what is 15 interest of 10000 You will have earned 30 456 in interest How much will savings of 10 000 be worth in 10 years if invested at a 15 00 interest rate This calculator determines the future value of 10k invested for 10 years at a constant yield of 15 00 compounded annually

The total compound interest earned is 3 926 80 Whether for personal savings retirement planning or educational investments this calculator offers the foresight needed to make informed financial decisions Read on to learn more about the magic of compound interest and how it s calculated Use our interest rate calculator to work out the interest rate you re receiving on credit cards loans mortgages or savings An interest rate is a percentage that is charged by a lender to a borrower for an amount of money This translates as a cost of borrowing

what is 15 interest of 10000

what is 15 interest of 10000

https://s3-us-west-2.amazonaws.com/courses-images/wp-content/uploads/sites/1141/2017/02/02232307/interest.jpg

Example 10 A Sum Of Rs 10 000 Is Borrowed At A Rate Of Interest 15

https://d1avenlh0i1xmr.cloudfront.net/31dc10f6-5d5c-4d81-8bec-0efcf3b50acd/slide32.jpg

Letter Of Interest For A Job Check More At Https

https://i.pinimg.com/736x/c6/43/20/c6432029a77bfeb9cc18c91a31df3c5e.jpg

How much money will 10 000 be worth if you let the interest grow It depends on the interest rate and number of years invested Use this calculator to figure out the answer This interest rate calculator is a compact tool that allows you to estimate various types of interest rate on either a loan or deposit account You may find yourself in a situation where you take a loan and you know only the due payments or you keep money in a bank and you know only your initial deposit and the current balance

Compound interest or interest on interest is calculated using the compound interest formula A P 1 r n nt where P is the principal balance r is the interest rate as a decimal n represents the number of times interest is compounded per year and t Compound interest calculator finds interest earned on savings or paid on a loan with the compound interest formula A P 1 r n nt Calculate interest principal rate time and total investment value

More picture related to what is 15 interest of 10000

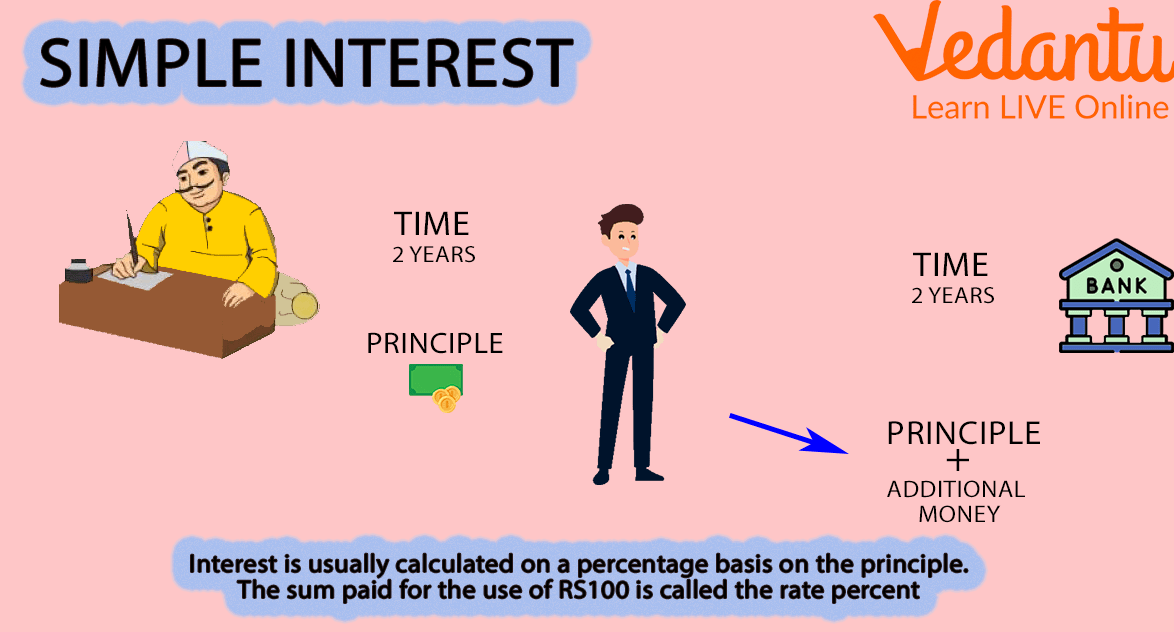

Solving Simple Interest Libracha

https://i.ytimg.com/vi/R-bKaFwihsE/maxresdefault.jpg

Recurring Deposit Interest Rates Of Major Banks May 2020 Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/04/RD-Interest-Rates-of-Major-Banks-for-Tenure-up-to-2-years-May-2020_Featured.png?fit=1225%2C886&ssl=1

What Is Simple Interest Example Formula Solved Examples And FAQs

https://www.vedantu.com/seo/content-images/03e04114-d645-48bc-83b0-85c4e43aa3bf.png

Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount Compound interest is interest earned on both the principal and on the accumulated interest For example if one person borrowed 100 from a bank at a compound interest rate of 10 per year for two years at the end of the first year the interest would amount to 100

A final amount including interest P principal amount r annual interest rate as decimal n number of compounds per year t number of years Use this handy calculator to find out the simple or compound interest Learn the difference between compound interest and The interest of a 10 000 loan with a 6 rate with ten years loan term repaid monthly is 3 322 46 How can I calculate loan interest Follow the below steps to calculate loan interest

What You Need To Know About Interest Rates DriveTime Blog

https://blog.drivetime.com/wp-content/uploads/2015/10/Interest-Rates.jpg

What Is 15 Percent Of 21 Solution With Free Steps

https://enhjna88wza.exactdn.com/wp-content/uploads/2022/12/pie-chart-15-percent-of-21.png?strip=all&lossy=1&resize=932%2C466&ssl=1

what is 15 interest of 10000 - This interest rate calculator is a compact tool that allows you to estimate various types of interest rate on either a loan or deposit account You may find yourself in a situation where you take a loan and you know only the due payments or you keep money in a bank and you know only your initial deposit and the current balance