what is form 2306 BIR Form No 2304 Download Zipped Excel Certificate of Income Payment Not Subject to Withholding Tax Excluding Compensation Income Description A Certificate to be accomplished and issued by a Payor to recipients of income not subject to withholding tax

BIR Form No 2306 Certificate of Final Income Tax Withheld A Certificate to be accomplished and issued by a Payor WA to each recipient of income subjected to final tax The column amount of payment should indicate the total amount paid and the total taxes withheld and remitted during the period BIR Form 2306 or Certificate of Final Income Tax Withheld is a tax certificate which needs to be accomplished by a withholding agent to a specific recipient whose income is subject to final tax

what is form 2306

what is form 2306

https://iflight.oss-cn-hongkong.aliyuncs.com/store/product/FPV-Motor/XING-E-Pro-2306/2306-black.png

Bir Form 2306 PDF Withholding Tax Dividend

https://imgv2-1-f.scribdassets.com/img/document/168331399/original/5e379fef4f/1629358277?v=1

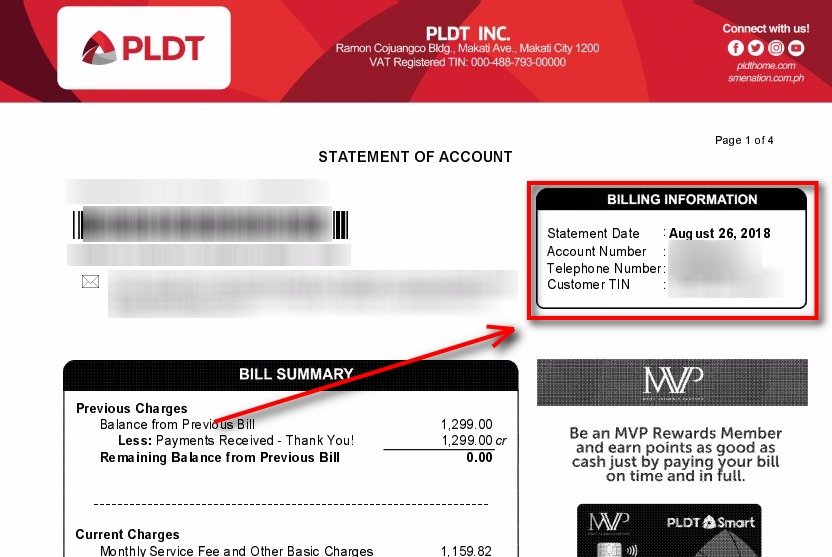

How To Pay Your Pldt Bill Using Gcash Correct Success Bank2home

https://investlibrary.com/wp-content/uploads/2018/09/How-to-pay-PLDT-bill-using-GCash-6B.jpg

Payment Form 0605 Every time that the taxpayer faces due on tax penalties or when the filer needs to make an advance payment When a business taxpayer settles annual registration fees either for a new business or renewal which should be on or before January 31st of every year BIR Form 2306 is a certificate of income tax withheld on sale of real property The form must be accomplished Bir 2306 downloadable Form by the seller and must be presented to the buyer before the sale is consummated

You may compute your income tax based on the normal graduated tax then you can get certificates BIR form 2316 or 2306 from your two employers You can attached those in your income tax return Your income subject to final tax may not be included in the computation of your income tax due but should be reflected in the ITR as The BIR Form 2307 known as the Certificate of Creditable Tax Withheld at Source is a certificate that is accomplished and issued to recipients of income

More picture related to what is form 2306

BIR Form 2316 Guidelines And Instructions 2020 KAMI COM PH

https://netstorage-kami.akamaized.net/images/bfec5cc15f00ba4e.jpg?imwidth=360

BIR Form No 2305

https://img.yumpu.com/55937108/1/500x640/bir-form-no-2305.jpg

BIR Form 2306 Withholding Tax Value Added Tax

https://imgv2-1-f.scribdassets.com/img/document/214589301/original/21bc43e2cf/1537306685?v=1

2306 January 2018 ENCS BIR Form No 2306 01 18ENCS Income Tax Fringe Benefit 1 In General for Citizen Resident Alien and Non Resident Alien Engaged in Trade or Business Within the Philippines 2 Non Resident Alien Not Engaged in Trade or Business Within the Philippines Interest Yield from Bank Deposits Deposit Substitutes Taxpayers who generate BIR Form Nos 2306 2307 and 2316 using their Computerized Accounting System CAS may still use the old versions of the said BIR Certificates for transactions covering the taxable year ending December 31 2019 pending reconfiguration of their CAS

