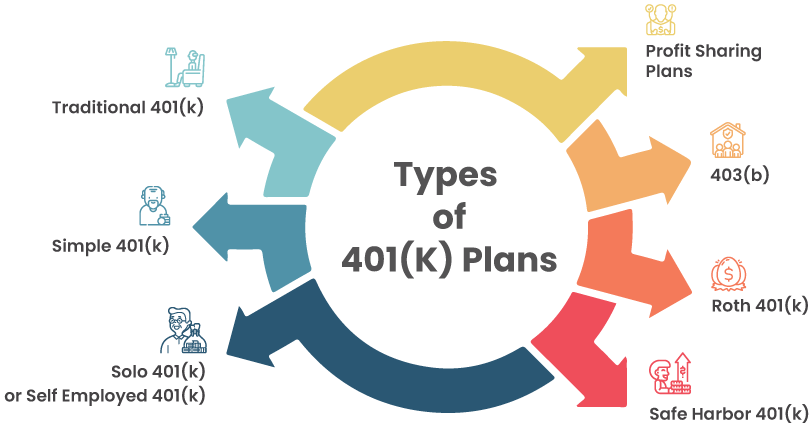

what is another name for a 401k plan Employers offer different types of 401 k plans with tax advantages for retirement including Traditional Safe Harbor SIMPLE Solo and Roth 401 k s

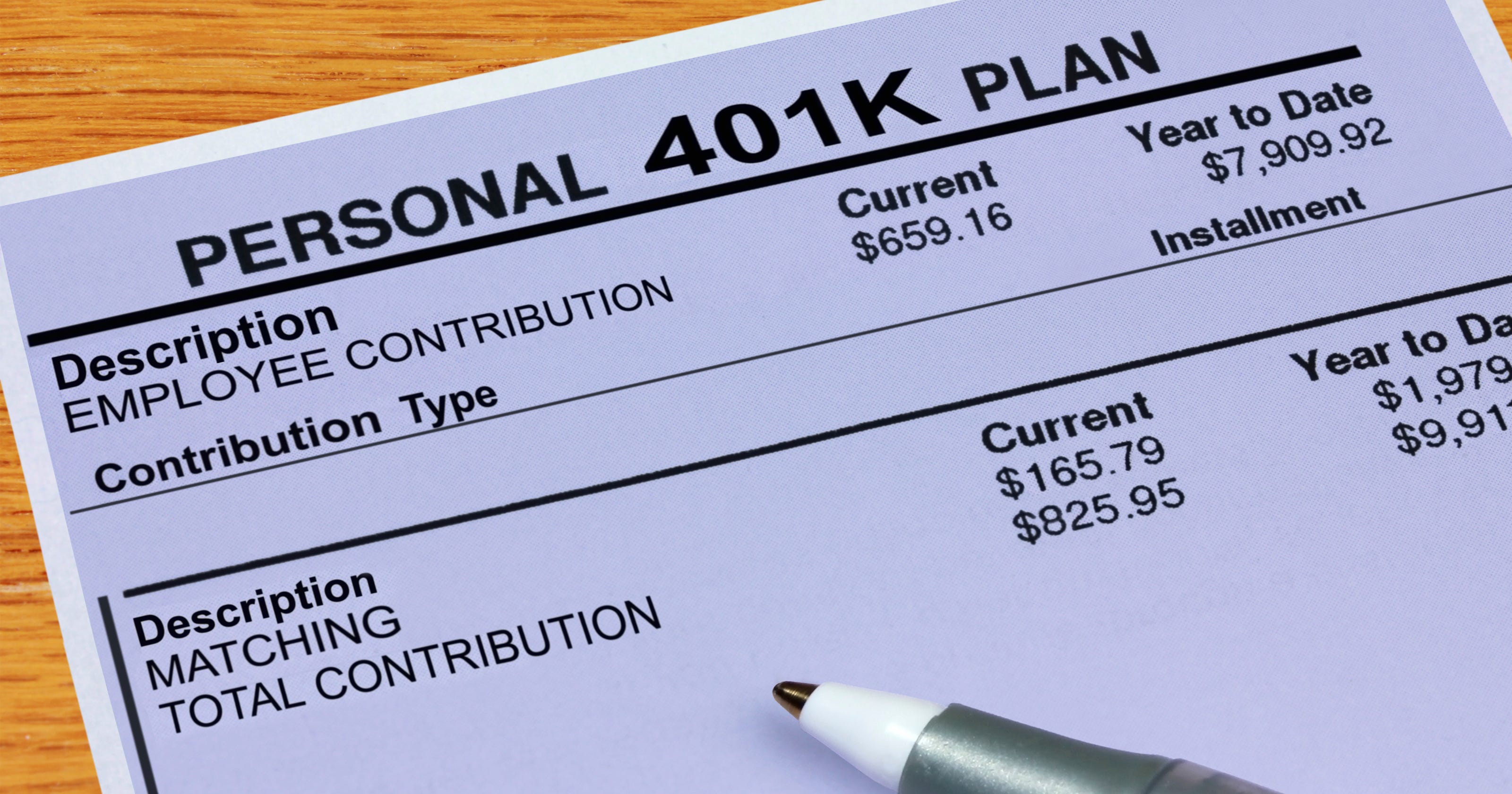

401 k In the United States a 401 k plan is an employer sponsored defined contribution personal pension savings account as defined in subsection 401 k of the U S Internal Revenue Code 1 Periodic employee contributions come directly out of their paychecks and may be matched by the employer SIMPLE is an acronym for Savings Incentive Match PLan for Employees With a SIMPLE 401 k plan employees can contribute up to 15 500 in 2023 if they re under age 50 or 19 000 if they re

what is another name for a 401k plan

what is another name for a 401k plan

https://www.sdretirementplans.com/wp-content/uploads/2021/10/Different-types-of-401K.png

