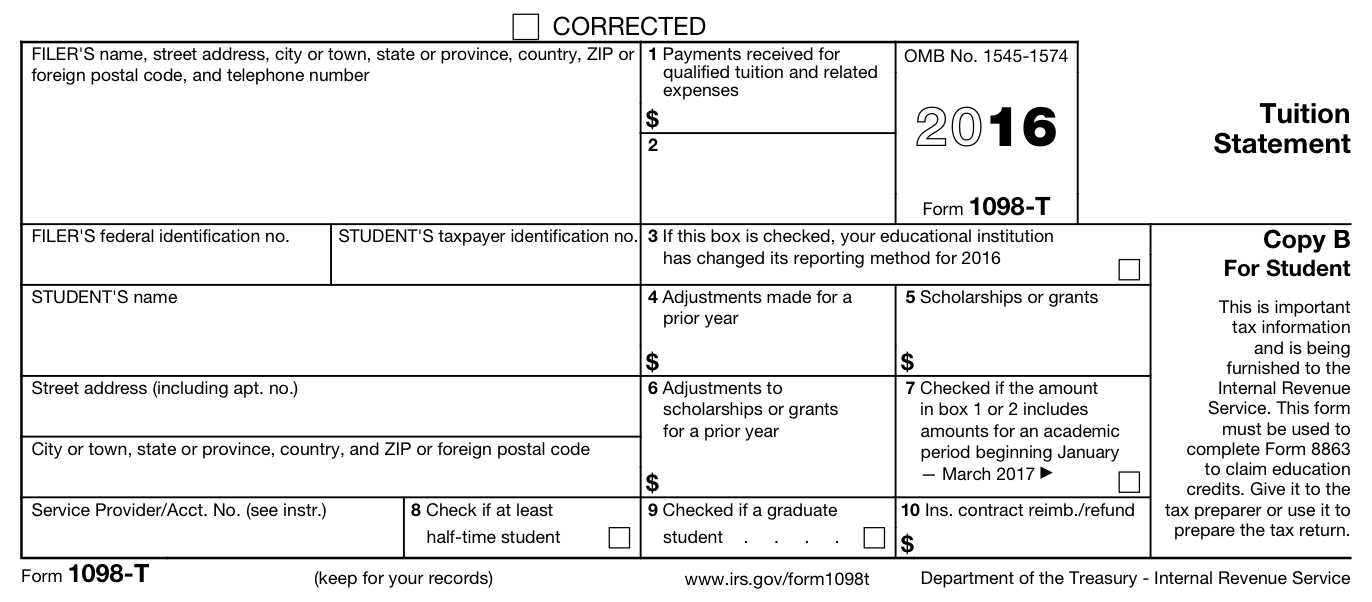

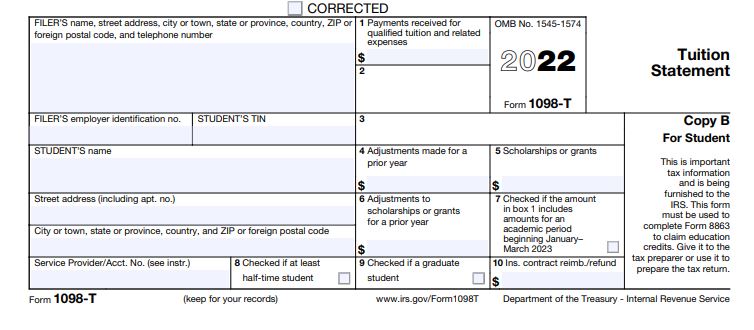

what is a 1098 t form used for Basically the 1098 T Form is information about educational expenses that may qualify you as the student or the student s parents or guardian if the student is still a

Why Form 1098 T is important to you It helps you identify eligible college expenses for valuable education credits up to 2 500 So do not discard this form What are the education tax Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The

what is a 1098 t form used for

what is a 1098 t form used for

https://www.handytaxguy.com/wp-content/uploads/2018/12/1098-T-Tuition-Statement-Image.png

What Is A 1098 T Form Used For Full Guide For College Students The

https://www.handytaxguy.com/wp-content/uploads/2019/02/Etsy-and-Taxes-Tips-and-Deductions-with-Etsy-Shop-Owners-taking-a-photo..jpg

What Is A 1098 T Personal Finance For PhDs

http://pfforphds.com/wp-content/uploads/2016/02/1098t.png

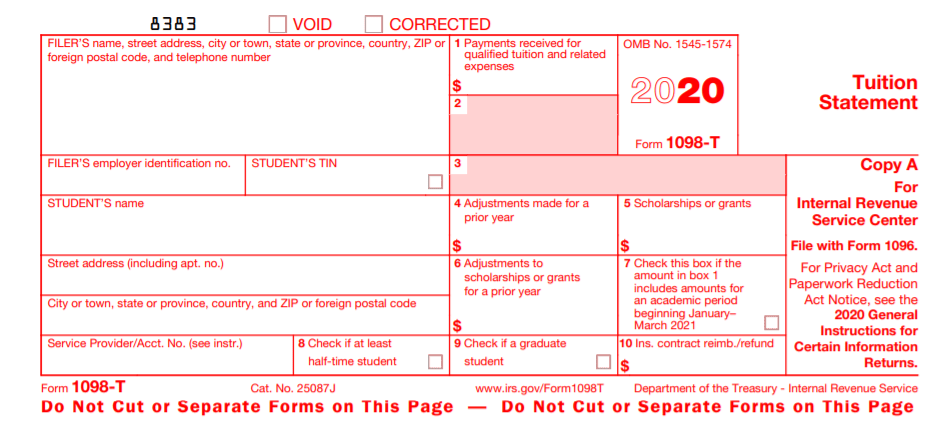

With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses The form

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the 11 rowsWhat is IRS Form 1098 T A college or university that received qualified tuition and related expenses on your behalf is required to file Form 1098 T above with the Internal Revenue Service IRS A copy of Form 1098 T must

More picture related to what is a 1098 t form used for

Understanding Your IRS Form 1098 T Student Billing

https://studentbilling.berkeley.edu/sites/default/files/styles/openberkeley_image_full/public/1098t_sample_2020.jpg?itok=9ehuNdu-×tamp=1610405644

IRS Form 1098 T University Of Dayton Ohio

https://udayton.edu/fss/_bursar_resources/img_new/2022_1098t_sample.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

What is a 1098 T form and what I should do with it 1098 T forms are issued by the university to students that made a payment for qualified tuition and fees during a given calendar year This A 1098 T form or tuition statement is an American IRS tax form filed by eligible education institutions to report payments received and payments due from paying students The institution is required to report a form for every

Form 1098 T is also known as the Tuition Statement It is a form that is used by colleges and universities to report the amount of qualified tuition and related expenses paid by a student or Form 1098 T is a tuition statement that students receive from their college It serves two primary purposes Documenting eligibility to claim the American Opportunity Tax Credit or

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

what is a 1098 t form used for - The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses The form