what is 30 of 5000 credit limit You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit But the lower the better According to Experian one of the three major credit bureaus the

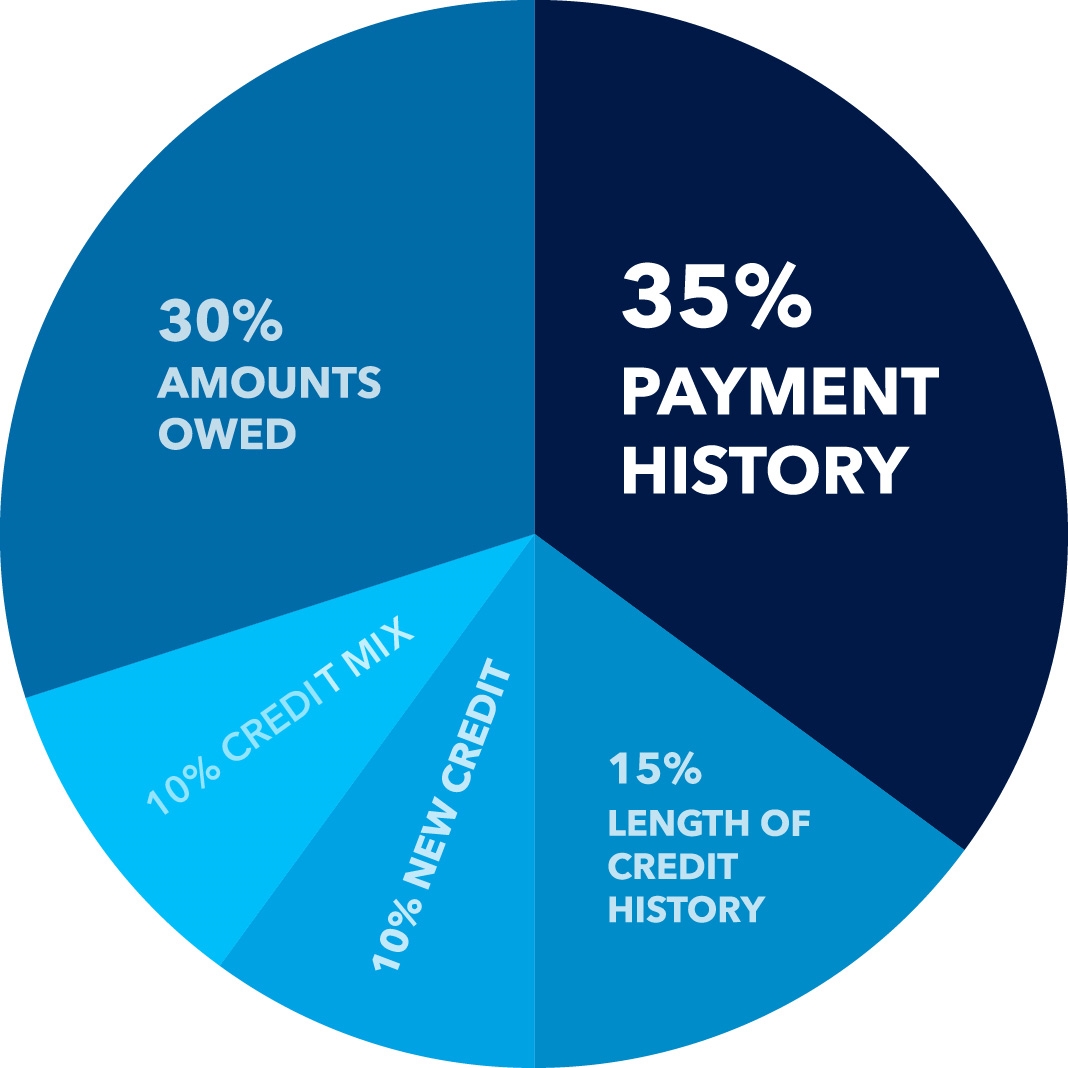

In the FICO scoring model this accounts for 30 percent of your overall credit score Our calculator will tell you what your ratio is What is your credit utilization ratio Your credit How much of your credit should you use Experts advise using no more than 30 of your credit card limits to keep your credit

what is 30 of 5000 credit limit

what is 30 of 5000 credit limit

http://blog.stundar.co.za/wp-content/uploads/2020/08/no-limit-records.jpg

How To Set A Credit Limit Commercial Domestic Investigations

http://www.commercialdomesticinvestigations.co.uk/wp-content/uploads/2017/10/credit-limit.jpg

Credit Limit Finance Image

http://www.picpedia.org/finance/images/credit-limit.jpg

Your credit utilization ratio is the amount you owe across your credit cards and other revolving credit lines compared to your total available credit expressed as Your credit utilization is how much of your available credit you re using at a given time Aim to use no more than 30 your total available credit

A credit limit is the maximum amount of money a person can spend when using a credit card For example if a credit card has a credit limit of 5 000 then the If you have a 5 000 credit limit and spend 1 000 on your credit card each month that s a utilization rate of 20 Experts generally recommend keeping your utilization rate under 30

More picture related to what is 30 of 5000 credit limit

30 Percent Of 200 YouTube

https://i.ytimg.com/vi/pz42oOtNS9U/maxresdefault.jpg

What Credit Card Gives You A 5000 Credit Limit Leia Aqui Is A 5k

https://www.cardrates.com/wp-content/uploads/2023/03/Best-High-Limit-0-APR-Credit-Cards.jpg

What Is 30 Percent Of 10000 In Depth Explanation The Next Gen Business

https://thenextgenbusiness.com/wp-content/uploads/2021/09/30-Percent-of-10000.webp

To calculate your credit utilization find your total credit limit by looking at all of your credit cards and lines of credit For example if you have two credit cards that each have 7 500 limits your total Credit limit on account 5 000 Total monthly charges 5 000 Updated available credit 0 Credit card payment 2 500 Updated available credit for new charges 2 500 So in this example you have

It s good to use no more than 30 of your credit card s limit in a period See how your credit utilization ratio affects your credit score You should use less than 30 percent of your credit card s credit limit especially if you want to avoid any damage to your credit score The lower your credit

The 9 Best Credit Cards With 5000 Limit With Bad Credit

https://bestonreviews.com/wp-content/uploads/2020/04/Credit-Cards-with-5000-Limit-with-Bad-Credit.jpg

What Is The Credit Limit On Self Leia Aqui What Is The Starting

https://cdn.bmgfiles.com/csoup/img/article-img/674_content_184.jpg

what is 30 of 5000 credit limit - Your credit utilization is how much of your available credit you re using at a given time Aim to use no more than 30 your total available credit