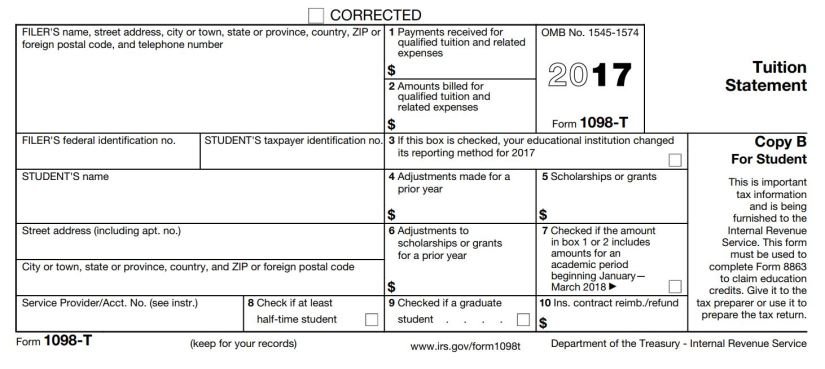

what is a 1098 t form from my college Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational

Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income

what is a 1098 t form from my college

what is a 1098 t form from my college

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

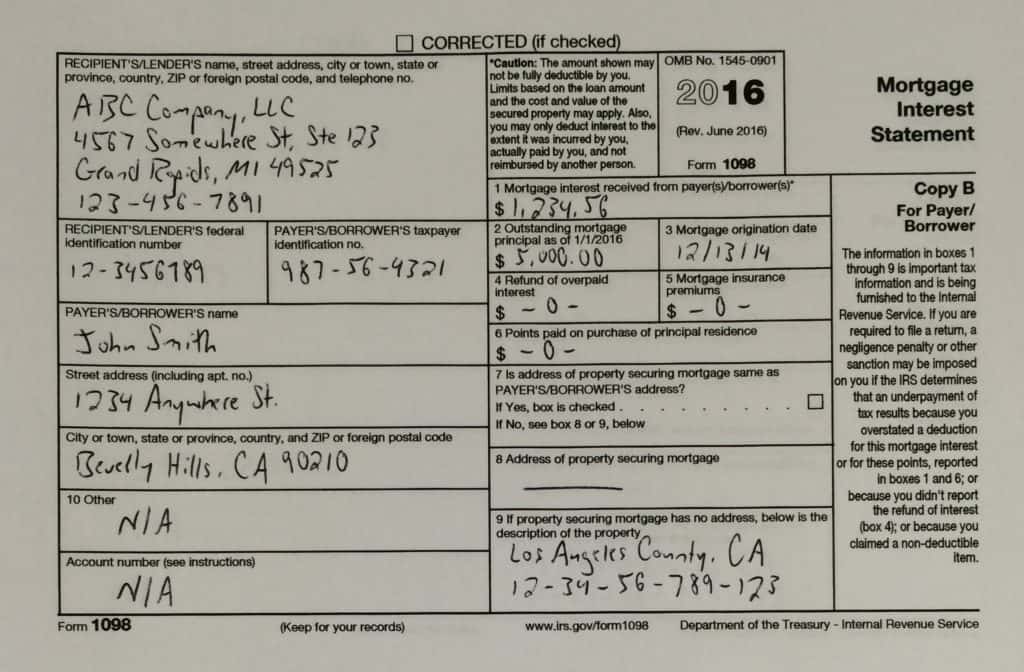

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Sso refresh session body sso refresh session button continue Form 1098 T is an information return where your college reports how much qualified tuition and expenses you or your parents paid during the tax year The IRS uses

Form 1098 T is a tuition statement that students receive from their college It serves two primary purposes Documenting eligibility to claim the American Opportunity Tax Credit or Lifetime Learning Credit The Form 1098 T is a statement that colleges and universities are required to issue to certain students It provides the total dollar amount paid by the student for what is referred to as

