what is efficient market hypothesis The efficient market hypothesis states that stock prices reflect all available information and are fairly valued Learn about the three variations of the theory the

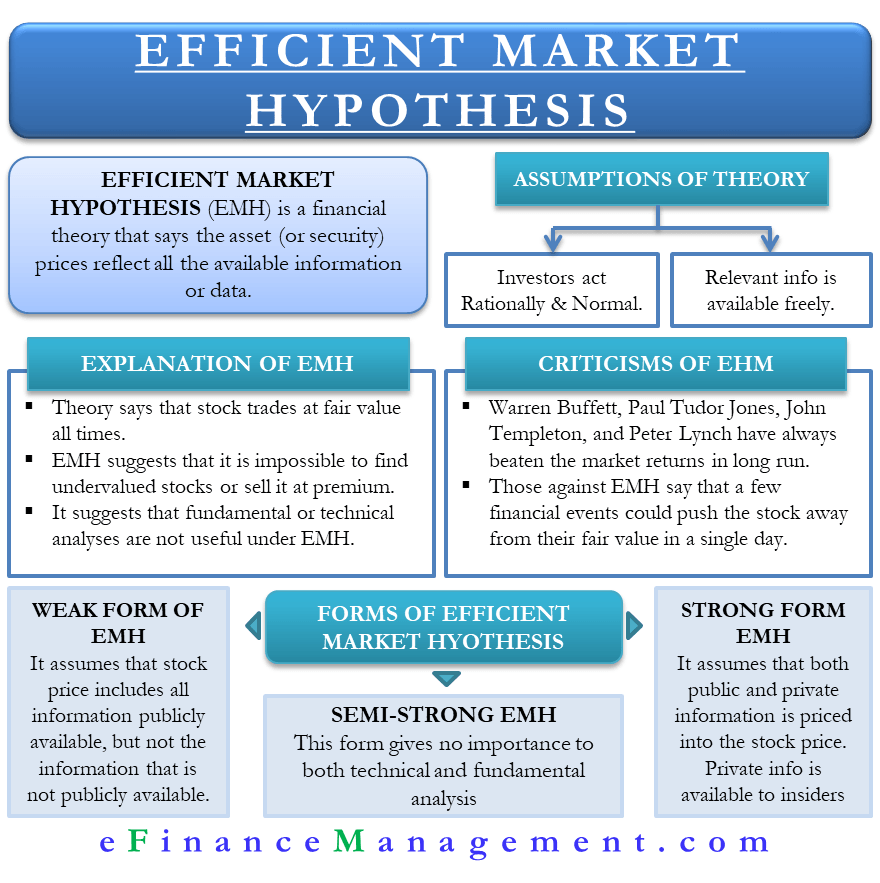

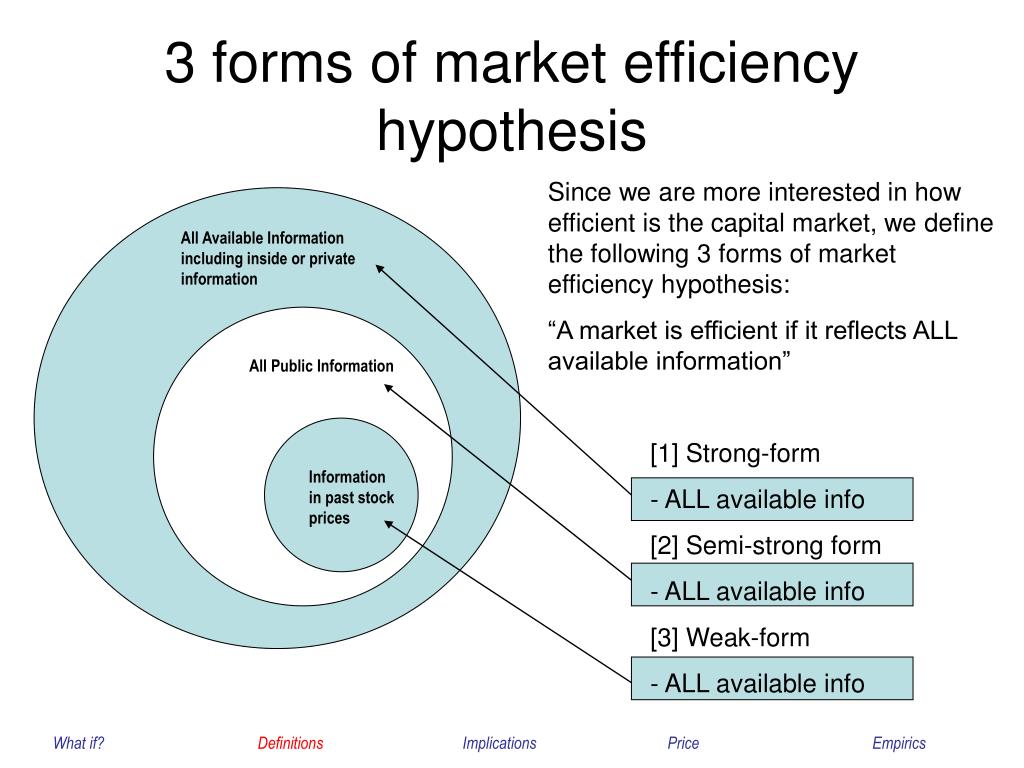

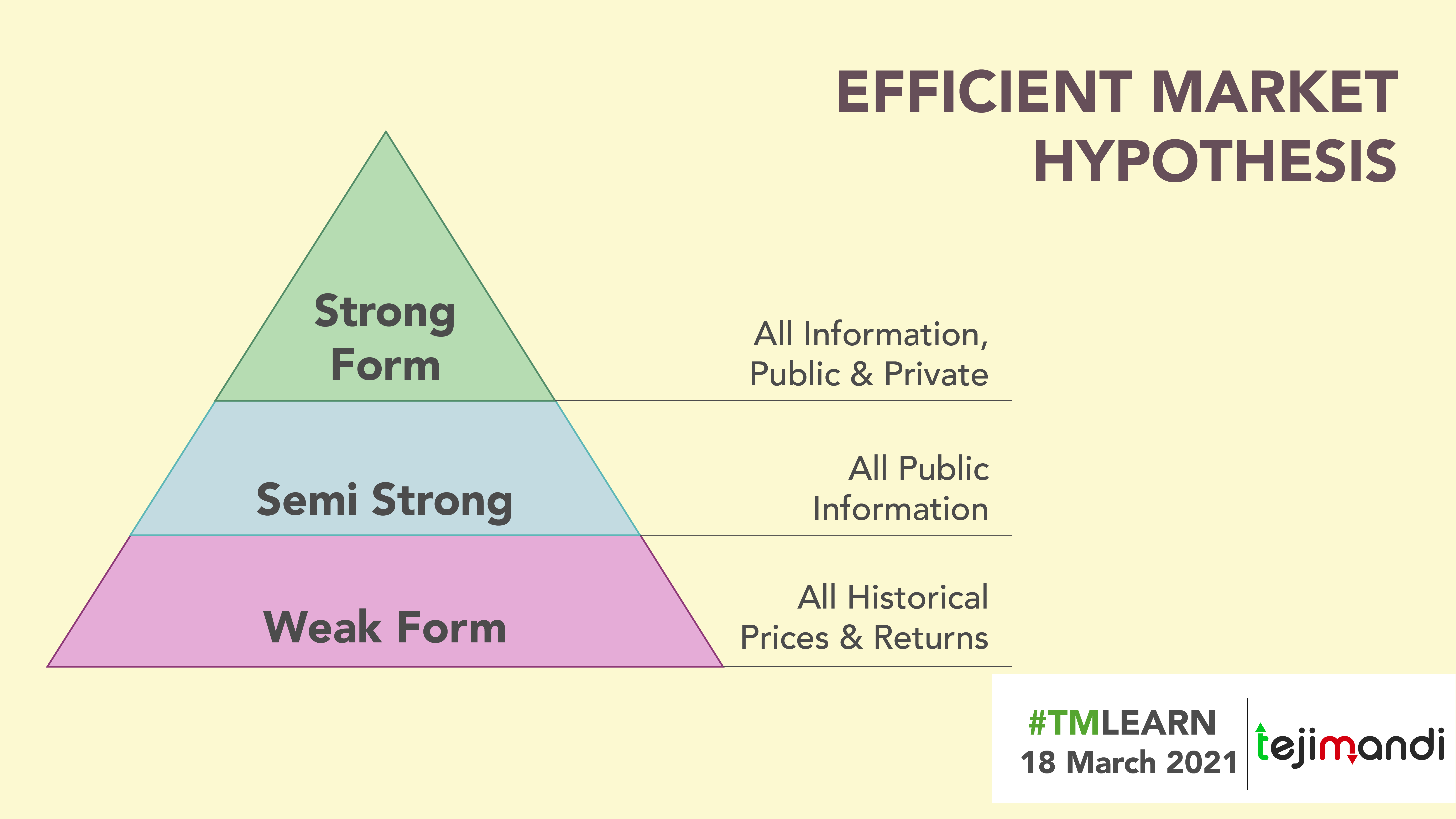

The efficient market hypothesis EMH claims that all assets are fairly priced and trade at their intrinsic value making it impossible to beat the market Learn the three forms of EMH how they differ and why they are controversial and contradictory The efficient market hypothesis says that financial markets are effective in processing and reflecting all available information with little or no waste making it impossible for investors to consistently outperform the market based on information already known to the public

what is efficient market hypothesis

what is efficient market hypothesis

https://static.seekingalpha.com/uploads/2020/10/20/saupload_Efficient-Market-Hypothesis.png

PPT Efficient Market Hypothesis The Concepts PowerPoint Presentation

https://image.slideserve.com/22988/3-forms-of-market-efficiency-hypothesis-l.jpg

