what is 80ccd 2 in income tax Learn how to claim an additional tax deduction under Section 80CCD 2 for contributions made by your employer to your National Pension System NPS account Find out the benefits eligibility and steps of claiming

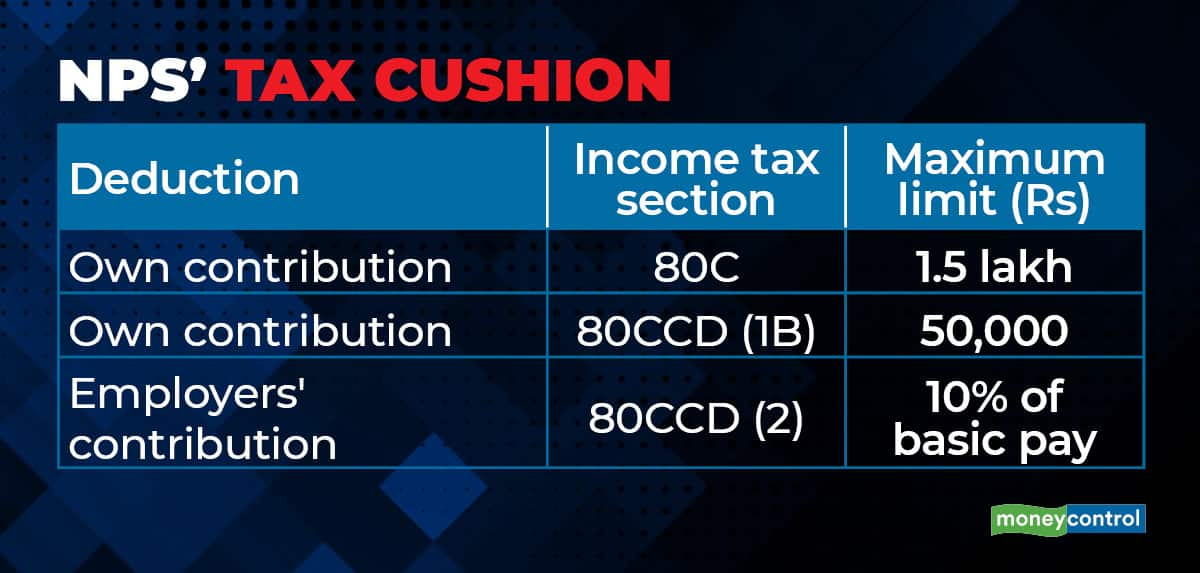

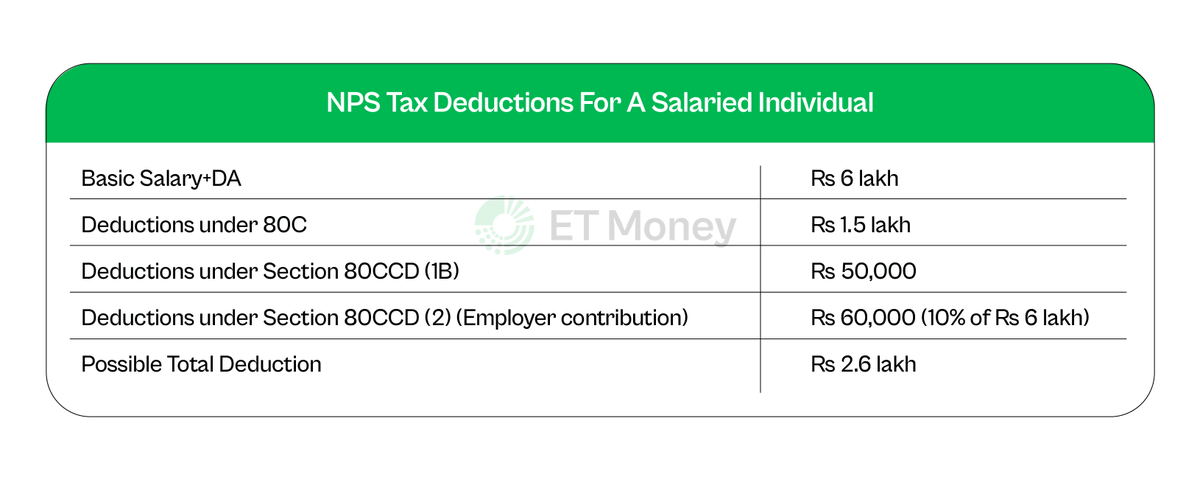

The NPS 80CCD income tax deductions are divided into two sub sections 1 and 2 and the limits under these two are not overlapping Combined tax savings under this If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer in the previous

what is 80ccd 2 in income tax

what is 80ccd 2 in income tax

http://images.moneycontrol.com/static-mcnews/2022/02/NPS-tax_001.jpg

What Is The National Pension System Section 80CCD 1B In Hindi

https://i0.wp.com/www.howtrending.com/wp-content/uploads/2022/01/et44t4.jpg?fit=720%2C432&ssl=1

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Learn how to claim tax deductions on contributions to NPS and APY under Section 80CCD of the Income Tax Act 1961 Find out the eligibility limits and conditions for Section 80CCD 2 allows a salaried individual to claim the following deduction Central Government or State Government Employer Up to 14 per cent of their salary basic DA Any other

More picture related to what is 80ccd 2 in income tax

What Is Dcps In Salary Deduction Login Pages Info

https://www.basunivesh.com/wp-content/uploads/2016/10/NPS-Tax-Benefits-1280x720.jpg

54F Requirements To Claim Exemptions Under Section 54F Of Income Tax Act

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/income-tax/Section.jpg

Income Tax Deduction Under 80C 80D And 80CCD Overview Types And

https://www.tickertape.in/blog/wp-content/uploads/2021/12/6-2.png

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits 80CCD 2 relates to the deduction of employer s contribution to New Pension Scheme NPS This contribution is firstly added in salary income and later allowed as

Section 80CCD 1B gives an additional deduction of Rs 50 000 on their NPS contributions Section 80CCD 2 provides that employees can claim a deduction on the NPS The deduction under Section 80CCD 2 is available upto 10 of the basic salary and dearness allowance of the employee For the Central and State government employee a

Tax Savings Deductions Under Chapter VI A Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2023/03/03105750/FigJam-Basics-1-1024x870.jpg

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

https://pbs.twimg.com/media/FcI0Ex5aAAIs5Uy.png

what is 80ccd 2 in income tax - A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of 14 of