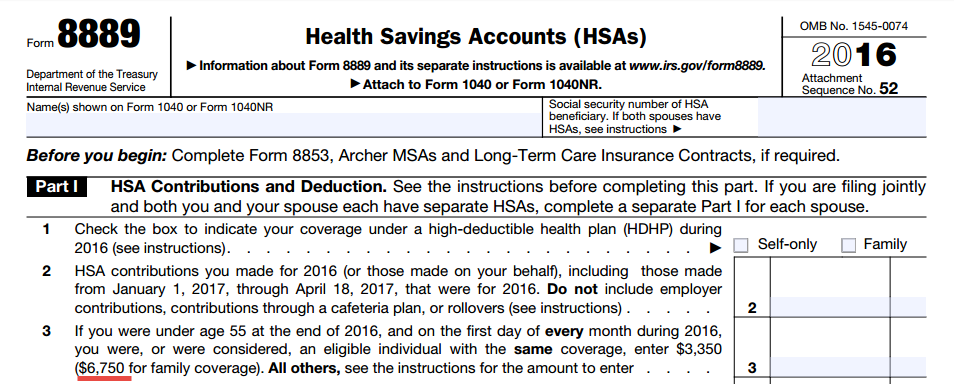

2016 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2017/01/2016_form_8889_family_contribution_amount.png

What is Form 8889 Put simply the IRS uses Form 8889 for HSA reporting If you hold an HSA account or are the beneficiary of a deceased HSA holder you re required to attach Form 8889 to your Form 1040 when filing your If you made contributions to or distributions from your HSA in 2020 you will need to file the federal tax form 8889 This form is specific and documents all of your HSA s financial activity for 2020

Purpose of Form Use Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA What should I put on Line 18 of Form 8889 where it says Last Month Rule Luckily it should be easy to figure out whether the Last Month Rule even applies to your tax

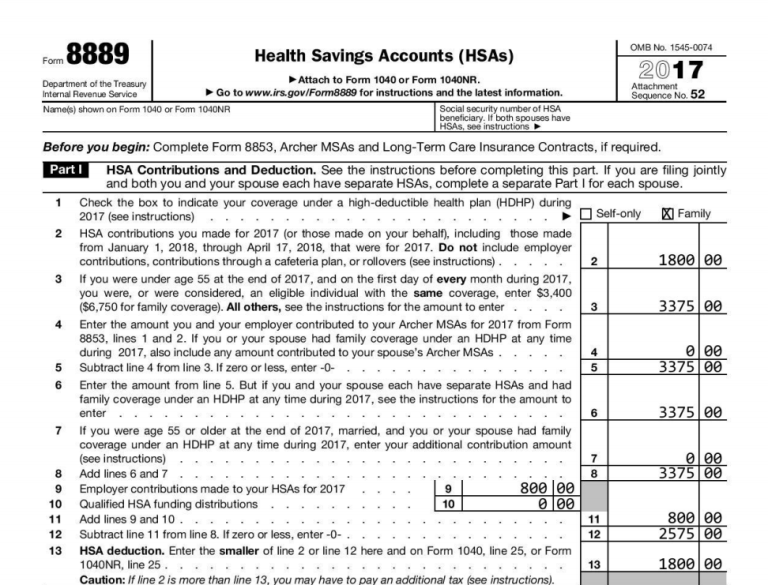

2017 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2018/02/2017-HSA-Form-8889-part-1-example-768x585.png

Form 8889 T For FSA HSA I Am SO Confused R TurboTax

https://preview.redd.it/yztwvo3btzq61.jpg?width=1080&crop=smart&auto=webp&s=dbfff5e74d807b44e8f785f9ca4db1db466444bb

what is form 8889 t line 18 - Tax form 8889 is an essential form you need to submit with your income taxes for HSA reporting Learn more here