what is 90 in income tax The DTAA or double taxation avoidance agreement is an agreement between countries that ensures that taxpayers do not end up paying taxes twice on the same income If

What is Section 90 of the Income Tax Act Section 90 provides legal framework for the Central Government of India to enter into treaties with foreign governments or specified What is Section 90 of the Income Tax Act Section 90 of the Income Tax Act deals with the agreement between India and foreign countries or specified territories for the avoidance of double taxation

what is 90 in income tax

what is 90 in income tax

https://img.indiafilings.com/learn/wp-content/uploads/2018/03/12010154/Income-Tax-Rate-for-Companies.jpg

Major Changes In Income Tax Income Tax Slabs Tax Rates Calculation

https://i.ytimg.com/vi/rRGs7tKMgUM/maxresdefault.jpg

Key Changes In Income Tax Return ITR Form For A Y 2019 20 Income

https://i.pinimg.com/736x/5d/3b/07/5d3b07cf2aa975abf2d69a6c11f4bf72.jpg

Section 90 of the Act specifies the provisions related to relief from double taxation in scenarios where India has entered into double taxation avoidance agreement DTAA with that particular foreign country As per the tax laws of India sections 90 and 91 of the Income Tax Act deal with the concept of FTC Section 90 discusses the claiming of FTC in a case where India has entered into a Double Taxation Avoidance Agreement DTAA with

If you are someone having a foreign source of income then it is important for you to understand the provisions for tax relief under sections 90 and 91 The income tax law has What is Section 90 of the Income Tax Act Section 90 of the Income Tax Act of 1961 is a provision that provides bilateral relief from double taxation to taxpayers with foreign

More picture related to what is 90 in income tax

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

Solutions To Practical Problems In Income Tax Sahitya Bhawan

https://www.sahityabhawan.in/wp-content/uploads/2021/11/practical-income-tax-21-1-1200x1824.jpg

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4f4b2caa6eb2579afccf97f0ae69d7d2/thumb_1200_1854.png

What is Section 90 of the Income Tax Act Section 90 of the Income Tax Act provides relief from double taxation by allowing Indian residents to claim a credit for taxes paid Calculation of Relief under section 90 91 Relief allowed under section 90 91 is lower of following accounts 1 Tax paid on double taxed income outside India 2 Tax

What is Section 90 of the Income Tax Act Section 90 of the Income Tax Act deals with the agreement between India and foreign countries or specified territories for the 90 1 The Central Government may enter into an agreement with the Government of any country outside India or specified territory outside India a for the granting of relief in respect

Income Tax Budget 2024 10

https://tamil.gizbot.com/img/2024/02/budget-2024-income-tax-no-changes-1706773497.jpg

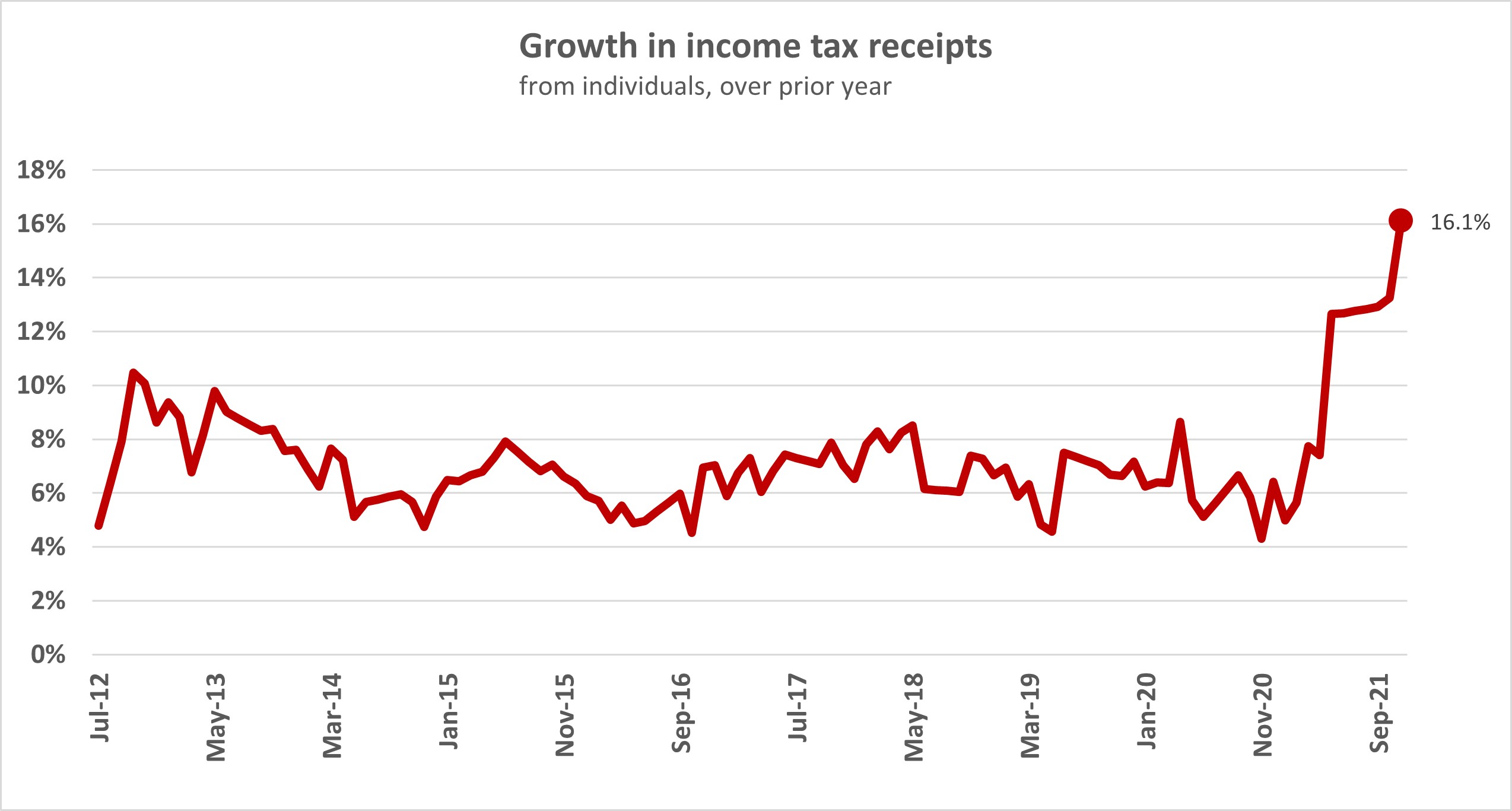

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

https://www.interest.co.nz/sites/default/files/2022-01/Growth_in_income_tax_receipts.jpg

what is 90 in income tax - What is Section 90 of the Income Tax Act Section 90 of the Income Tax Act of 1961 is a provision that provides bilateral relief from double taxation to taxpayers with foreign