what is a 290 tax code IRS Code 290 Everything You Need To Know An IRS Code of 290 indicates that you owe more taxes than you initially believed You could need to pay additional surcharges on your tax assessment for various reasons including the findings of an audit or errors in how the IRS computed your return

What is IRS Code 290 IRS Code 290 indicates an additional tax has been assessed on your account There are several reasons that you might have additional taxes due such as the results of an audit or incorrect calculations on your return Code 290 is a transaction code that appears on IRS transcripts and is associated with the Request for Transcript of Tax Return form Form 4506 T This code indicates that the IRS has received and fulfilled a request for a tax transcript

what is a 290 tax code

what is a 290 tax code

https://assets-global.website-files.com/5e5e0a963f2bf9d0d9d31e01/617c1ff9b7f9c113e5bff755_Suretax-Tax-Codes---Explained.jpg

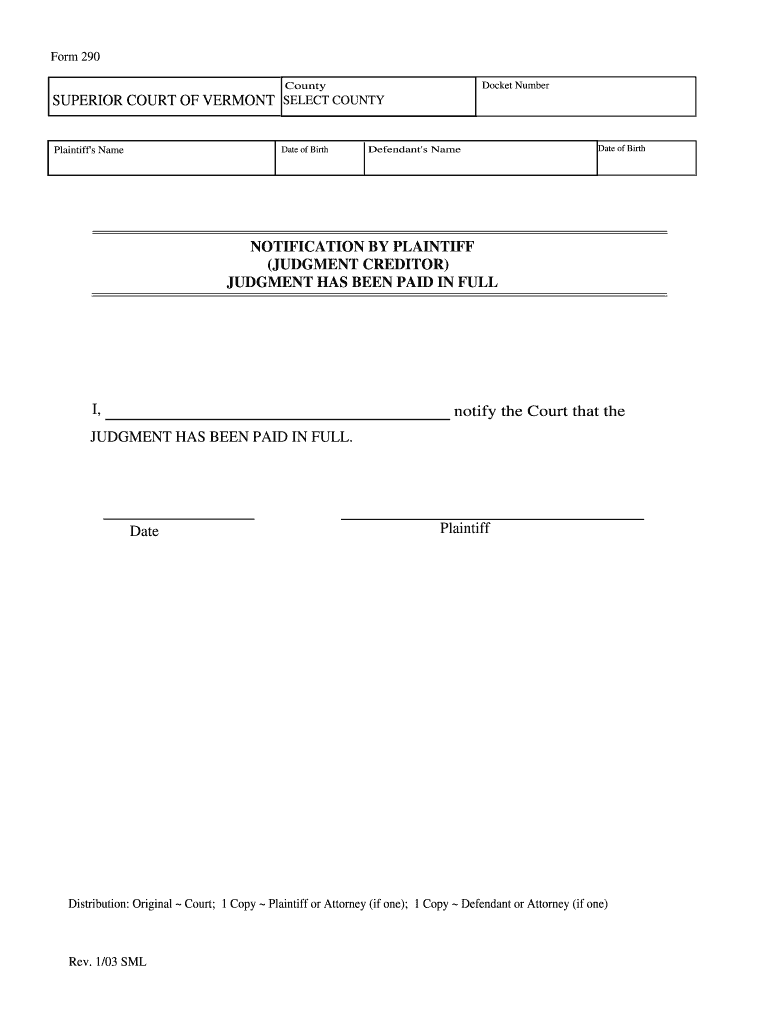

Form 290 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/490/243/490243984/large.png

IRS Code 290 Meaning Of Code 290 On 2021 2022 Tax Returns Calm CFO

https://calmcfo.com/wp-content/uploads/2022/11/IRS-Code-290-Meaning-of-Code-290-on-2021-2022-Tax-Return-1500x1000.jpg

Understanding IRS Code 290 Your Guide to ERC Claim Denials TaxNow 29 Jul 2024 Based on recent alerts and news it appears that the IRS has started distributing denial letters 105C Letters to the 10 20 of what it considers to be highest risk ERC claims A TC 290 with zeros is often input when a penalty abatement request is considered and sometimes the TC 290 with zeros is simply input to systemically generate a document locator number needed for the refiling of a tax return or tax account documents being returned to IRS files

In simple terms the IRS code 290 on the tax transcript means additional tax assessed It may actually mean that your Tax Return was chosen for an audit review and for the date shown no additional tax was assessed The amount on the Code 290 line is the additional tax levied on your account The IRS will issue you a bill with a due date for the additional taxes you owe If you agree to the adjustment you should pay your taxes as quickly as possible

More picture related to what is a 290 tax code

https://blog.faradars.org/wp-content/uploads/2021/03/what-is-tax.jpg

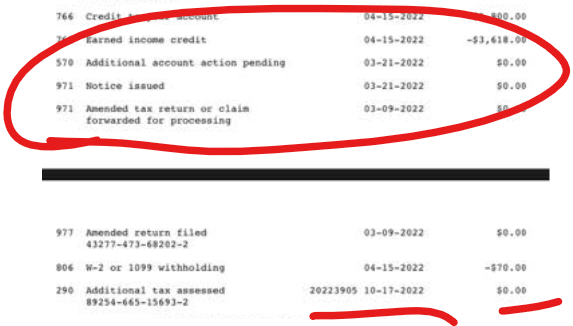

IRS Tax Transcript Reviews For Adjusted Amended Returns With No Refund

https://savingtoinvest.com/wp-content/uploads/2022/11/image-15.png

What Is Code 570 And 971 On My IRS Tax Transcript

https://amynorthardcpa.com/wp-content/uploads/2022/08/What-Is-Code-570-and-971-on-My-IRS-Tax-Transcript-FB.png

What Does It Mean If I See Code 290 When you see Code 290 on your IRS transaction register it means your return is being reviewed or is undergoing processing They ve made a determination about your paperwork status which means an expected refund is on its way If you don t see Code 290 your return might still be on hold Part I of this two part blog discussed how to identify penalty relief associated with the IRS s recently announced broad penalty relief initiative on IRS tax account transcripts and explained the many uses of the transcript transaction code TC 290

One such code you might encounter is IRS Transcript Code 290 which indicates Additional tax assessed In this blog post we ll break down what this code means why you might receive it and what steps you While the TC 290 is for the IRS system message Additional Tax Assessed it does not automatically mean you owe taxes In fact the code often occurs even if there is no tax assessed which is shown by a 0 in the amount line You can see this in the screenshot above

IRS Code 290 Meaning Of Code 290 On 2022 2023 Tax Transcript SOLVED

https://thebusinessalert.com/wp-content/uploads/2021/07/IRS-Code-290-Additional-Tax-Assessed.jpg

Understanding The New Tax Code

https://static.fmgsuite.com/media/images/5bb910d4-47f9-4772-99b2-e2ceb93c0bff.jpg?v=1

what is a 290 tax code - The amount on the Code 290 line is the additional tax levied on your account The IRS will issue you a bill with a due date for the additional taxes you owe If you agree to the adjustment you should pay your taxes as quickly as possible