what is 80g 5 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals as well as companies The deduction under section

Explanation 1 An institution or fund established for the benefit of Scheduled Castes backward classes Scheduled Tribes or of women and children shall not be deemed to be an Section 80G of the Income Tax Act provides a tax deduction for contributions to certain prescribed charitable institutions Specifically 80G registration focuses on donations made for charitable purposes while Section

what is 80g 5

what is 80g 5

https://facelesscompliance.com/wp-content/uploads/2020/05/Receipt.jpg

80 Grams To Cups Baking Like A Chef

https://www.bakinglikeachef.com/wp-content/uploads/80-grams-to-cups.jpg

Cadbury Dairy Milk Fruit Nut Chocolate Slab 80g Ezambezi

https://ezambezi.com/wp-content/uploads/2022/03/cadbury-dairy-milk-fruit-nut-chocolate-slab-80g.jpg

Tax benefit under section 80G depends on rate of Tax applicable to the Assessee Further section 80G 5 provides that this section applies to donations to any institution or fund referred to in sub clause iv of clause a of sub section 2 only if it is established in India for a charitable purpose and if

Section 80G of the Income Tax Act provides tax incentives to individuals contributing to eligible charitable trusts or institutions This section allows for deductions on donations made to specified funds or charities Amendment has been made in Section 80G 5 of Income Tax Act 1961 by Finance Act 2020 according to which all entities which are

More picture related to what is 80g 5

What Is Section 80G Tax Deductions On Your Donations Deduction U s

https://i.ytimg.com/vi/qbX0I6TKH9g/maxresdefault.jpg

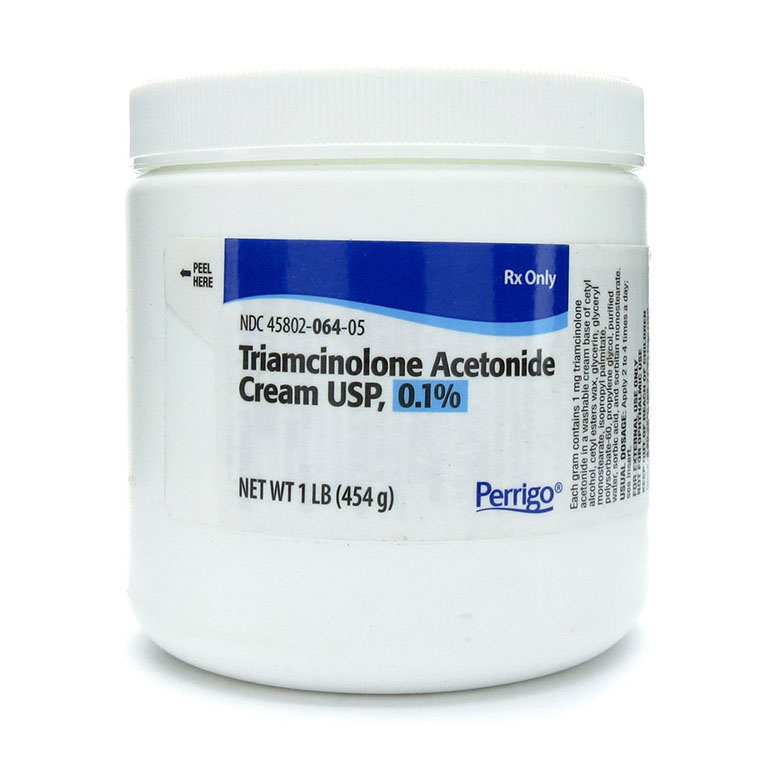

Thu c Triamcinolone Acetonide C ng D ng T c D ng Ph T ng T c

https://thuocdantoc.vn/wp-content/uploads/2018/12/triamcinolone-acetonide-la-thuoc-gi.jpg

http://sport600.ru/images/what.png

Section 80G 5 viii and 35 1A i prescribe statement of particulars to be furnished by a reporting person in respect of each financial year beginning with financial year 2021 22 Filing of Statement of donations in Form 10BD is I want to know how much deducted is allowed if amount paid as donation and donation receipt shows ORDER U S 80G 5 vi OF THE INCOME TAX ACT 1961

This article focuses on the major changes brought in by the Finance Act 2020 by introducing new section 10AB replacing section 10AA and bringing in similar amendments in What is approval u s 80G 5 Is it necessary for a charitable Institution How to apply for it What is the use of approval u s 80G 5 for Charitable Trust Charitable Society Non Governmental

