what is a fidelity 457 The 457 plan is an IRS sanctioned tax advantaged employee retirement plan The plan is offered only to public service employees and employees at tax exempt organizations

Key Takeaways 401 k plans and 457 plans are both tax advantaged retirement savings plans 401 k plans are offered by private employers while 457 plans are offered by state and local A 403 b is a tax advantaged retirement plan for nonprofit employers like schools and churches Similar to other tax advantaged retirement plans 403 b accounts let your

what is a fidelity 457

what is a fidelity 457

https://www.wfscameron.org/wp-content/uploads/2021/12/fidelity-bonding-picture-1.jpg

What Is A 457 b Inflation Protection

https://i.ytimg.com/vi/K1t9TE-0jP0/maxresdefault.jpg

What Is A Fidelity Bond YouTube

https://i.ytimg.com/vi/IP8S_oHGUJo/maxresdefault.jpg

The 457 b is offered to state and local government employees and the 457 f is for top executives in nonprofits A 403 b plan is typically offered to employees of private nonprofits and A 457 b plan is an employer sponsored tax deferred retirement savings vehicle available to some state and local government employees It works like a 401 k in that employees can divert a portion

The 457 Plan is a type of tax advantaged retirement plan with deferred compensation The plan is non qualified it doesn t meet the guidelines of the Employee Retirement A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit

More picture related to what is a fidelity 457

What Is A Fidelity Check The Intentional IEP

https://www.theintentionaliep.com/wp-content/uploads/2023/03/What-is-a-Fidelity-Check-1024x683.jpg

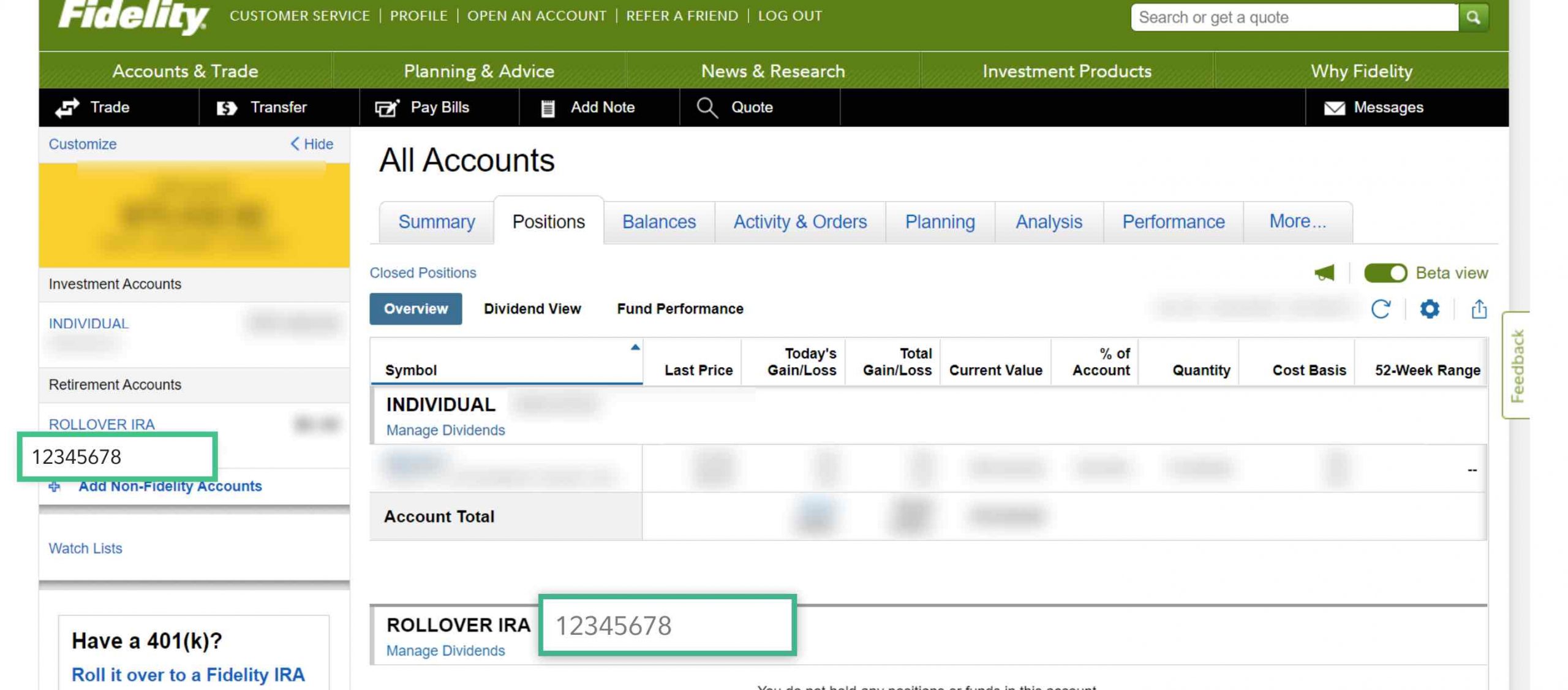

How To Find Your Fidelity Account Number Capitalize

https://www.hicapitalize.com/wp-content/uploads/2020/12/Fidelity-Website-Positions-scaled-1.jpg

