what is covered in 80d Deduction allowed under Section 80D Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents

You can claim tax deduction on health insurance under Section 80D of the Income Tax Act Heres the total amount you can save benefits and eligibility Read now Under Section 80D tax deduction can be claimed on premium paid on health insurance Who is covered for tax deduction Individual health insurance Family health insurance self spouse

what is covered in 80d

what is covered in 80d

https://www.projectfinance.com/wp-content/uploads/2021/09/Covered-Call-Final-2.jpg

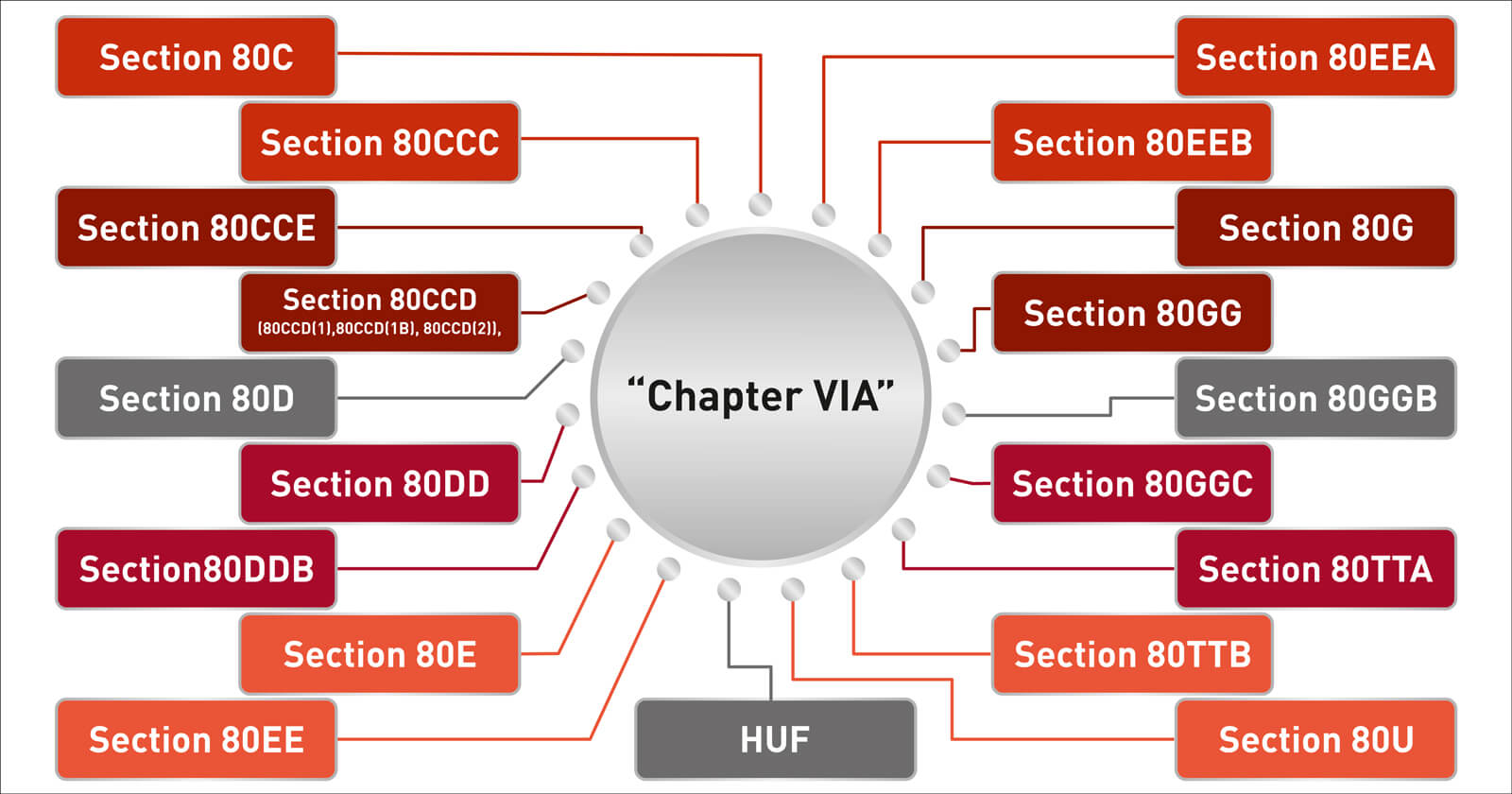

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

What Is Covered Bill

https://withbill.com.au/wp-content/uploads/2022/01/Thech-Peeps_Alert_by_Growwwkit-1024x1024.png

By understanding the details of section 80D individuals and taxpayers can financially plan their health insurance coverage better optimise their tax savings and lower their overall tax What is Covered under Section 80D Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take

Know what is covered under Section 80D its eligibility criteria limits and documents required to claim deductions under section 80D Section 80D of the Income Tax Act allows tax deductions on health insurance premiums paid for yourself your family and your parents Investments covered under Section 80D include health insurance premiums preventive health

More picture related to what is covered in 80d

Unboxing Canon 80D What s In The Box YouTube

https://i.ytimg.com/vi/NRuQ6AxCDtc/maxresdefault.jpg

What Is Covered Under Business Liability Insurance What Isn t

https://bogleagency.com/wp-content/uploads/2018/09/What-is-Covered-Under-Business-Liability-Insurance-What-Isnt.jpeg

101 HTML Intro D What Is Covered YouTube

https://i.ytimg.com/vi/zzimD_S3SAY/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGF8gXyhfMA8=&rs=AOn4CLAEw3_090ZamGkCYSIcRQMaJZ1EZg

Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a HUF This tax Section 80D of the Income Tax Act provides individuals and HUFs with an opportunity to claim deductions on health insurance premiums Understanding the eligibility criteria deduction limits and other provisions is

Deduction available under Section 80D The deduction allowed under Section 80D is Rs 25 000 in a financial year In the case of senior citizens the deduction limit allowed is Rs What is Section 80D Health insurance premium payments made in a given year are eligible for deduction from total income for any Individual or HUF under Section

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

Katy Covered Patio Tradition Outdoor Living

http://traditionoutdoorliving.com/wp-content/uploads/2019/12/Patio_Cover_Katy_TB.jpg

what is covered in 80d - Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse