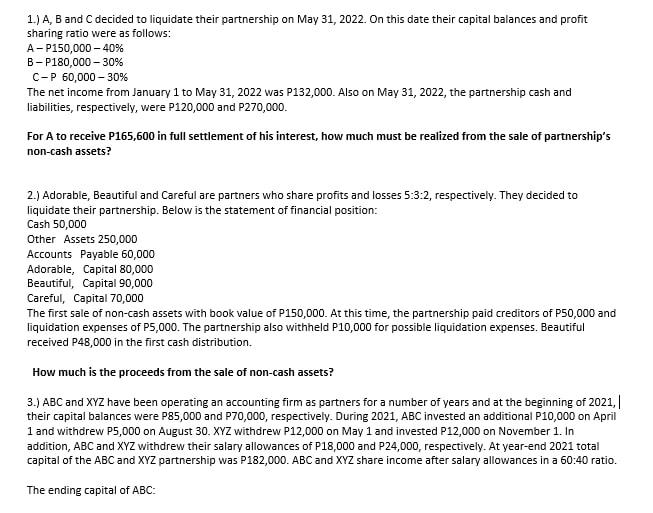

what is 25 000 after tax The Salary Calculator tells you monthly take home or annual earnings considering UK Tax National Insurance and Student Loan The latest budget information from April 2024 is used to show you exactly what you need to know

On a 25 000 salary your take home pay will be 20 511 after tax and National Insurance This equates to 1 709 per month and 394 per week If you work 5 days per week this is 79 per day or 10 per hour at 40 hours per week Here is a full calculation for a 25 000 gross income after UK tax and national insurance deductions in the 2024 2025 tax year