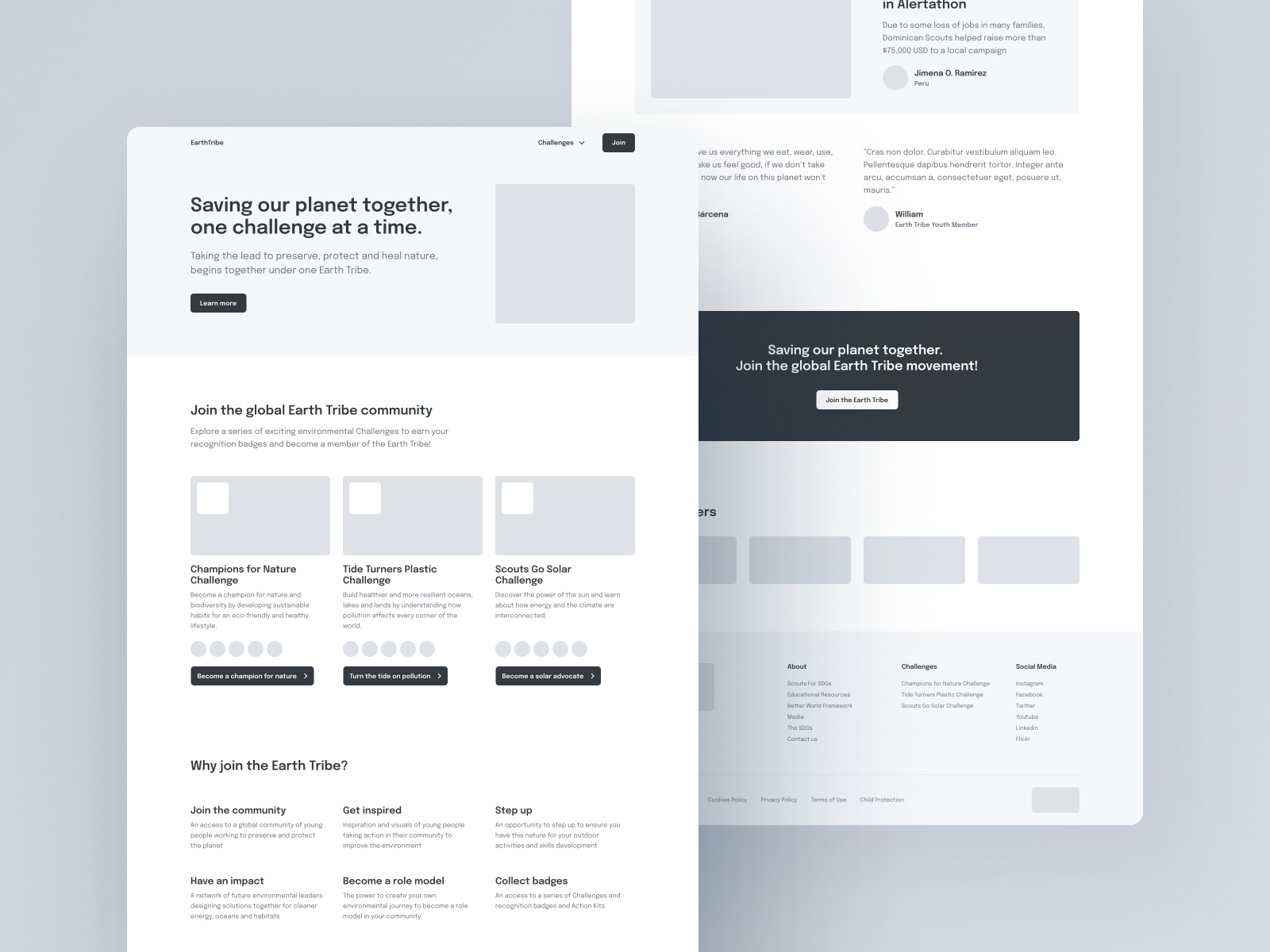

What Is A High Fidelity Wireframe And How To Make One

https://d3h2k7ug3o5pb3.cloudfront.net/image/2023-01-31/980ac4c0-a133-11ed-91cc-733ac0a0cb68.png

A 457 b plan is likely your main retirement savings option if you work for the state or local government or certain non profits such as a church With A 457 b plan is an employer sponsored tax favored retirement savings offered to public service employees and some nonprofit organization employees

457s are savings plans primarily offered to government employees including state and local government officials public school teachers county and city 403 b 457 b Retirement Savings Plans Comparison Chart Visit benefits mcps for details or call Fidelity at Monday through Friday from 8

Low Fidelity Vs High Fidelity Wireframes Uizard

https://uizard.io/blog/content/images/2022/09/UZ_BLOG_220912_LoFivsHifi.webp

How To Find Your NetBenefits Fidelity Account Number Merchant Shares

https://cdn.merchantshares.com/1663638623563.jpg

what is a fidelity 457 - The 457 b is offered to state and local government employees and the 457 f is for top executives in nonprofits A 403 b plan is typically offered to employees of private nonprofits and