what is a 12000 property tax exemption 70 to 100 12 000 from the property s value A disabled veteran may also qualify for an exemption of 12 000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least

Property Tax Exemption Alabama Not specific to veterans must be 100 permanently disabled or over age 65 with less than 12 000 in annual income Single family residence and up to 160 acres of land completely exempt from taxes Alaska Must be rated at least 50 disabled First 150 000 in valuation is exempt Arizona Not specific A disabled veteran may also qualify for an exemption of 12 000 of the assessed value of the property if the veteran is age 65 or older with a disability rating of at least 10 percent totally blind in one or both eyes or has lost use of one or more limbs

what is a 12000 property tax exemption

what is a 12000 property tax exemption

https://i.ytimg.com/vi/MDwAqSRU6Ag/maxresdefault.jpg

Which States Offer Disabled Veteran Property Tax Exemptions Military

https://www.military.net/wp-content/uploads/2023/09/state-property-tax-exemptions-veterans-2048x1152.jpg

Senior Property Tax Exemption How You Can Apply For This Property Tax

https://i.ytimg.com/vi/KZj-0AF_qfU/maxresdefault.jpg

Texas bases its property tax exemptions on the disability status of the veteran 70 100 percent may be able to deduct 12 000 from their property s taxable value 50 69 percent may receive a 10 000 exemption from the property s value 30 49 percent may receive a 7 500 exemption from the property s value 10 29 percent may receive The tax reduction can be applied to one property in Texas that the veteran owns even for properties given to veterans through charitable organizations Senior disabled veterans aged 65 or older can receive a 12 000 exemption with a disability rating of 10 or higher or under other select circumstances

70 to 100 receive a 12 000 property tax exemption 50 to 69 receive a 10 000 property tax exemption 30 to 49 receive a 7 500 property tax exemption 10 to 29 receive a 5 000 property tax exemption 10 or more disability The new exemption will exempt all of the value of your home Consequently the 12 000 disabled veterans exemption will have no effect If you own other taxable property such as a vacation home or business you should file a new application with the appraisal district and designate the exemption as applying to the other property Q

More picture related to what is a 12000 property tax exemption

Property Tax Exemptions MHS Lending

https://d2fnysaq0ytmgw.cloudfront.net/public/content/media/image/property-tax-home.jpg?VersionId=MVHwD2hwXtqRjmn9M9KThwJ8pWDaSDWc

Smithtown Town Board Approves Tax Exemption For Seniors Long Island

https://longislandmediagroup.com/wp-content/uploads/2023/03/taxbreaksenior.jpg

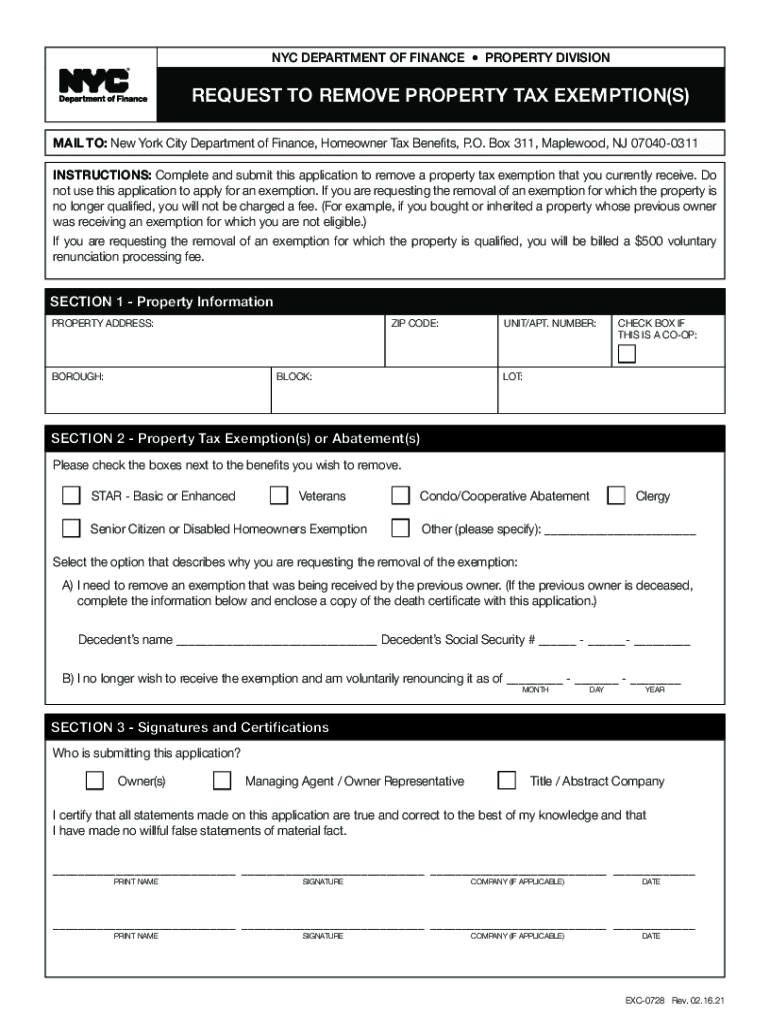

Request To Remove Property Tax Exemption Form Fill Out And Sign

https://www.signnow.com/preview/573/323/573323440/large.png

Qualified Disabled Veterans and Gold Star Spouses can receive 50 of the first 200 000 value of their home value exempted from their property tax This exemption is for primary residences owned and occupied since 1 January of the year in which the Veteran or Gold Star Spouse is applying File with Taxfyle Learn how to qualify for a homestead exemption and understand property tax exemptions to save on your tax bill as a property owner Get the tax relief you re eligible for

Property tax exemptions help qualifying property owners by reducing or eliminating their property tax bill Learn who qualifies for these exemptions and more Property tax is a tax on real estate and some other kinds of property See how to calculate property tax where to pay property tax and how to save money

Bill Would Preserve Property Tax Exemptions For Nonprofits

https://www.tallahassee.com/gcdn/presto/2021/03/05/PTAL/7bb04f92-386e-459c-9270-b98cc14a82ac-Sabeen_Perwaiz.jpg?crop=4039,2272,x0,y505&width=3200&height=1801&format=pjpg&auto=webp

What Is The Florida Homestead Property Tax Exemption

https://www.hauseit.com/wp-content/uploads/2023/07/Florida-Homestead-Exemption.jpg

what is a 12000 property tax exemption - 70 100 12 000 from the property value Based on your disability rating you will be asked to fill out different forms All forms are categorized and can be found on the Texas Veterans website Your county will determine which exemptions may be combined so contact your appraisal district to verify What if I am a disabled veteran over 65