More picture related to what is a 1098 t form from my college

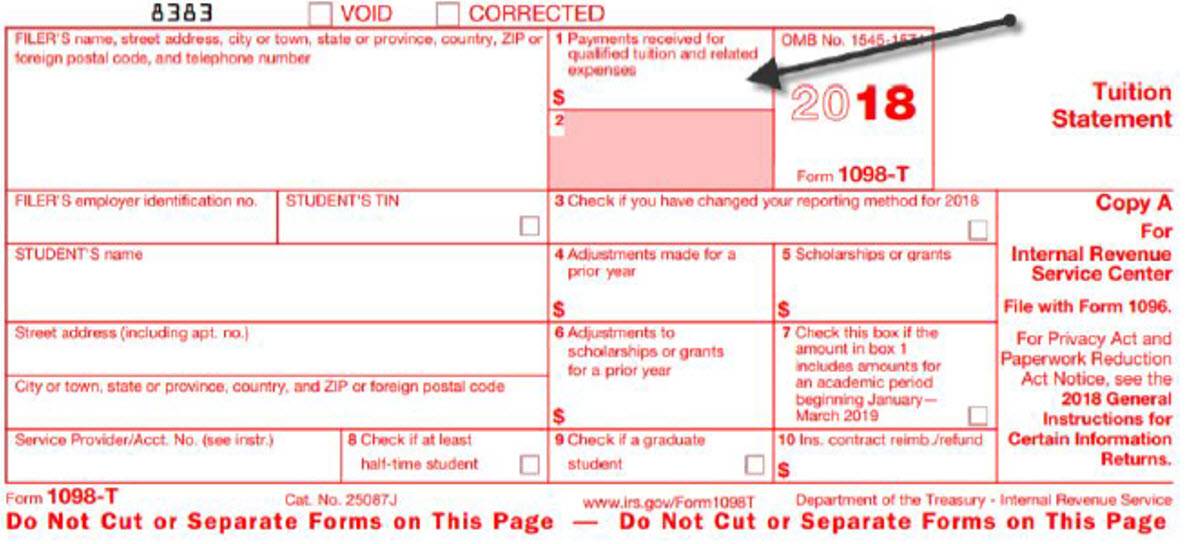

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

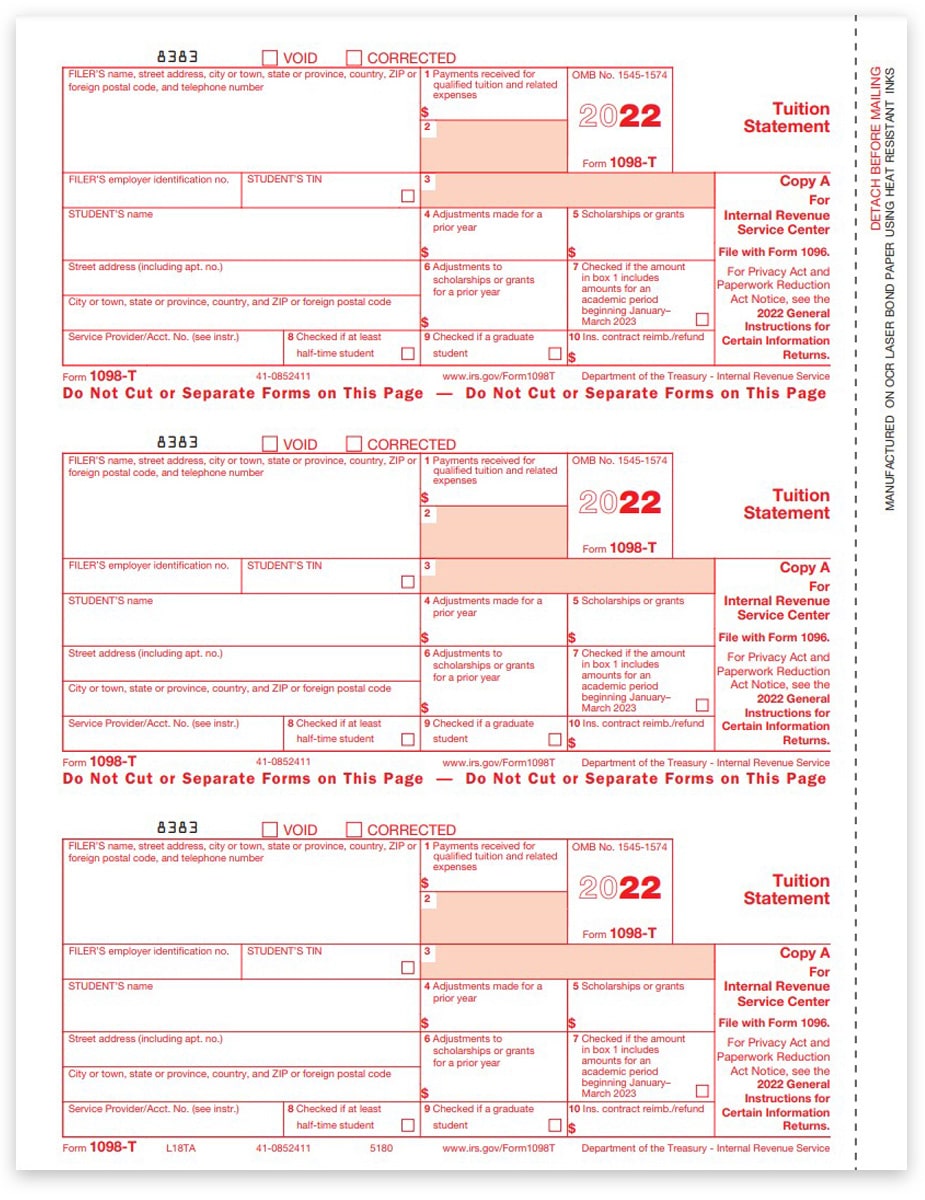

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

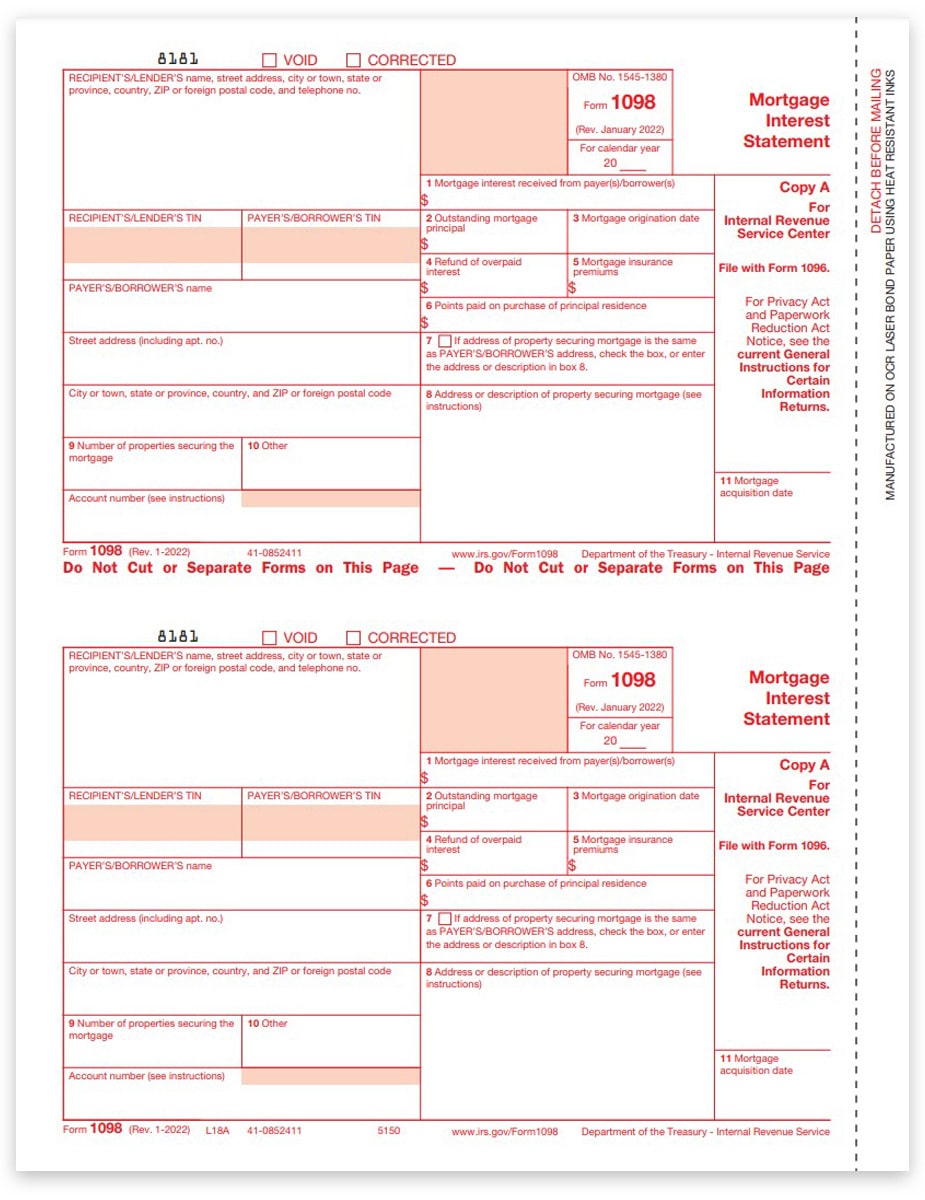

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Form 1098 T is an annual IRS form provided to students to report student related educational payments The form summarizes payments towards qualified tuition and fees for the calendar year January 1 through December 31 Temple University is required to provide all students with a 1098 T tax form that records certain required information Federal 1098 T forms are distributed by January 31 each year to students who meet the Internal Revenue Services

What is the 1098 T form The 1098 T form is a tax form required by the IRS for Higher Education Institutions to send to all active students The form pertains to the Hope Scholarship and The 1098 T along with the 1098 T Detail provides tax information necessary to determine eligibility for the American Opportunity Credit and the Lifetime Learning Credit These are