IS THE STOCK MARKET PREDICTABLE Efficient Market Hypothesis YouTube

https://i.ytimg.com/vi/o9TfmdAkrbM/maxresdefault.jpg

The Efficient Market Hypothesis EMH is a theory suggesting that financial markets are perfectly efficient meaning that all securities are fairly priced as their prices reflect all available public information Efficient market theory EMT is a finance concept that states that market prices reflect all available information and are impossible to beat Learn about the three forms of EMT the empirical evidence in support and against it and the criticisms and alternatives to it

The efficient market hypothesis EMH is a theory that states that asset prices reflect all available information and that investors cannot consistently beat the market by using any strategy The EMH has three forms weak semi strong and strong The efficient market hypothesis EMH is a financial economics theory that states that asset prices reflect all available information Learn about the theoretical background empirical studies historical background and criticisms of the EMH

More picture related to what is efficient market hypothesis

Efficient Market Hypothesis Definition And Meaning Capital

https://capital.com/files/imgs/glossary/1200x627x1/What-is-the-efficient-market-hypothesis.jpeg

Efficient Market Hypothesis A Unique Market Perspective

https://tejimandi.com/wp-content/uploads/2022/06/Efficient-market-hypothesis-A-unique-market-perspective.png

Efficient Market Hypothesis EMH What Is It And Why Does It Matter

https://www.fiology.com/wp-content/uploads/2023/11/Efficient-Market-Hypothesis-EMH.jpg

What is the Efficient Markets Hypothesis The Efficient Markets Hypothesis EMH is an investment theory primarily derived from concepts attributed to Eugene Fama s research as detailed in his 1970 book Efficient Capital Markets A Review of Theory and Empirical Work The efficient market hypothesis EMH states that stock prices reflect all available information and are impossible to beat Learn about the three forms of EMH their

[desc-10] [desc-11]

What Is Efficient Market Hypothesis YouTube

https://i.ytimg.com/vi/Zr32TxkVrWg/maxresdefault.jpg

What Is Efficient Market Hypothesis EMH Theory Explained

https://assets.finbold.com/uploads/2022/07/photo1693034880.jpg

what is efficient market hypothesis - [desc-14]