what is 8889 tax form Learn how to file Form 8889 if you contribute to or distribute money from your HSA in a tax year Find out the benefits limits and rules of HSAs and how to report them on

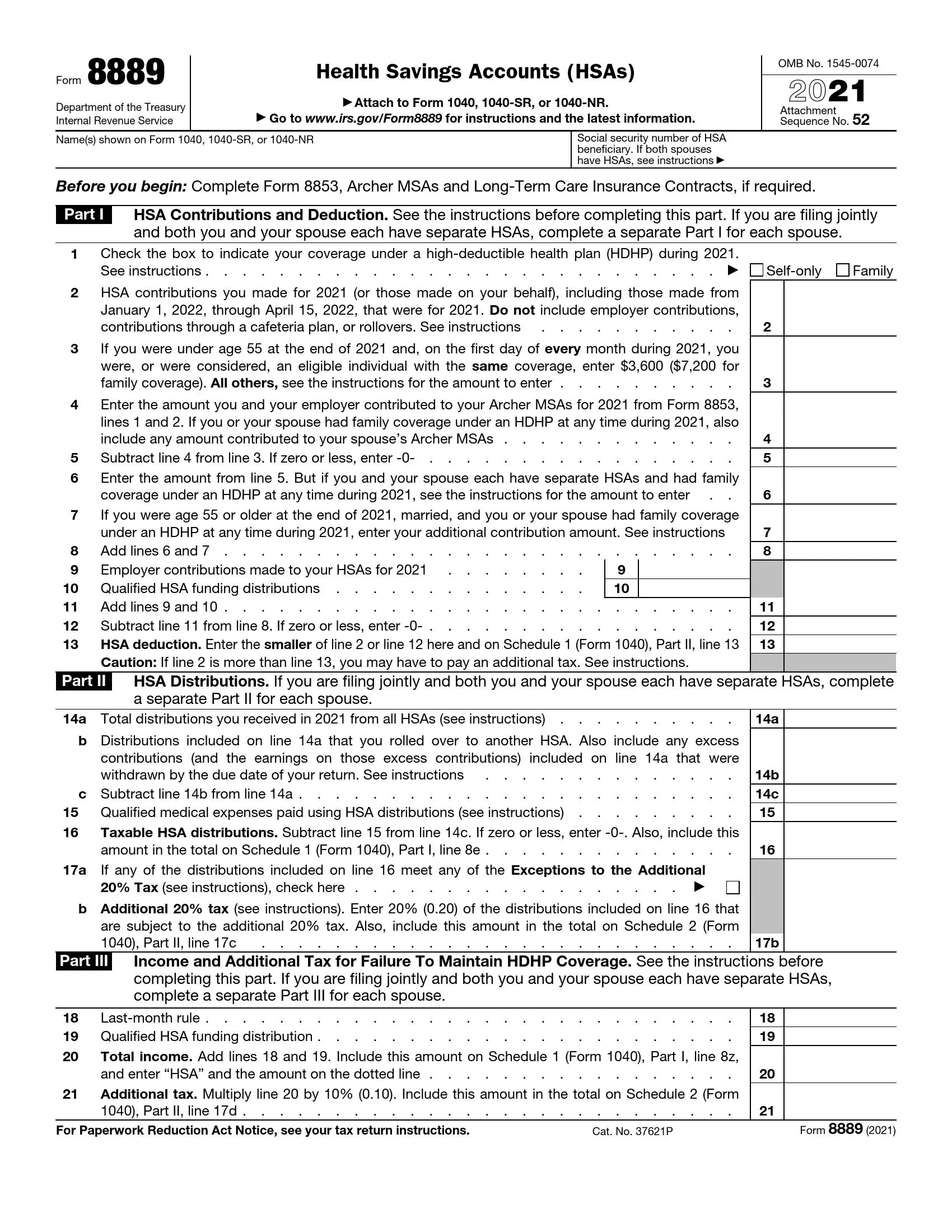

2023 Form 8889 Before you begin Complete Form 8853 Archer MSAs and Long Term Care Insurance Contracts if required Part I HSA Contributions and Deduction See the instructions Tax form 8889 is the document you submit to the IRS that determines what additional taxes you ll have to pay If you make any mistakes you could be subject to penalties so it s important to get it right