what is 25 000 after tax

what is 25 000 after tax

https://www.income-tax.co.uk/images/95000-after-tax-salary-uk-2020.png

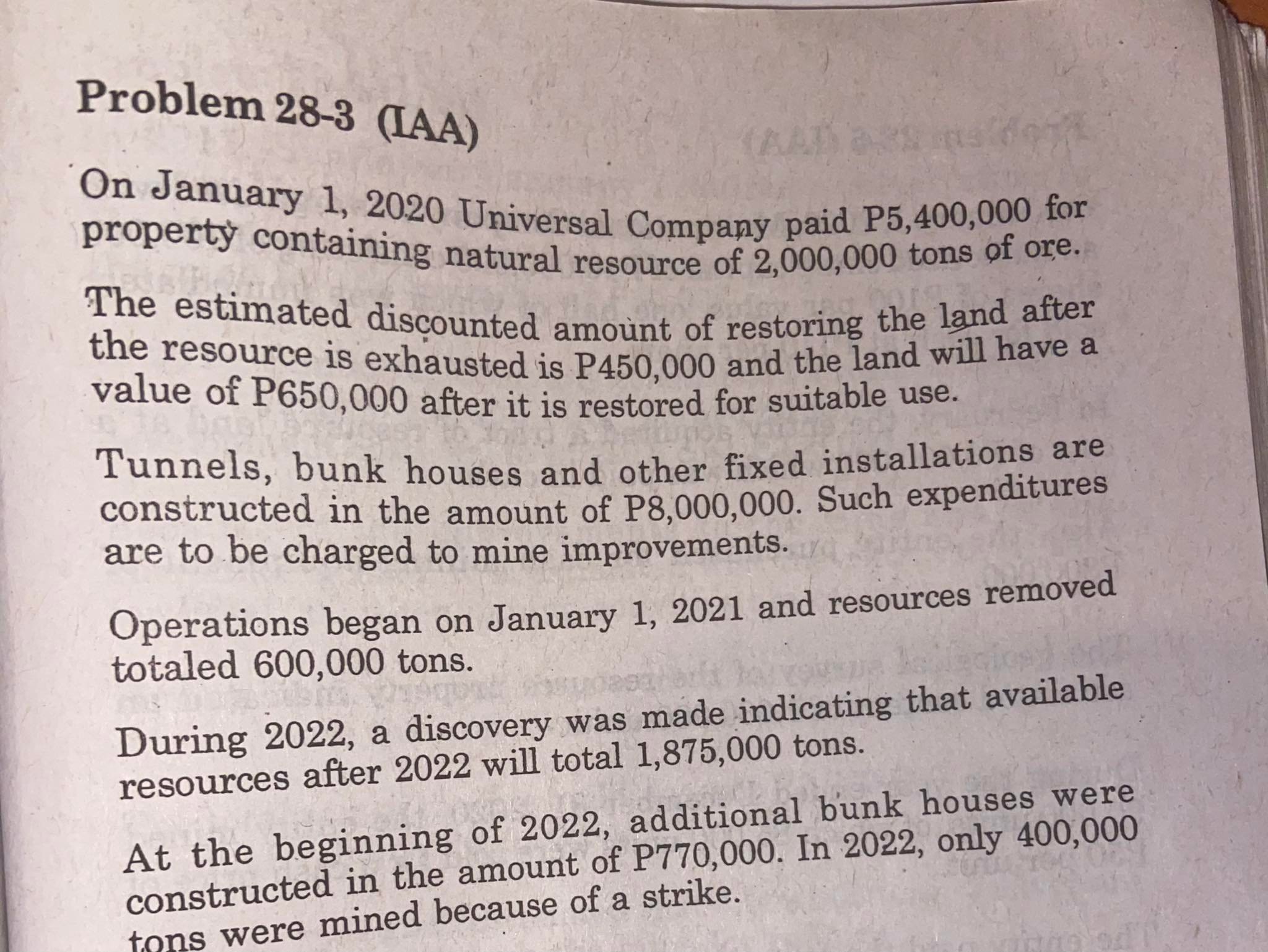

Answered Roblem 28 3 IAA On January 1 2020 Bartleby

https://content.bartleby.com/qna-images/question/639a4eee-0c08-425f-a8e9-6d6bb445f105/401a24ad-0284-4df7-a2f6-370c08c4c2cc/m8nc01.jpeg

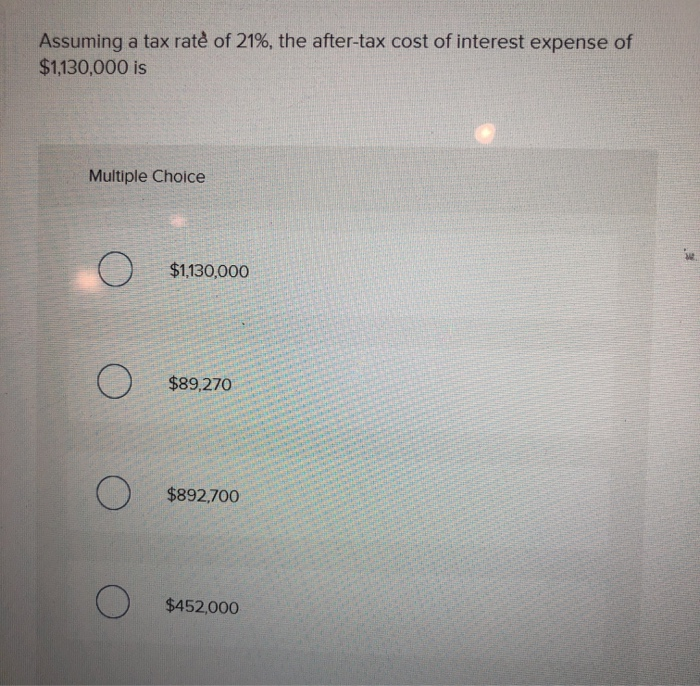

Solved Assuming A Tax Rate Of 21 The After tax Cost Of Chegg

https://media.cheggcdn.com/study/ac0/ac041526-7cff-4f4a-ad28-143261dd7596/image.png

For the 2022 2023 tax year 25 000 after tax is 20 511 annually and it makes 1 709 net monthly salary This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no If you have a gross salary of 25 000 then you will pay 2 500 in income tax and 1 964 16 in national insurance You will be left with a net 20 535 84 a year after tax and national insurance

Calculate your Take Home Pay considering income tax rate personal allowance national insurance and tax code Update for UK tax year from 2024 April The Salary Calculator has been updated with the latest tax rates which take effect from April 2024 Try out the take home calculator choose the 2024 25 tax year and see how it affects your take home pay

More picture related to what is 25 000 after tax

Question 2 Equity Accounting 30 Marks Wayne Ltd Owns 25 Of The

https://answerhappy.com/download/file.php?id=316280

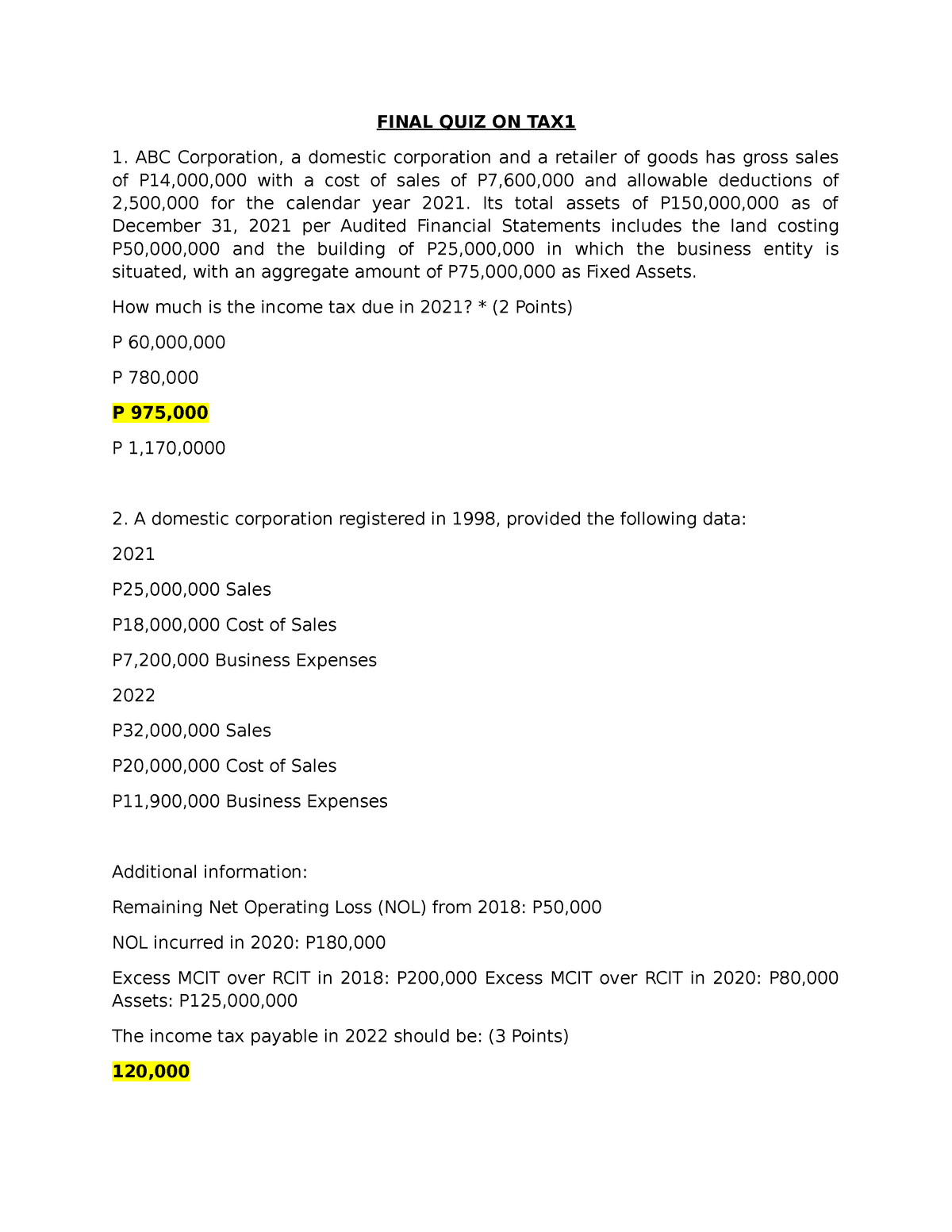

Accounting Reviewer About Tax That Will Help Students FINAL QUIZ ON

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a87bd54329554bf8ff2999e62a0fb8b5/thumb_1200_1553.png

What Is A Tax Code Pabsco Vrogue

https://i.stack.imgur.com/3Vfat.png

Calculate your take home pay given income tax rates national insurance tax free personal allowances pensions contributions and more Our easy to use taxable income calculator provides accurate and fast estimates helping you plan your finances effectively 25 000 after tax is 21 271 With

Tax Calculations for 25 000 00 You start with 25 000 00 as your annual salary After entering it into the calculator it will perform the following calculations Income Tax Calculation Basic Tax Rate BR 2 486 00 12 430 00 x 20 2 486 00 20 on annual earnings above the PAYE tax threshold and up to 37 700 If you re earning a gross salary of 25 000 per month you ll take home 13 911 after tax and national insurance A monthly gross salary of 25 000 will result in a 300 000 yearly salary

