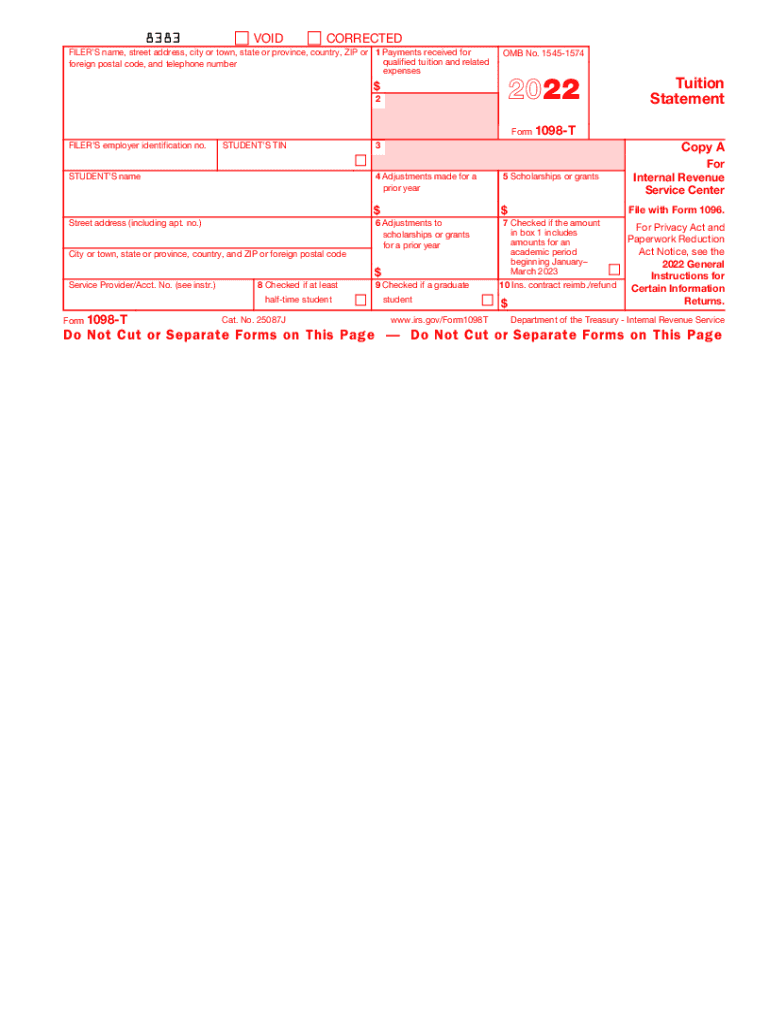

what is a 1098 t form 2022 To complete Form 1098 T use The 2022 General Instructions for Certain Information Returns and

File Form 1098 T Tuition Statement if you are an eligible educational institution You must file for each student you enroll and for whom a reportable transaction is made Also if you are an Schools are supposed to give a Form 1098 T to students by Jan 31 of the calendar year following the tax year in which the expenses were paid Here s what to know about this form and what to do with it when you file your

what is a 1098 t form 2022

what is a 1098 t form 2022

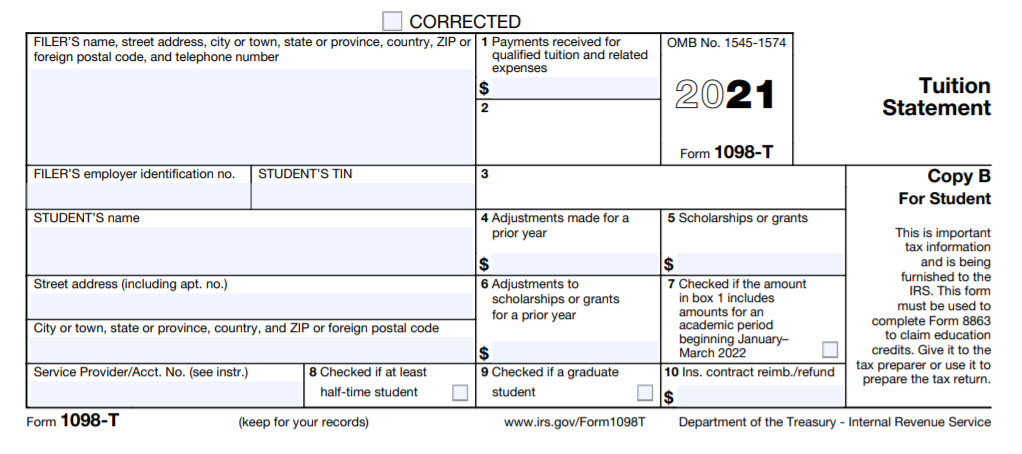

https://busfin.osu.edu/sites/default/files/2021-1098-t.jpg

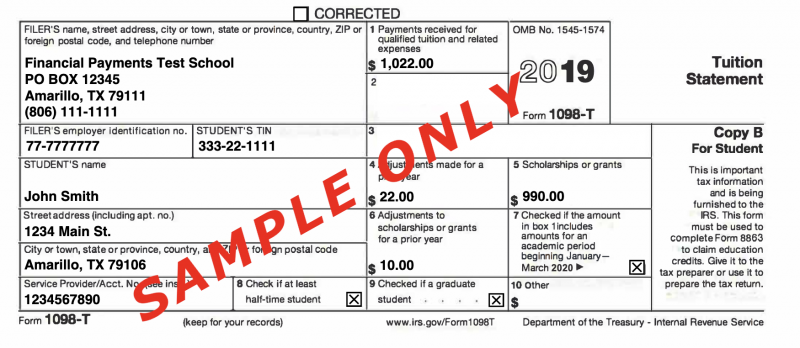

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the

What is Form 1098 T Form 1098 T is a tax document prepared by higher education institutions to report payments of qualified tuition and related expenses QTRE as well as scholarships Form 1098 T is a tuition statement that students receive from their college It serves two primary purposes Documenting eligibility to claim the American Opportunity Tax Credit or Lifetime Learning Credit

More picture related to what is a 1098 t form 2022

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

2022 Form IRS 1098 T Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/577/387/577387426/large.png

1098 T Form 2023 Printable Forms Free Online

https://www.pvamu.edu/fmsv/wp-content/uploads/sites/37/1098-T-2023-image_cropped.png

Basically the 1098 T Form is information about educational expenses that may qualify you as the student or the student s parents or guardian if the student is still a dependent This is for the education related The IRS Form 1098 T is an information form filed with the Internal Revenue Service The IRS Form 1098 T that you receive reports amounts paid for qualified tuition and related expenses

Form 1098 T is an information return where your college reports how much qualified tuition and expenses you or your parents paid during the tax year The IRS uses Specific Instructions for Form 1098 T File Form 1098 T Tuition Statement if you are an eligible educational institution You must file for each student you enroll and for whom a reportable

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

what is a 1098 t form 2022 - Form 1098 T is a tuition statement that students receive from their college It serves two primary purposes Documenting eligibility to claim the American Opportunity Tax Credit or Lifetime Learning Credit