what is 30 of 800 credit limit How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit utilization down and lower is better

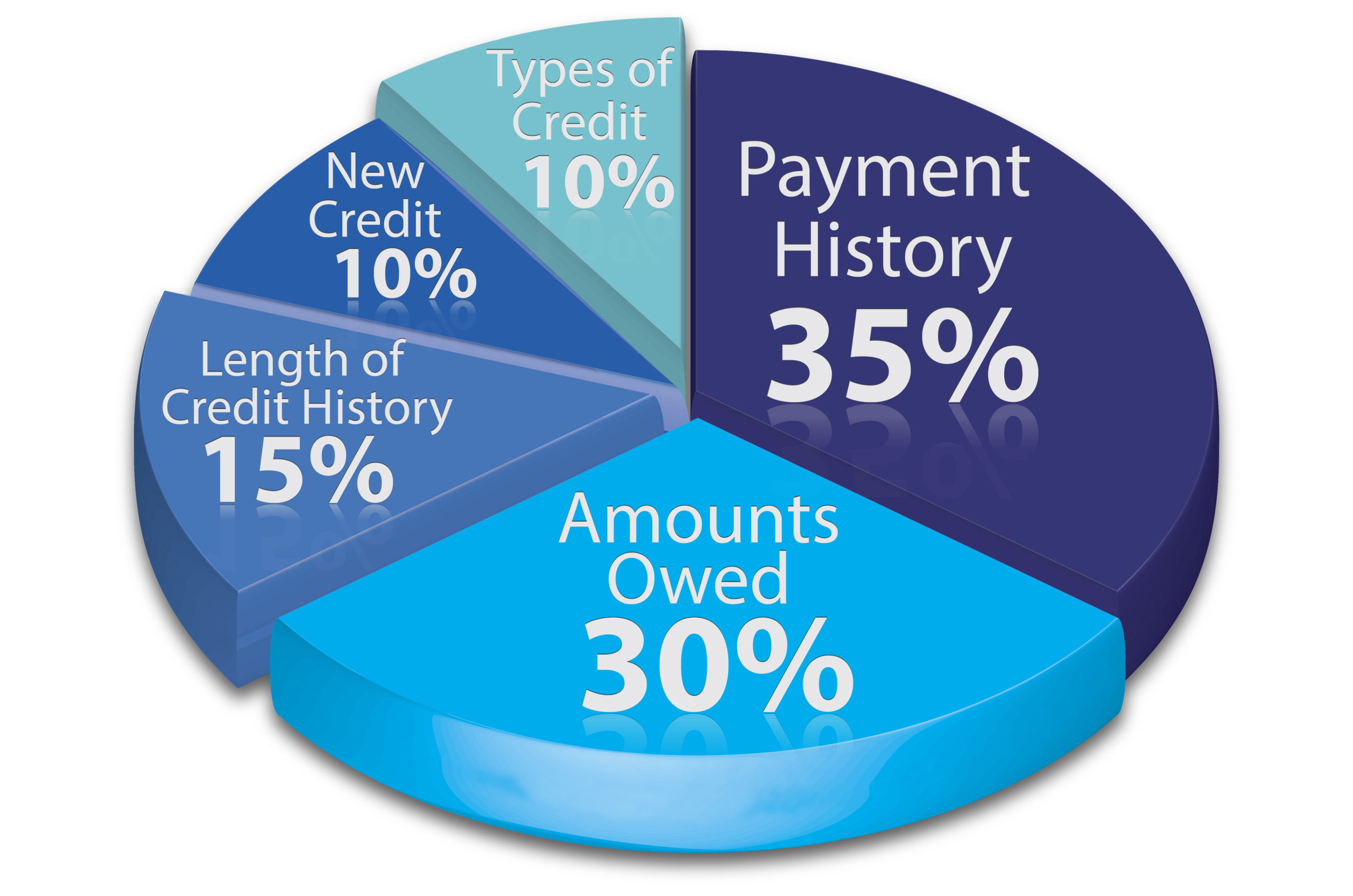

Your credit utilization comprises about 30 of your total credit score This credit utilization ratio calculator will tell you how much you re using and whether or not it is positively or negatively impacting your score A good guideline is the 30 rule Use no more than 30 of your credit limit to keep your debt to credit ratio strong Staying under 10 is even better

what is 30 of 800 credit limit

what is 30 of 800 credit limit

https://i.ytimg.com/vi/92uGvk5Gq44/maxresdefault.jpg

HOW TO GET AN 800 CREDIT SCORE IN 30 DAYS YouTube

https://i.ytimg.com/vi/iQPuHlRte44/maxresdefault.jpg

What Do People With 800 Credit Scores Have In Common Adkins Firm

https://itsyourcreditreport.com/wp-content/uploads/2021/01/AdobeStock_69711084-scaled.jpeg

You should aim to use no more than 30 of your credit limit at any given time Allowing your credit utilization ratio to rise above this may result in a temporary dip in your score You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the average credit utilization ratio for a person with a credit score over 800 is 11 5

We advise using no more than 30 of your limit overall and on each individual card to maintain healthy credit Lenders will likely consider those who have too much credit utilization as To obtain a solid credit score you should keep your credit utilization ratio under 30 For example let s say your credit limit is 1 000 and you have a current balance of 600

More picture related to what is 30 of 800 credit limit

What Does An 800 Credit Score Mean CreditCards

https://www.creditcards.com/wp-content/uploads/What-does-an-800-credit-score-mean.jpg

800 Credit Score Club How I Got A 800 Credit Score Budgeting Money

https://i.pinimg.com/originals/b7/fc/7c/b7fc7c16798ab9beb456eb54c6d16b5b.jpg

What Is 30 Of 1000 Find 30 Percent Of 1000 30 Of 1000

https://techyxl.com/wp-content/uploads/2022/08/30-of-1000.jpg

Your credit utilization ratio is the amount you owe across your credit cards and other revolving credit lines compared to your total available credit expressed as a percentage In the FICO scoring model this accounts for 30 of your overall credit score A credit limit is the highest balance an individual can carry on their credit card or credit line without incurring penalties or declining transactions It s an integral part of the lender s risk management strategy ensuring that the borrower does not accumulate debt beyond their capacity to repay

A good credit limit is around 30 000 as that is the average credit card limit according to Experian To get a credit limit this high you typically need an excellent credit score a high income and little to no existing debt Your available credit is the amount of money you have available through your credit cards given your current balance For example if your credit limit is 2 000 and your balance is 500

Is Being In The 800 Credit Score Club Really That Important Loans Canada

https://loanscanada.ca/wp-content/uploads/2018/12/800-Credit-Score-Club.png

How To Get Into The 800 Credit Score Club And Should You Care

https://i.pinimg.com/736x/70/4d/26/704d26ffbdc8ede24ed7eb4781cd5b60.jpg

what is 30 of 800 credit limit - You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the average credit utilization ratio for a person with a credit score over 800 is 11 5