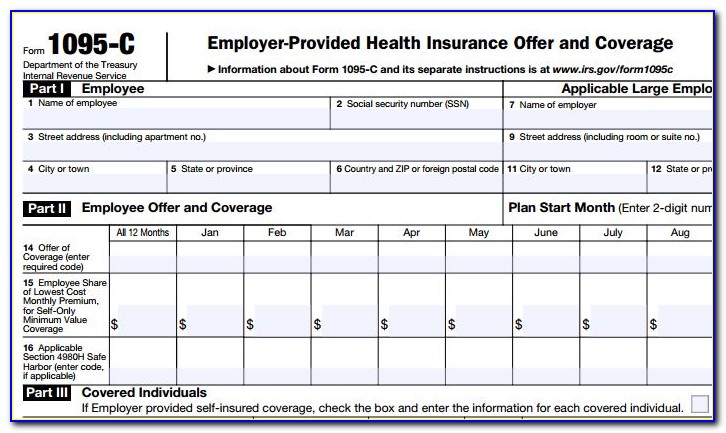

what is form 1095 The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers They are forms 1095 A 1095 B and 1095 C These forms help determine if you the required health insurance under the Act For individuals who bought insurance through the health care marketplace this information

There is one other scenario in which Form 1095 C can be an important part of the tax filing process If you had marketplace coverage and thus received Form 1095 A and also had an offer of coverage from an applicable large employer and thus received Form 1095 C you ll need to pay close attention to the details of Form 8962 and the What is a 1095 Many people wonder what is a 1095 Here s a summary of the form series With the passing of the Affordable Care Act three new tax forms came into the scene Form 1095 A B and C

what is form 1095

what is form 1095

https://i1.wp.com/claimlinx.com/wp-content/uploads/2021/05/1095-A.jpg?fit=2240%2C1260&ssl=1

File Your 1095c Mandate For FREE California Business Benefits

https://www.mightytaxes.com/wp-content/uploads/2016/02/form_1095_c_taxes.gif

Free Printable 1095 Form Printable Forms Free Online

https://i.ytimg.com/vi/ezSv_vq7FmA/maxresdefault.jpg

If you are expecting to receive a Form 1095 A you should wait to file your income tax return until you receive that form However it is not necessary to wait for Forms 1095 B or 1095 C in order to file File IRS form 1095 A to get highest federal tax return Learn what to do how to file why you got form what to do if no 1095 A

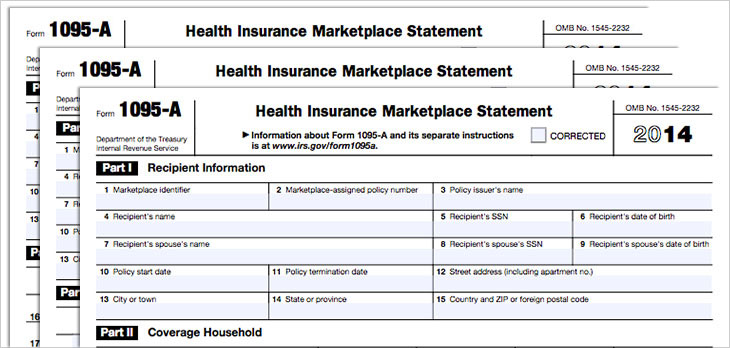

Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace You will receive Form 1095 A if you or a member of your household purchased health insurance through a state or federal healthcare exchange This is also known as the health insurance marketplace You should be on the lookout for Form 1095 A if you received marketplace coverage at any time during the previous year

More picture related to what is form 1095

:max_bytes(150000):strip_icc()/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

Form 1095 B Health Coverage Definition

https://www.investopedia.com/thmb/2XnfXw46EJigomCVCZRxGRy8QFo=/2200x1700/filters:no_upscale():max_bytes(150000):strip_icc()/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png

What Is Form 1095 A And Why I Am Getting It

https://4.bp.blogspot.com/-gYIYn8L3BX4/XEkljZuEbfI/AAAAAAAAAZY/Zv8nfd7xRSg_JnpeQIikNlgffsyIeFcNwCLcBGAs/s1600/eca5eb51-1a8b-4e17-ab4c-253a038ec104%2B%252812%2529.png

Aca Form 1095 Deadline Form Resume Examples gzOe6BXkWq

https://www.viralcovert.com/wp-content/uploads/2018/10/aca-form-1095-deadline.jpg

Basic Information about Form 1095 A If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace you ll get Form 1095 A Health Insurance Marketplace Statement You will get this form from the Marketplace not the IRS You will use the information from the Form 1095 A to calculate the amount The 1095 tax forms are used by exchanges employers and health insurance companies to report health insurance coverage to the IRS

[desc-10] [desc-11]

1095 C FORM Southland Data Processing

https://www.sdppayroll.com/wp-content/uploads/2015/11/1095-C-FORM.jpg

What Is Form 1095 C And Do You Need It To File Your Taxes

https://www.mightytaxes.com/wp-content/uploads/2016/02/form_1095_a_file_taxes.jpg

what is form 1095 - Information about Form 1095 A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file Form 1095 A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace