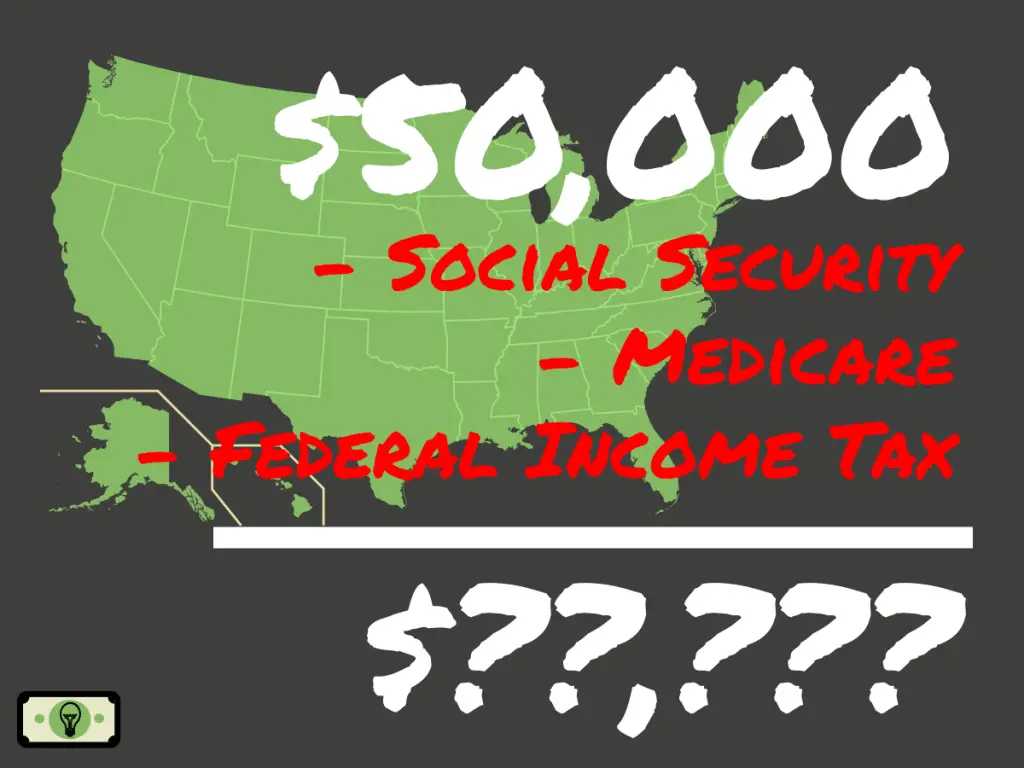

what is 24 500 after tax The calculation above shows that after tax a gross income of 24 500 per year in 2024 leaves you with 20 744 taken home This is equivalent to around 1 729 per month

By default the 2023 24 tax year is applied but if you wish to see salary calculations for other years choose from the drop down View similar salaries On a 24 500 salary your take home pay will be 20 177 after tax and National Insurance This equates to 1 681 per month and 388 per week If you

what is 24 500 after tax

what is 24 500 after tax

https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-50000-dollars-sm-2-1024x768.png

Income Tax Authorities To Impose 200 Penalty On Any abnormal Rise In

https://data1.ibtimes.co.in/en/full/626459/demonetisation-demonetization-currency-rbi-rs-500-rs-1000-note-currency-pm-modi-arun-jaitley-trends.jpg

Legal Tech Startup Ex Parte Raises 7 5M In Funding To Predict

https://techstartups.com/wp-content/uploads/2022/03/ExParte.jpg

After tax UK Salary Tax Calculator 40 000 After Tax If your salary is 40 000 then after tax and national insurance you will be left with 31 222 This means that after tax you will take home 2 602 every month or 24 500 after tax will give you a net income of 20 195 84 If you have a gross salary of 24 500 then you will pay 2 400 in income tax and 1 904 16 in national insurance

Take Home Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be 24 500 after tax is 20 921 Earn a salary of 24 500 See how you take home 20 921 after tax or view your salary of 24 500 hourly daily weekly monthly or yearly

More picture related to what is 24 500 after tax

How To Calculate Profit After Tax And Its Various Implications

https://khatabook-assets.s3.amazonaws.com/media/post/2022-03-09_065540.8356120000.webp

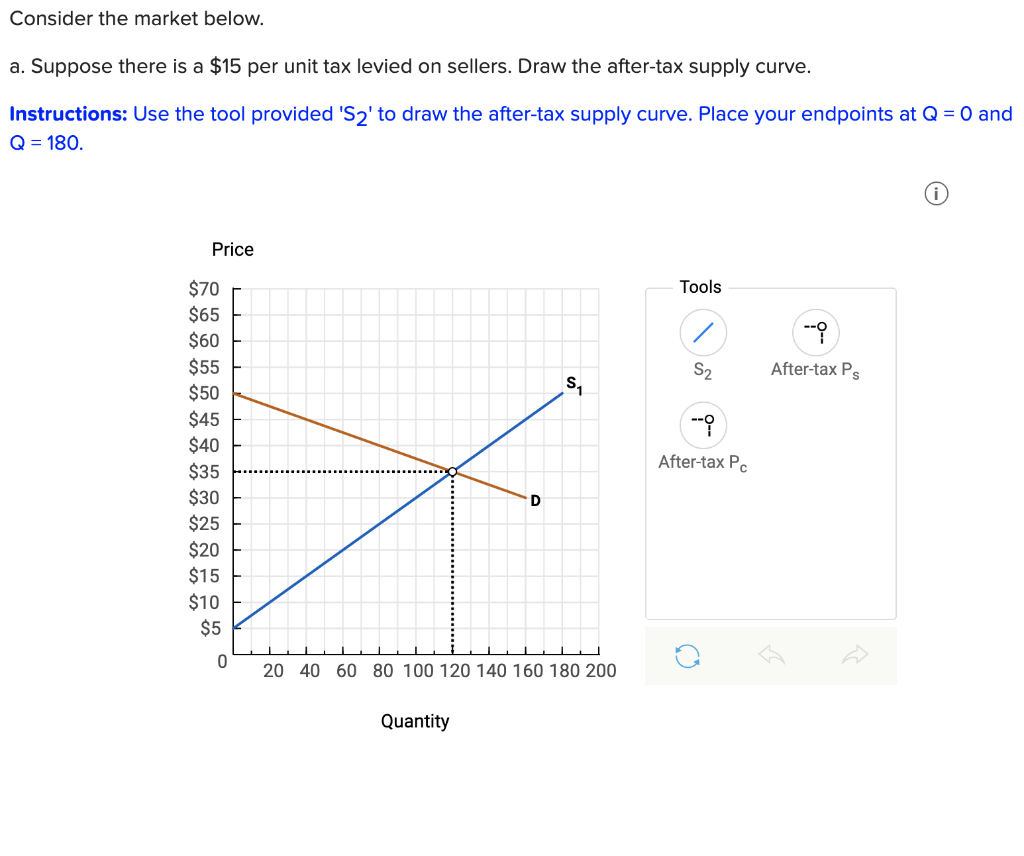

Solved Consider The Market Below A Suppose There Is A 15 Chegg

https://media.cheggcdn.com/media/1f2/1f254e75-44fa-4424-aa15-eebed28e4f24/phpezHNsR

60 000 After Tax 2023 2024 Income Tax UK

https://www.income-tax.co.uk/images/60000-after-tax-salary-uk-2020.png

Use Reed co uk s free and simple salary tax calculator to estimate what you re left with after tax and national insurance are deducted from your 24 000 salary Calculate Monthly net 1 695 Monthly tax 191 Monthly NI 114 Tax Calculator Results For 24 000 24 000 Salary After Tax Video Explanation Tax bands for

Salary Calculator Results If you are living in the UK and earning a gross annual salary of 33 176 or 2 765 per month the total amount of taxes and contributions that will be Reverse Tax Calculator UK Tax Calculators Tax Calculators Personal Tax Work out tax backwards Find the gross income required to get the take home pay you want Enter

TAX Tax TAX EASY The Power To Regulate Liberty And Property To

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/2bae9284ae38e0e2f738d6e153ad7395/thumb_1200_1553.png

Guide To Provide 24 7 Customer Service With Tips Benefits

https://document360.com/wp-content/uploads/2022/11/How_to_Provide_247_Customer_Service_with_Tips__Benefits-2048x1165.jpg

what is 24 500 after tax - After tax UK Salary Tax Calculator 40 000 After Tax If your salary is 40 000 then after tax and national insurance you will be left with 31 222 This means that after tax you will take home 2 602 every month or