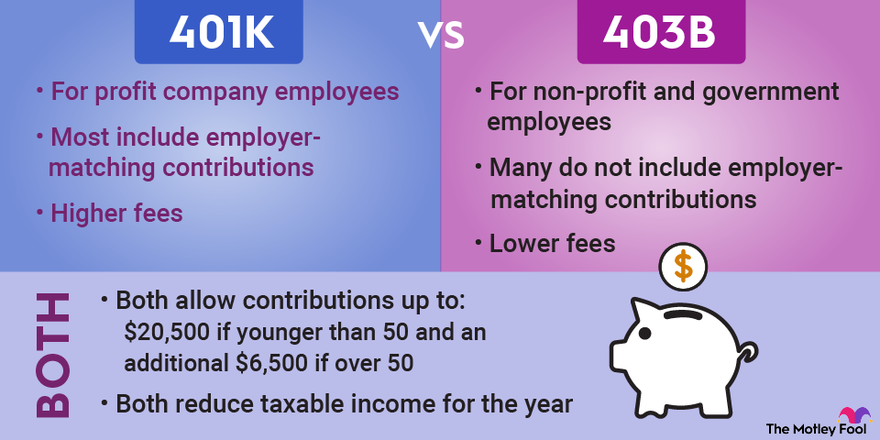

what is a 403 b plan A 403 b is a tax advantaged retirement plan designed for non profit organizations and certain government entities The 403 b works a lot like its better known counterpart

A 403 b is a type of retirement plan available for employees in public schools charitable 501 c 3 tax exempt organizations and certain faith based organizations Employers provide access to 403 b s to attract and retain workers If you don t have access to a 403 b you can save for retirement using a different type of A 403 b is the retirement planning vehicle used by not for profit or other tax exempt employers of nurses doctors teachers professors school personnel

what is a 403 b plan

what is a 403 b plan

https://image.slidesharecdn.com/retirementplanbasics-170310065744/95/retirement-plan-basics-what-is-a-403b-plan-3-638.jpg?cb=1489129090

403 b Vs 401 k What s The Difference The Motley Fool

https://m.foolcdn.com/media/dubs/images/401k-vs-403b-infographic.width-880.png

403 2018

https://img.zpbusiness.com/img/benefits-personal-finance-retirement-accounts/403b-plan-rules-contribution-limits-deadlines-2018.png

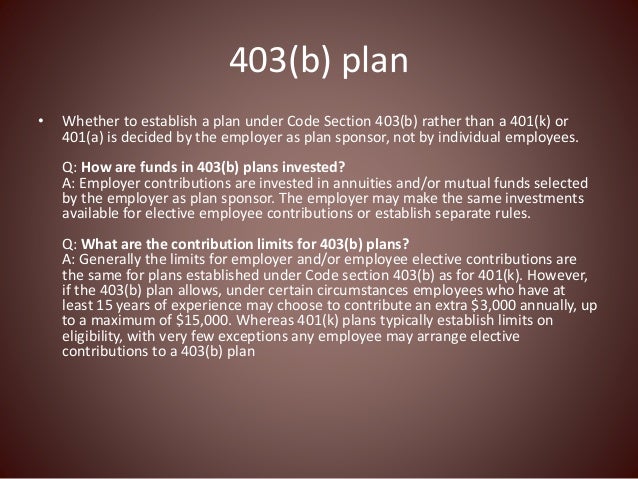

Named after the section of the tax code that describes it a 403 b is a special type of retirement savings plan that s similar to a 401 k in many ways but with a few key A 403 b plan is a tax deferred option that invests your money in annuities and mutual funds Employers choose how their 403 b plans are structured and what options

A 403 b plan is a workplace retirement plan designed to help employees save for retirement while receiving certain tax benefits 403 b plans are typically offered by public schools and higher education institutions churches and charitable entities classified as tax exempt under the Internal Revenue Code Section A 403 b is a tax advantaged retirement plan available to many of America s public employees employees of universities and hospitals religious leaders and workers at non governmental organizations Like a 401 k a 403 b comprises contributions that aren t taxed right away

More picture related to what is a 403 b plan

The Pros And Cons Of A 403 b Plan The Motley Fool

https://g.foolcdn.com/editorial/images/181732/gettyimages-945782878.jpg

403 b Plans The Basics Austin Asset

https://www.austinasset.com/wp-content/uploads/2020/08/403b_Small-1024x576.jpg

What Is A 403 b Plan Self Directed Retirement Plans

https://www.sdretirementplans.com/wp-content/uploads/2023/02/403-b-plan.jpg

A tax advantaged retirement plan 403 b s are typically offered to employees at public schools colleges and universities as well as to employees of tax exempt organizations including The 403 b plan and the 401 k plan are both tax advantaged retirement savings plans sponsored by employers for their employees The biggest difference in the 403 b vs 401 k is

A 403 b plan is a tax sheltered annuity plan offered by tax exempt employers Contributions you make to a 403 b plan aren t taxed until you withdraw the money Your investment grows tax deferred These plans are similar to 401 k plans but investments are limited to annuities and mutual funds A 403 b is a retirement savings plan designed for employees of non governmental organizations NGOs public schools and some charitable or non profit

/403b_plan-5bfc38ffc9e77c005147a1b4.png)

The Benefits Of A 403 b Plan

https://www.investopedia.com/thmb/yLxo5f9JBM524fEpGfOdE-qpLRY=/680x440/filters:fill(auto,1)/403b_plan-5bfc38ffc9e77c005147a1b4.png

.jpg)

How Does A 403 b Plan Work Ramsey

https://cdn.ramseysolutions.net/daveramsey.com/media/blog/retirement/investing/what-is-a-403(b).jpg

what is a 403 b plan - Named after the section of the tax code that describes it a 403 b is a special type of retirement savings plan that s similar to a 401 k in many ways but with a few key