what is a 457 f plan The 457 f plan is also known as a Supplemental Executive Retirement Plan SERP It is a retirement savings plan for only the highest paid executives in the tax exempt sector

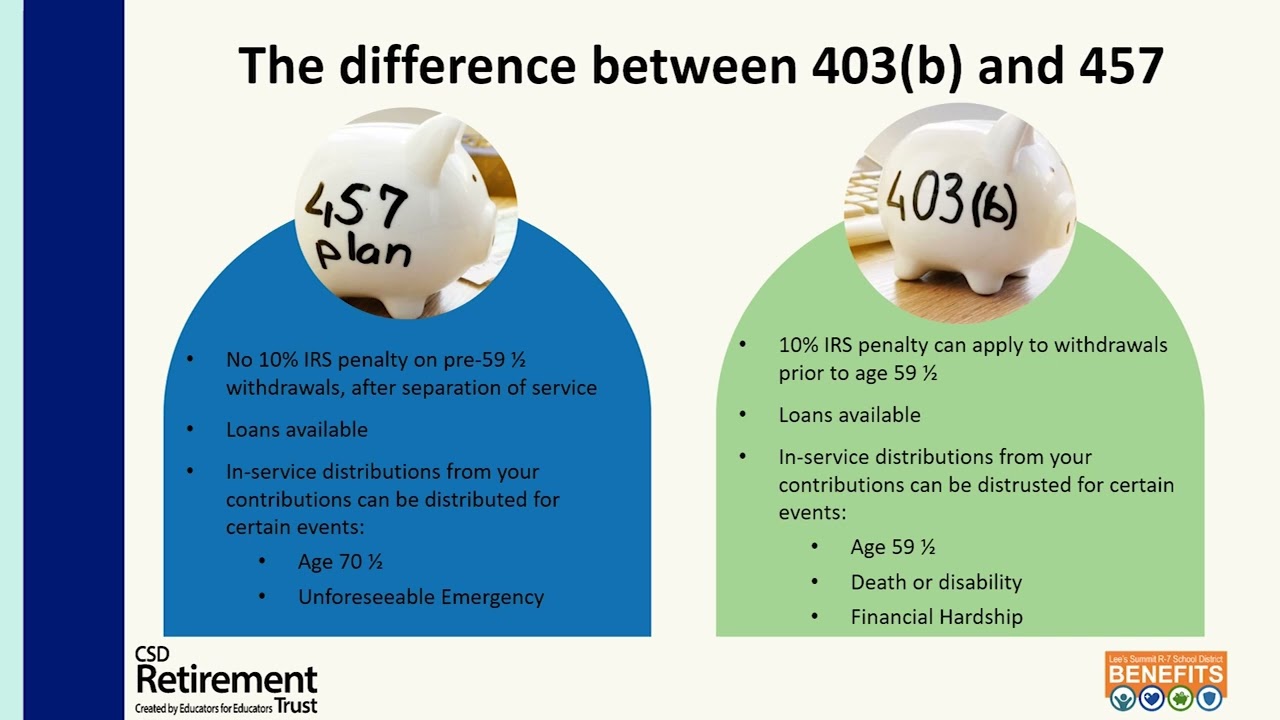

A Sec 457 f plan is the only plan under which the benefits are subject to income tax upon vesting even if they are not paid out at that time Exempt arrangements include qualified retirement plans such as defined benefit and Sec 401 k plans A 457 plan is a type of tax advantaged retirement plan offered primarily to state and local public employees and to some non profit employees It allows participants to defer a portion of their salaries into the plan for future use typically retirement

what is a 457 f plan

what is a 457 f plan

https://i.ytimg.com/vi/i3bl74Q4jm8/maxresdefault.jpg

What Is A 457 b YouTube

https://i.ytimg.com/vi/K1t9TE-0jP0/maxresdefault.jpg

LSR7 Voluntary Retirement Plan YouTube

https://i.ytimg.com/vi/9b5ue9tuuYM/maxresdefault.jpg

Just like a 401 k or 403 b retirement savings plan a 457 plan allows you to invest a portion of your salary on a pretax basis The money grows tax deferred waiting for IRS code section 457 f allows for nongovernmental nonprofit organizations to set up a plan that can be tax deferred and exceed the normal defined contribution employee deferral limit Ineligible 457 plans are made available because nonprofit organizations are not allowed to have another kind of nonqualified deferred compensation plan

A 457 plan is a type of retirement plan offered by government and nonprofit organizations 457 plans allow you to defer a portion of your pay invest in various assets and pay taxes A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit employees

More picture related to what is a 457 f plan

What Is A 457 Plan Defintion Types Benefits

https://images.inkl.com/s3/article/lead_image/17931156/457-plan.png

457 f Plan Definition Eligibility Key Features Strategies

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1b46eP.img?w=1334&h=750&m=4&q=79

What Is A 457 b Plan How Does It Work WealthKeel

https://wealthkeel.com/wp-content/uploads/2022/03/What-is-a-457b-Plan-How-Does-it-Work.png

Section 457 f Nonqualified ineligible deferred compensation plans Note After May 6 1986 state and local governments are not eligible to adopt Section 401 k plans except for rural cooperatives and Indian tribal entities Under grandfather provisions plans established prior to that date may continue to operate and add new participants A 457 f is a special type of 457 plan for highly compensated employees at certain nonprofits and hospitals It s usually reserved for top level executives 457 f plans allow for employer contributions only and there are no contribution limits

Section 457 plans are nonqualified unfunded deferred compensation plans established by state and local government and tax exempt employers These employers can establish either eligible covered by 457 b or ineligible covered by 457 f plans and are subject to the specific requirements and deferral What is a 457 f Supplemental Retirement Plan A 457 f nonqualified deferred compensation arrangement is a nonqualified retirement plan which gives the tax exempt employer an opportunity to supplement the retirement income of its select management group or highly compensated employees by contributing to a plan that will be paid to the

457 Vs 401k What s The Difference 2023

https://www.annuityexpertadvice.com/wp-content/uploads/457-Vs.-401k.png

What Is A 457 b Retirement Plan Know Better Plan Better

https://knowbetterplanbetter.com/static/c657b1fc456fd4e8e6c9692315dcf321/dc6f3/457-plan.jpg

what is a 457 f plan - A 457 plan is a type of employer sponsored tax advantaged retirement account available to state and local government employees and certain usually highly paid nonprofit employees