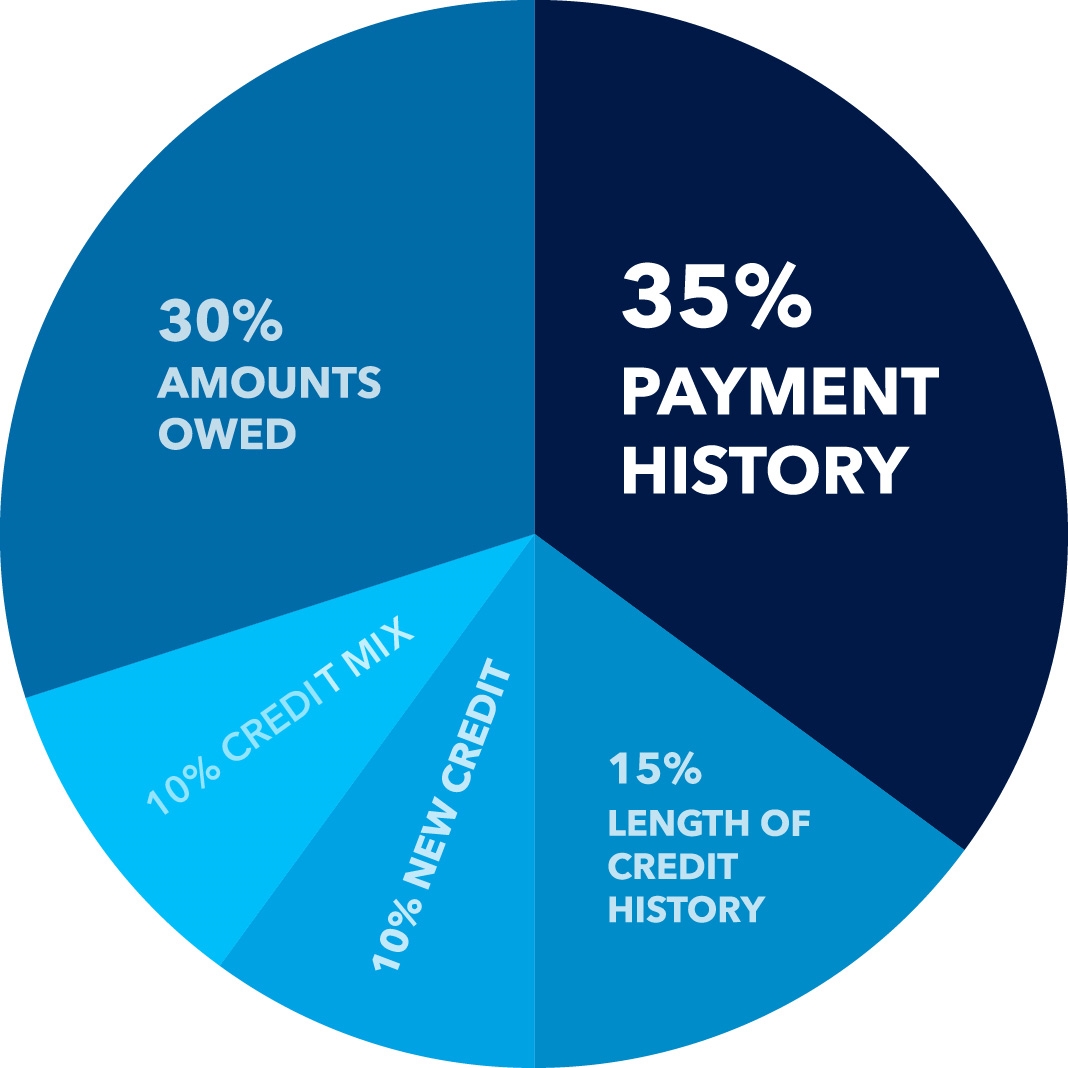

what is 30 percent of 800 credit limit In the FICO scoring model this accounts for 30 percent of your overall credit score Our calculator will tell you what your ratio is What is your credit utilization ratio Your credit

Your credit utilization comprises about 30 of your total credit score This credit utilization ratio calculator will tell you how much you re using You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the average credit utilization

what is 30 percent of 800 credit limit

:max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg)

what is 30 percent of 800 credit limit

https://www.thebalancemoney.com/thmb/ZxyHuvHQyRzjqKb9_6cir9dUXMc=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg

HOW TO GET AN 800 CREDIT SCORE IN 30 DAYS YouTube

https://i.ytimg.com/vi/iQPuHlRte44/maxresdefault.jpg

Getting An 800 Credit Score Before You Turn 25 In 2020 Credit Score

https://i.pinimg.com/736x/38/29/cf/3829cf25b9f93d71988ad7628c3b8745.jpg

How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit utilization down Suppose you have a credit card with a 2 000 credit limit and your current balance is 800 To find out what percentage of your credit limit you have used use the Credit Percentage

Depending on the scoring model your credit utilization can affect up to 30 of your credit score For your FICO Score utilization is the second most important factor behind Your credit utilization ratio is the amount you owe across your credit cards compared to your total credit line available expressed as a percentage In the FICO scoring model this

More picture related to what is 30 percent of 800 credit limit

Percent Study Guide

https://s3.studylib.net/store/data/009653193_1-edb50e6616676e68088bc81bb8d382c3-768x994.png

What Is 25 Percent Of 800 Calculatio

https://calculat.io/en/number/percent-of/25--800/generated-og.png

Percent Calculations

https://s2.studylib.net/store/data/018198803_1-3fd9d20ccbe57f0269dc9b953bb5ba42-768x994.png

Your credit utilization ratio is how much you owe on all your revolving accounts such as credit cards compared with your total available credit expressed as a percentage It s important Experts say there is a misconception among consumers that your credit score won t be negatively affected unless your total balance climbs above 30 of your available credit

You should aim to use no more than 30 of your credit limit at any given time Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score 30 49 Not great for your score but not overly concerning 50 Bad for your credit score and a red flag for lenders 100 Very bad for your credit score and a huge red

What Is The Credit Limit On Self Leia Aqui What Is The Starting

https://cdn.bmgfiles.com/csoup/img/article-img/674_content_184.jpg

Category Finance Stewardship CREATION JUSTICE MINISTRIES

http://www.creationjustice.org/uploads/2/5/4/6/25465131/screen-shot-2022-06-22-at-12-57-36-pm_orig.png

what is 30 percent of 800 credit limit - The credit utilization rule of thumb states that consumers should aim to use 30 or less of their available credit to maintain a healthy credit score But some experts say that s