what is 8889 tax form

what is 8889 tax form

https://formspal.com/wp-content/uploads/2022/01/irs-form-8889-2021-preview.webp

How To Complete IRS Form 8889 For Health Savings Accounts HSA YouTube

https://i.ytimg.com/vi/f0ldHvce_24/maxresdefault.jpg

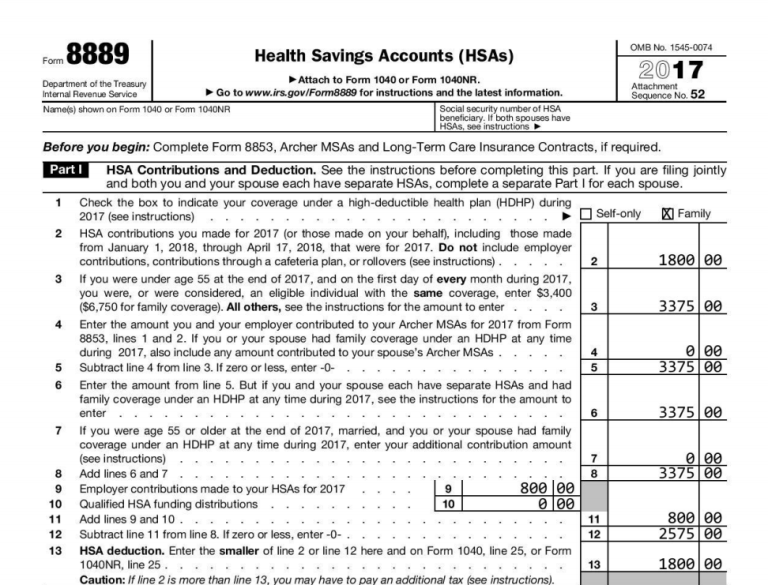

2017 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2018/02/2017-HSA-Form-8889-part-1-example-768x585.png

Form 8889 is the IRS form that helps you to do the following Report contributions to a Health Savings Account HSA Calculate your tax deduction from making HSA contributions Report distributions you took from Form 8889 is for people with high deductible health plans to report Health Savings Account HSA contributions and distributions on their federal tax returns TurboTax

This form is specific and documents all of your HSA s financial activity for 2020 It is an ancillary tax form that flows to Form 1040 to adjust your income your contributions reduce your taxable income whereas any penalties adds back to income increasing tax What is Form 8889 Form 8889 is used to report how your HSA will affect your taxes Here s what it covers Your HSA eligibility Total contributions made to your HSA by you and or your employer during the tax

More picture related to what is 8889 tax form

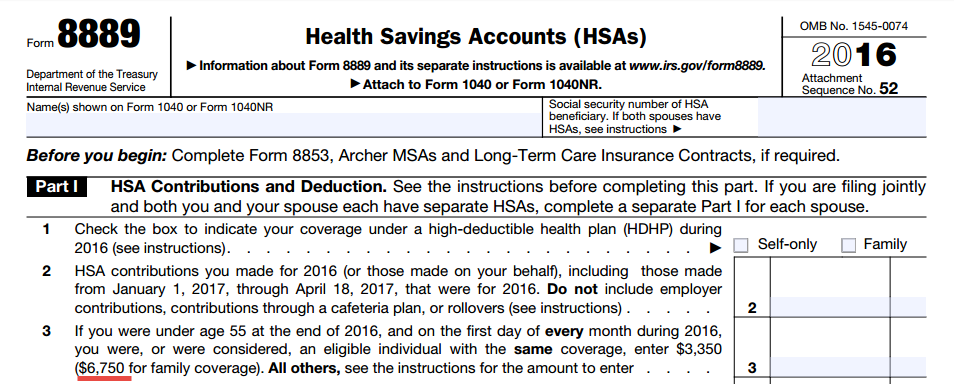

2016 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2017/01/2016_form_8889_family_contribution_amount.png

Form 8889 2023 Printable Forms Free Online

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/irs_form_8889_featured_image.png

2016 HSA Form 8889 Instructions And Example YouTube

https://i.ytimg.com/vi/6j9x3OZm_KI/maxresdefault.jpg

Form 8889 Health Savings Account HSA is used to report HSA contributions distributions and withdrawals Tip On jointly filed returns Form 8889 will have a T or S What is Form 8889 Put simply the IRS uses Form 8889 for HSA reporting If you hold an HSA account or are the beneficiary of a deceased HSA holder you re required to attach Form 8889 to your Form 1040 when filing your

Form 8889 is for reporting transactions on HSA accounts Note that HSA accounts are individual accounts so TurboTax provides separate forms for taxpayer and spouse so that Purpose of Form Use Form 8889 to Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA

IRS Form 5329 For Retirement Savings And More Tax Relief Center

https://help.taxreliefcenter.org/wp-content/uploads/2019/07/TRC-CFI-IRS-Form-5329.png

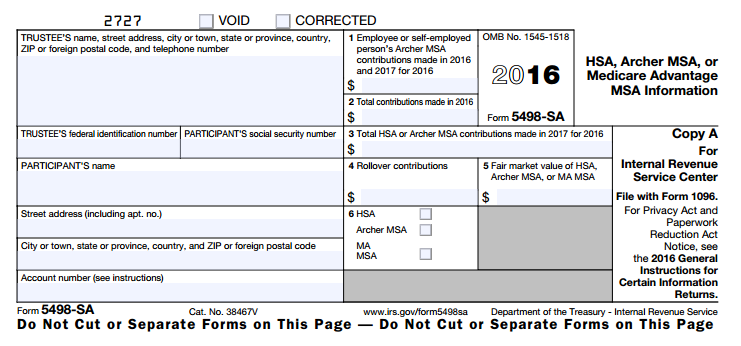

What Is HSA Tax Form 5498 SA HSA Edge

https://www.hsaedge.com/wp-content/uploads/2016/08/HSA_Form_5498-SA_2016.png

what is 8889 tax form - Form 8889 is the IRS form that helps you to do the following Report contributions to a Health Savings Account HSA Calculate your tax deduction from making HSA contributions Report distributions you took from