What Is A 401 k Plan 2020 Robinhood

https://images.ctfassets.net/lnmc2aao6j57/1kivddTqvwypu2AptDbzcF/b928bfa7eec86463ffc1f214ff03f0ea/info_401k_mobile.png

What Is A 401 k Match OnPlane Financial Advisors

https://images.squarespace-cdn.com/content/v1/5c101a4e7c9327fdf174b93b/1564583290453-TT3LQ1RAEZYYLHF083DP/30years_3%25.jpg

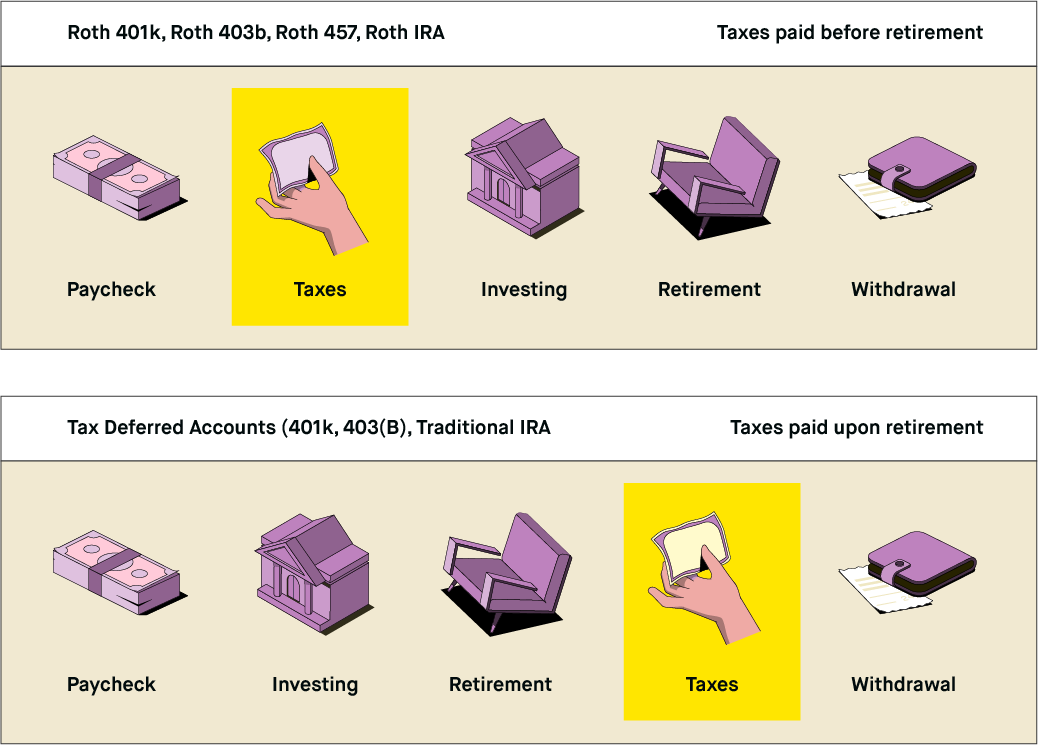

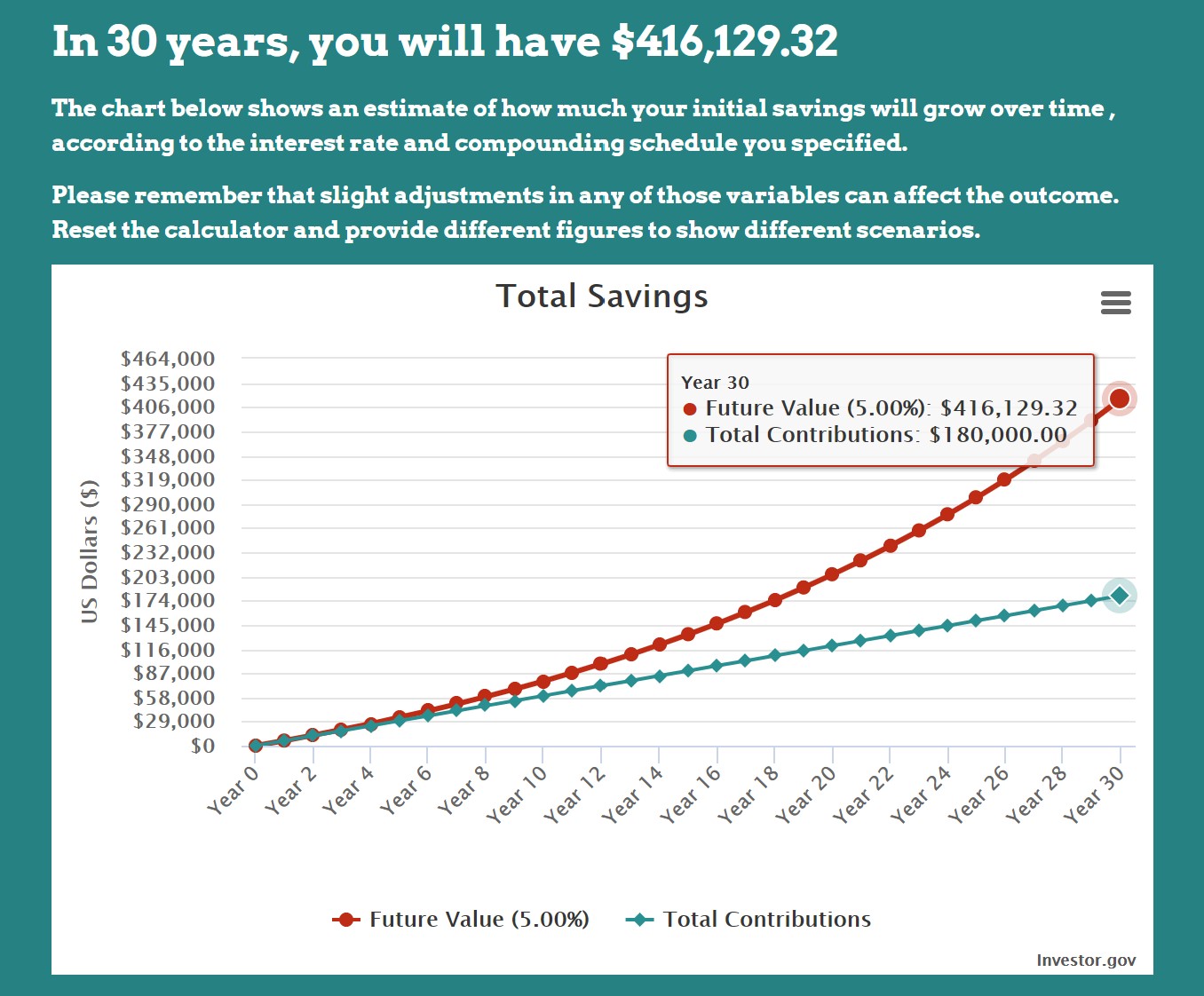

A 401 k is an employer sponsored retirement plan With tax benefits and potential employer matching contributions a 401 k is a great way to save for retirement A 401 k plan is a tax advantaged retirement account employers offer to help their employees invest for retirement The two most common types of 401 k plans are traditional and Roth

Key Takeaways A 401 k is a qualified retirement plan which means it is eligible for special tax benefits You can invest a portion of your salary up to an annual limit Your employer may or A 401 k is an employer sponsored retirement plan so named after a part of the U S tax code offered by companies to the employees who work there Similar plans for teachers nonprofit employees and government workers include 403 b s and 457s

More picture related to what is another name for a 401k plan

What Are The Benefits Of Having 401 k Plan

https://learn.financestrategists.com/wp-content/uploads/Benefits-of-Getting-a-401k-Plan-1024x546.png

How Companies Can Improve Their 401 k Plans

https://www.gannett-cdn.com/-mm-/4f1aaefb83599761e560c64d1397c3e4146411c7/c=0-104-3453-2055/local/-/media/USATODAY/None/2014/10/30/635502730928573425-177287438.jpg?width=3200&height=1680&fit=crop