Prepares the Creditable Tax BIR Forms 2306 2307 upon request of the creditors contractors suppliers Annually prepares the BIR Form 2316 for the city employees Reviews and Signs the BIR Forms 2306 2307 and 2316 for the city employees Releasing of the BIR Forms 2306 2307 and F2316 Commonly referred to as the Certificate of Creditable Tax Withheld At Source the BIR Form 2307 presents the income that s subjected to Expanded Withholding Tax EWT paid by the withholding agent In the accounting books of the taxpayer it is included under the assets section as Form 2307 is reflected as income tax pre payments

Prepare And File Form 2290 E File Tax 2290

https://www.roadtax2290.com/images/3-3d.png

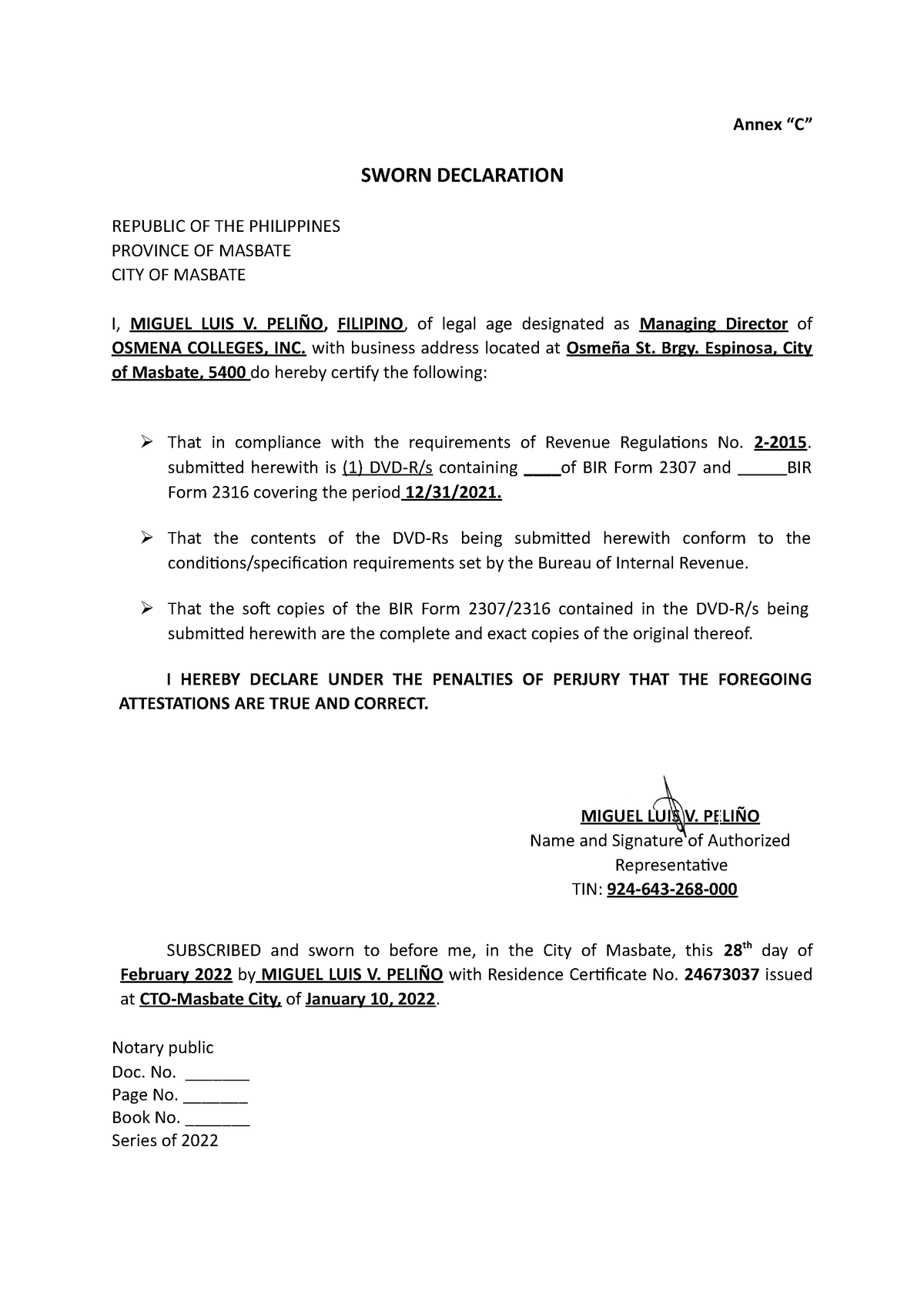

Sworn Declaration Pre Form Of Sworn Dec Annex C SWORN DECLARATION

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8d48c4307bac598408b8bea6c2ad7912/thumb_1200_1697.png

what is form 2306 - The 2307 Form is issued exclusively to individuals sole proprietorship businesses partnerships and corporations engaged in trade or business that have paid certain types of income where BIR imposed a corresponding withholding tax based on their respective tax Identification Numbers TIN