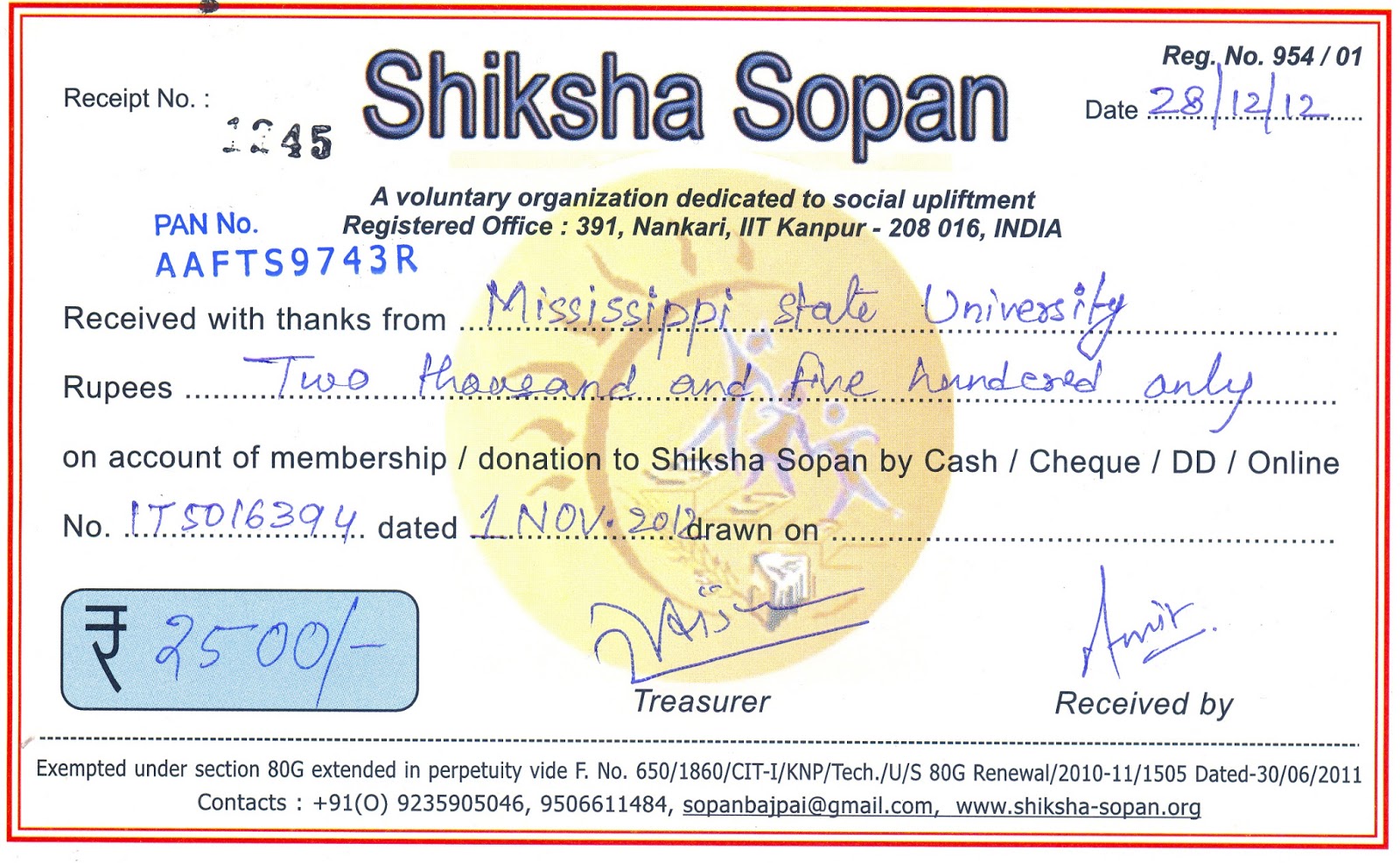

Contribution Receipt November 2012 Shiksha Sopan

http://1.bp.blogspot.com/-xYZUnOKMMHI/UPch0olHMmI/AAAAAAAAC-g/ro86DYbC6Qc/s1600/nov.jpg

What You Need To Know About 80G And How It Can Reduce Your Tax Liability

https://blog.researchandranking.com/wp-content/uploads/2023/05/What-is-80G.jpg

what is 80g 5 - The Indian government introduced Form 10BD under Section 80G for charitable institutions to report donations accurately to prevent false claims Failure to submit the statement on time