what is form 1098 c used for Specific Instructions Who Must File A donee organization must file a separate Form 1098 C Contributions of Motor Vehicles Boats and Airplanes with the IRS for each

You must attach Copy B of Form 1098 C to your income tax return in order to take a deduction for the contribution of a qualified vehicle with a claimed value of more than 500 If you e file your Key Takeaways Form 1098 C is necessary for claiming a deduction on a donated vehicle valued at more than 500 The maximum deduction for a donated vehicle

what is form 1098 c used for

what is form 1098 c used for

https://udayton.edu/fss/_bursar_resources/img_new/2022_1098t_sample.jpg

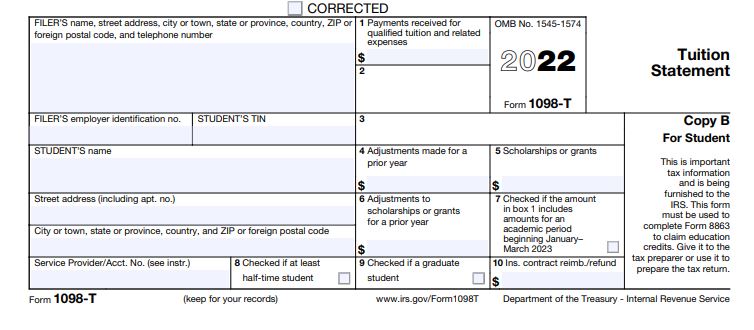

What Is Form 1098 T Who Should File Form 1098 T

https://d2rcescxleu4fx.cloudfront.net/images/1098-T.jpg

1098 C Software To Create Print E File IRS Form 1098 C

http://idmsinc.com/images/screenshots/1098C.png

Donating a qualified vehicle to a charity Learn how Form 1098 C is used to report the details of your donation and how it affects your deduction If the charity sold the vehicle without significant use or improvement your deduction is the sale amount If the vehicle was used or improved by the charity you may deduct the fair

1098 C This form is for Contributions of Motor Vehicles Boats and Airplanes If you donated a car boat or airplane worth more than 500 to a charity you can take a charitable deduction for your contribution using this form Form 1098 C is used to report donations of motor vehicles boats and airplanes to qualified charitable organizations The form provides information about the donor the recipient charity and the donated property It also includes the fair

More picture related to what is form 1098 c used for

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

Per IRS Instructions for Form 1098 C Contributions of Motor Vehicles Boats and Airplanes Instructions for Donor Caution You must attach Copy B of Form 1098 C to your income tax Receiving a 1098 C means you may be able to claim a tax deduction for donating a vehicle to charity whether you donate a shiny new car that you won in a raffle

What is Form 1098 C Form 1098 C is used to report contributions of Motor Vehicles Boats and Airplanes to the IRS for each contribution of a qualified vehicle done by an organization that has a claimed value of more than 500 Form 1098 C Contributions of Motor Vehicles Boats and Airplanes is a source document that is filed with the IRS by a charitable organization whenever they receive a

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

what is form 1098 c used for - 1098 C This form is for Contributions of Motor Vehicles Boats and Airplanes If you donated a car boat or airplane worth more than 500 to a charity you can take a charitable deduction for your contribution using this form