What Is The Difference Between Roth IRA And Roth 401k Finances Rule

https://www.financesrule.com/wp-content/uploads/2020/06/What-Are-401-k-Accounts.jpg

Named for the tax code section that created it a 401 k is an employer sponsored retirement savings plan with special tax benefits The exact tax advantages depend on which kind of 401 k contributions you make more on that later A 401 k retirement plan is a key part of your benefits package but the type of plan each employer offers is slightly different From an employer match to automatic increases to eligibility requirements there are plenty of key questions to ask yourself

A 401 k plan is an employer sponsored retirement account that allows you to invest a portion of your income in stocks bonds and other securities Roughly 70 million Americans A 401k plan is a type of retirement savings plan that allows employees to contribute a portion of their pre tax income to a retirement account The contributions are invested in a variety of assets such as stocks bonds and mutual funds

401 k Contribution Limits Rising Next Year Kiplinger

https://cdn.mos.cms.futurecdn.net/GcuHwB6FpjU23FQLAvf9VS.jpg

:max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Retirement Plan 401k

https://www.thebalancemoney.com/thmb/Zk5vHtGLbBP1-iwLMiDVgM_ZAWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png

what is another name for a 401k plan - A 401 k is an employer sponsored retirement plan so named after a part of the U S tax code offered by companies to the employees who work there Similar plans for teachers nonprofit employees and government workers include 403 b s and 457s