what is 5 apr on 50 000 The Advanced APR Calculator finds the effective annual percentage rate APR for a loan fixed mortgage car loan etc allowing you to specify interest compounding and payment frequencies Input loan amount interest rate number of payments and financing fees to find the APR for the loan

APR Calculator is an advanced device that helps you to compute the Annual Percentage Rate APR that is the annual rate charged for the credit APR then represents the total cost of the borrowed money This calculator determines the APR of a loan with additional fees or points rolled into the amount borrowed We calculate 1 the monthly payment based on the actual loan amount then 2 back calculate to a new interest rate which is the APR as if this payment was made on just the amount financed

what is 5 apr on 50 000

what is 5 apr on 50 000

https://opengeekslab.com/wp-content/uploads/2019/09/What-is-5G.png

What Is 5G The Benefits And Implications For South Africa

https://fastestfibre.co.za/wp-content/uploads/2023/02/1.-What-is-5G-technology-and-how-does-it-work.jpg

What Does APR Mean On A Credit Card

https://m.foolcdn.com/media/affiliates/images/Credit_card_APR_RYhyIj6.2e16d0ba.fill-1080x1080.jpg

Calculate the APR Annual Percentage Rate of a loan with pre paid or added finance charges How to use Bankrate s APR loan calculator Our calculator tool will help you to estimate your monthly payments on a personal loan as well as the total interest accrual over the life of the loan

APR Calculator to calculate the annual percentage rate your loan The APR calculator calculates the overall costs of the loan including financing fees and interest payments To calculate an approximate APR for your loan or credit card just follow these easy steps Enter the amount you will borrow into the Loan Amount field Enter any additional non interest charges such as arrangement fees into the Additional Charges field Enter the number of years that the loan is for into the Duration field

More picture related to what is 5 apr on 50 000

APR Vs Interest Rate Know The Difference When Choosing A Personal Loan

https://www.upgrade.com/img/apr-vs-interest-rate.png

Solved Last Month Kaitlin s Average Daily Balance On Her Credit Card

https://www.coursehero.com/qa/attachment/24751794/

Mik On 5G Ja Miten Se Vaikuttaa El m si Samsung Suomi

https://images.samsung.com/is/image/samsung/assets/fi/p6_gro1/p6_initial_explore/p6_initial_brand/p6_what-is-5g-and-how-will-it-affect-your-life/im0029_explore_what-is-5g-and-how-will-it-affet-your-life_content1_mo_720x720.jpg?$FB_TYPE_J_F_MO_JPG$

Use this loan calculator to determine your monthly payment interest rate number of months or principal amount on a loan Find your ideal payment by changing loan amount interest rate and term and seeing the effect on payment amount The APR calculator determines a loan s APR based on its interest rate fees and terms You can use it as you compare offers by entering the following details Loan amount How much you plan to borrow Finance charges Required fees from the lender such as an origination fee or mortgage broker fee Situational fees such as a late payment fee

The monthly payment on a 50 000 loan is around 542 63 to 955 06 with interest rate of 5 5 The monthly payment for loans varies depending on the interest rate and the loan payoff terms For example the monthly payment for a 10 year term loan with a 5 5 interest rate is 542 63 and the monthly payment for a 5 year term loan with the same Our calculator shows you the total cost of a loan expressed as the annual percentage rate or APR Enter the loan amount term and interest rate in the fields below and click calculate to see

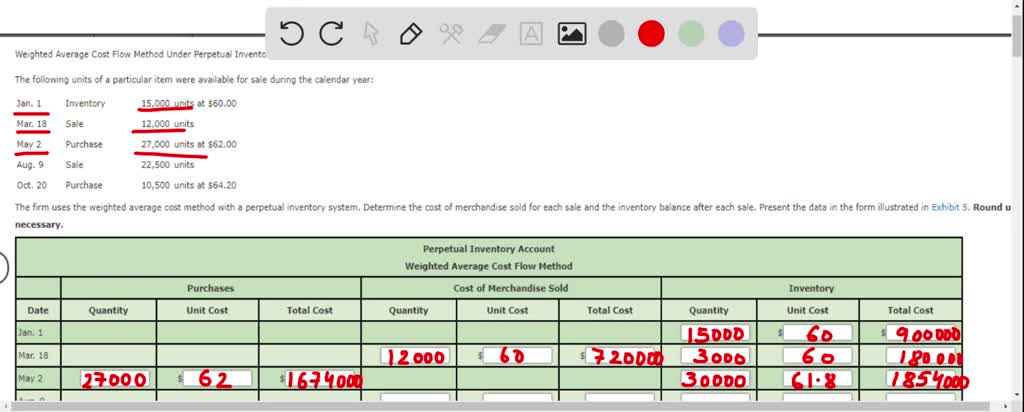

SOLVED The Following Units Of A Particular Item Were Available For

https://cdn.numerade.com/ask_previews/b2f10384-2998-4346-8be1-fedccea9e25e_large.jpg

What Is 5G Here s What You Need To Know About The New Network

https://image.slidesharecdn.com/2-190305170718/95/what-is-5g-heres-what-you-need-to-know-about-the-new-network-1-1024.jpg?cb=1551805685

what is 5 apr on 50 000 - Calculate my rate Our loan calculator gives you a realistic idea of how much you could borrow and what your repayments and interest rates could be Subject to application financial circumstances and borrowing history