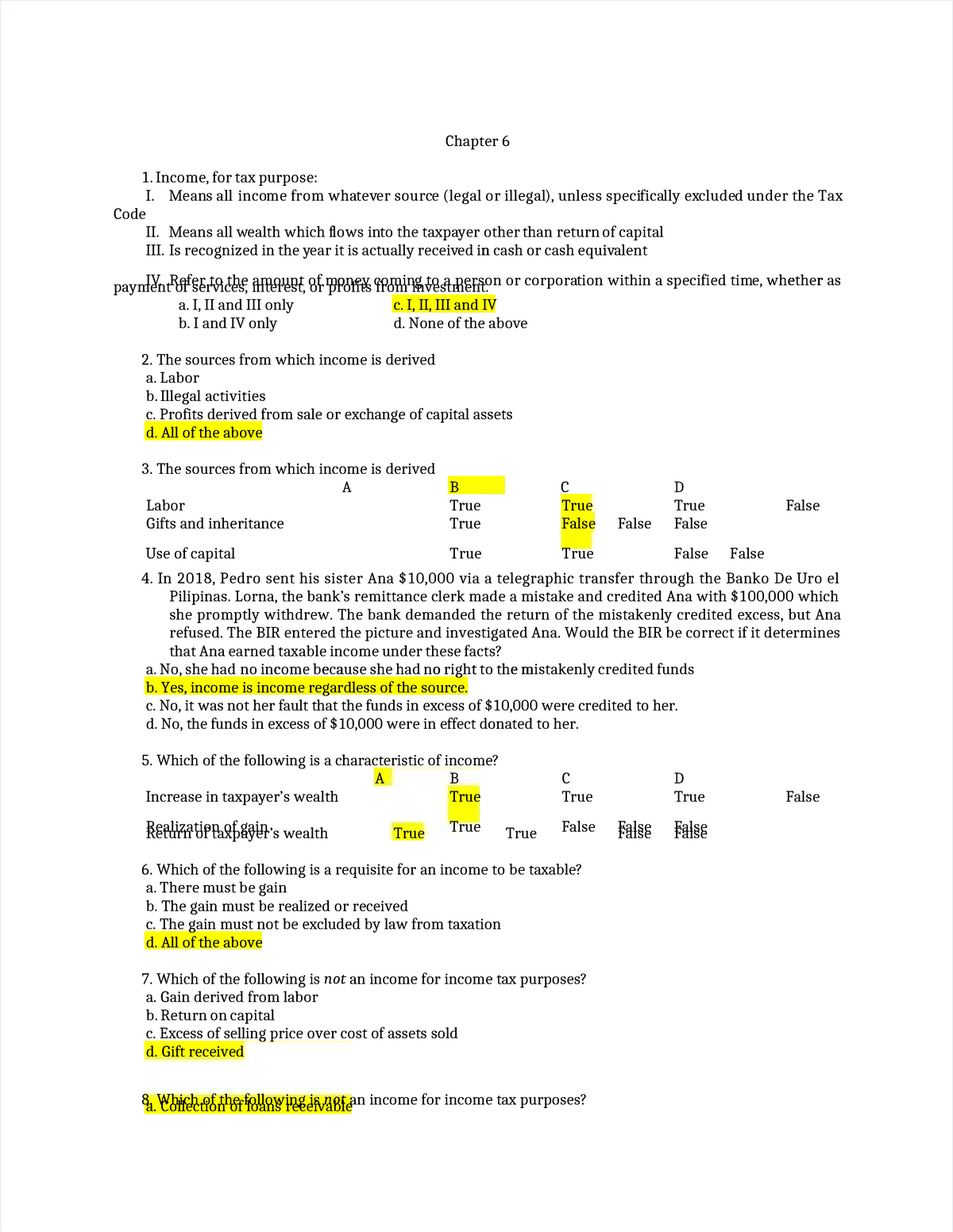

Gross Income On Taxation Test Bank Chapter 6Chapter 6 Income For

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/6dbfbe1216d38544fb7853682c486b65/thumb_1200_1552.png

Solved 1 A B And C Decided To Liquidate Their Partnership Chegg

https://media.cheggcdn.com/media/c66/c6647f3c-772b-47a6-9b8c-214863de58ab/phpTFFCZ4

what is 25 000 after tax - If you earn 25 000 salary per year you will take home 1 739 every month after 207 tax and 1 647 national insurance is deducted by your employer from your 25 000 monthly gross salary