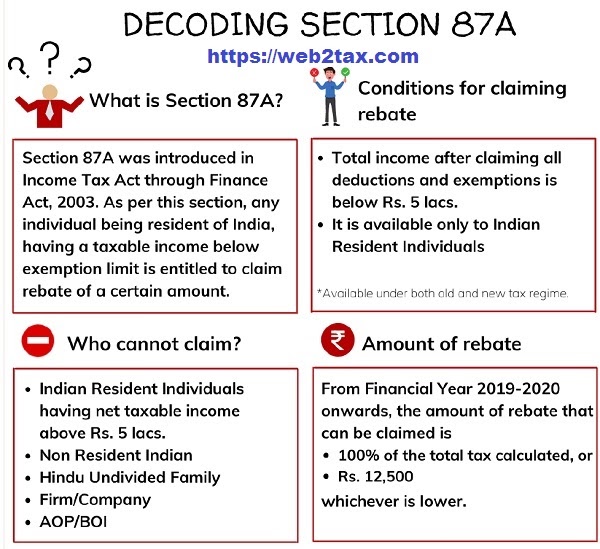

what is 87a in income tax in hindi 87A FY 2021 22 AY 2022 23 u s 87A Eligibility Criteria to Claim Income Tax Rebate u s 87A for FY 2020 21 and FY 2019 20

1961 87 87 87A NRI HUF

what is 87a in income tax in hindi

what is 87a in income tax in hindi

https://1.bp.blogspot.com/-QwbPPuIJkqE/YQ8hxWt3tWI/AAAAAAAARd4/sOkojJa-6Jk150E9-TVE2yd2ILJswOw_QCNcBGAsYHQ/w1200-h630-p-k-no-nu/87%2BA%2BPicture.jpg

Different Ways To Save Income Tax In India Under Section 80C

https://i.pinimg.com/originals/2b/99/cb/2b99cb347a93577e2e11ab53512dc436.png

Personal Income Tax Guide In Malaysia 2016 Tech ARP

https://www.techarp.com/wp-content/uploads/2016/03/lhdn.png

87a 2500 3 5 1 2019 87A 87A 12500 rebate 12500

Income Tax Section 87A in Hindi Dhara 87A 87A Individual Income Tax Return Income Tax Act Section 87A Rebate How is Section 87A Rebate Calculated

More picture related to what is 87a in income tax in hindi

Tax Payment Which States Have No Income Tax Marca

https://phantom-marca.unidadeditorial.es/7f630bcfa3cc4f2b33db1ffa28dd66ab/resize/1200/f/jpg/assets/multimedia/imagenes/2023/02/05/16756118713316.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Share Market Income Tax In Hindi

https://hindi.adigitalblogger.com/wp-content/uploads/2022/09/शेयर-मार्केट-टैक्स-.jpg

Ans 5000 87A 12 500 3 1961 87a

ZERO Income Tax with Tax Rebate Section 87A Income Tax Calculation Examples Hindi In this video by FinCalC TV we will see ZERO Income Tax with Tax Rebate 87A 87A 2003 5 12 500

What Is Income Tax In Hindi

https://paisekagyan.com/wp-content/uploads/2021/12/What-is-Income-Tax-in-Hindi-इनकम-टैक्स-क्या-है-1024x684.jpg

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

what is 87a in income tax in hindi - Tax rebate is a relief for individuals to avoid income tax burden if income is below a certain threshold The rebate is up to Rs 7 lakh in the new tax regime and up to Rs 5 lakh in the old regime Steps limits and calculations under Section 87A are discussed