what is form 1098 e used for What is IRS Form 1098 E IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service IRS and to you

1098 E Form student loan interest statement is a tax form used to report student loan interest Learn more about this tax form with the help of H R Block 1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your

what is form 1098 e used for

what is form 1098 e used for

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

The 1098 E form is the Student Loan Interest Statement that your servicer uses to report student loan interest payments to you and the IRS Your loan servicer should send you a 1098 E form IRS Form 1098 E is a tax form you get from the lender if you paid 600 or more in interest on your student loans during the tax year Key Takeaways Form 1098 E is issued by lenders to report student loan interest

The 1098 E form is a student loan interest statement It states how much interest you paid on student loans within a year and you may find out you are eligible for deductions File Form 1098 E if you are a financial institution governmental unit or any of its subsidiary agencies educational institution or any other person who receives student loan interest of

More picture related to what is form 1098 e used for

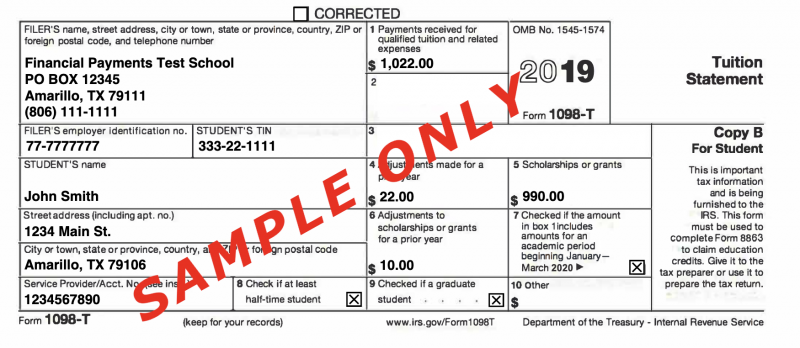

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

This tax form also known as the student loan interest statement is typically sent by lenders via post or email to any borrower who has paid more than 600 in interest payments Form 1098 E reports the amount of student loan interest you paid in a year Your loan servicer or lender should send you this form by Jan 31 if you ve paid at least 600 in interest on a qualifying student loan

A 1098 E form is used to report interest from your student loans It is used for the purpose of filing your federal taxes A 1098 E form is only required if you paid 600 or more in interest The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

Instructions For Form 1098 Mortgage Interest Statement Lendstart

https://assets.trafficpointltd.com/app/uploads/sites/136/2022/01/02082507/Form-1098.jpg

what is form 1098 e used for - Your student loan lenders are required to send you Form 1098 E only if you paid at least 600 in student loan interest during the year If you have several student loans with the