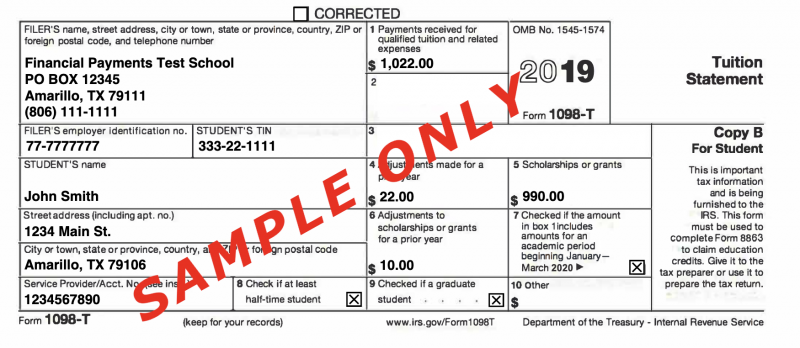

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

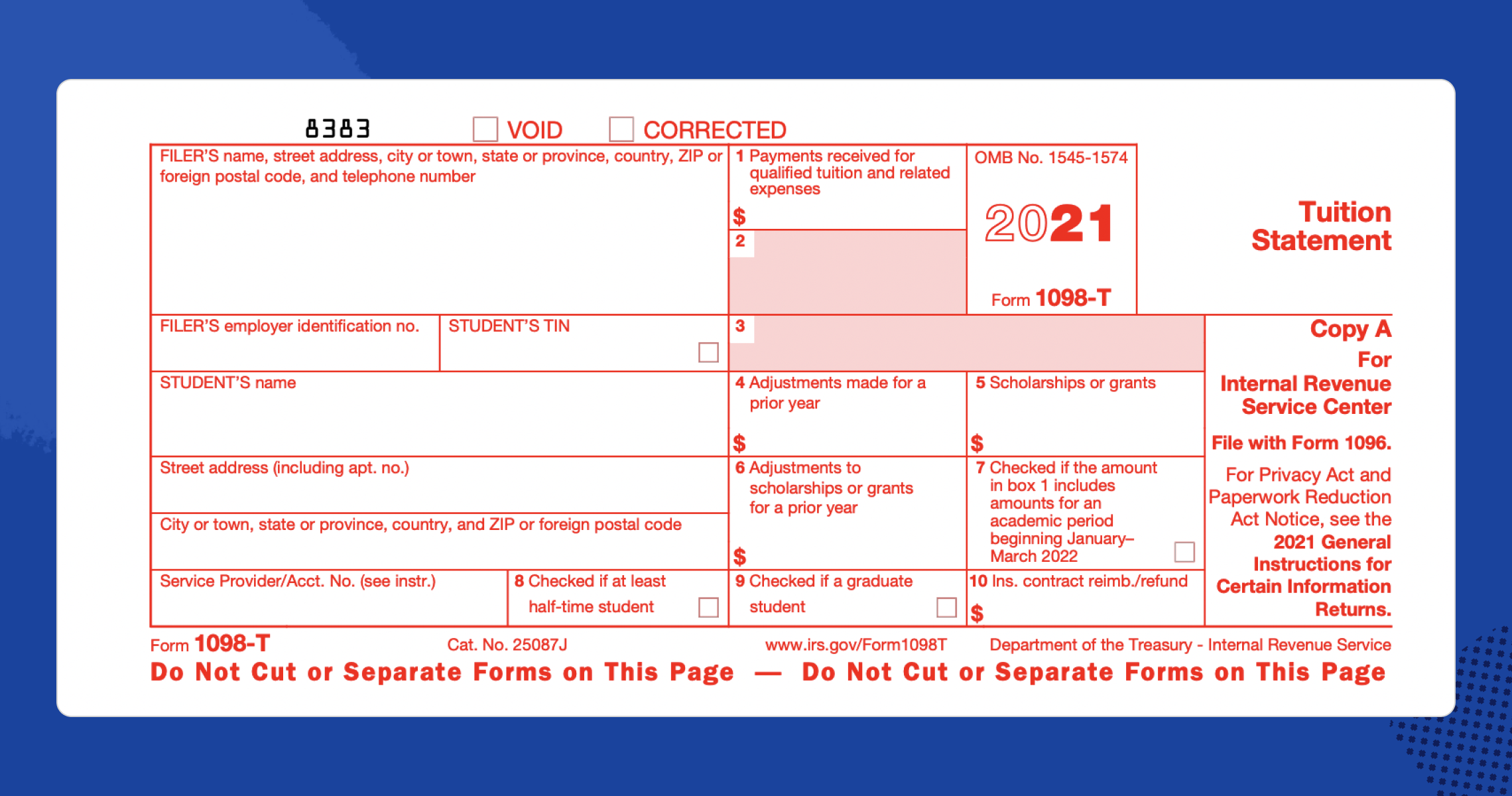

1098 T Form How To Complete And File Your Tuition Statement

https://blog.pdffiller.com/app/uploads/2016/02/1098-T-form-tuition-statement.png

what is a 1098 t form from my college - Form 1098 T is an information return where your college reports how much qualified tuition and expenses you or your parents paid during the tax year The IRS uses