What Is 1221l Tax Code - Worksheets have evolved right into flexible and essential tools, accommodating diverse needs across education, organization, and individual monitoring. They offer organized formats for numerous tasks, ranging from basic math drills to intricate company evaluations, therefore enhancing knowing, preparation, and decision-making processes.

K Tax Code Explained What To Do If It s Wrong

K Tax Code Explained What To Do If It s Wrong

Worksheets are structured documents made use of to arrange information, info, or tasks systematically. They offer a visual representation of principles, permitting individuals to input, adjust, and examine information effectively. Whether in the classroom, the conference room, or in the house, worksheets enhance procedures and boost efficiency.

Kinds of Worksheets

Knowing Devices for Kids

Worksheets are highly helpful tools for both instructors and trainees in academic atmospheres. They encompass a selection of tasks, such as mathematics tasks and language tasks, that allow for technique, reinforcement, and evaluation.

Company Worksheets

Worksheets in the business ball have numerous objectives, such as budgeting, task management, and assessing information. They assist in notified decision-making and surveillance of goal accomplishment by companies, covering monetary records and SWOT evaluations.

Individual Task Sheets

On an individual level, worksheets can aid in goal setting, time monitoring, and behavior monitoring. Whether intending a spending plan, arranging a daily routine, or keeping track of fitness progress, individual worksheets use framework and accountability.

Making best use of Understanding: The Benefits of Worksheets

Worksheets use countless benefits. They boost engaged understanding, boost understanding, and support analytical thinking capabilities. Moreover, worksheets sustain framework, rise effectiveness and allow teamwork in group circumstances.

Update Your Tax Code What To Do If Your Tax Code Is Incorrect SJB

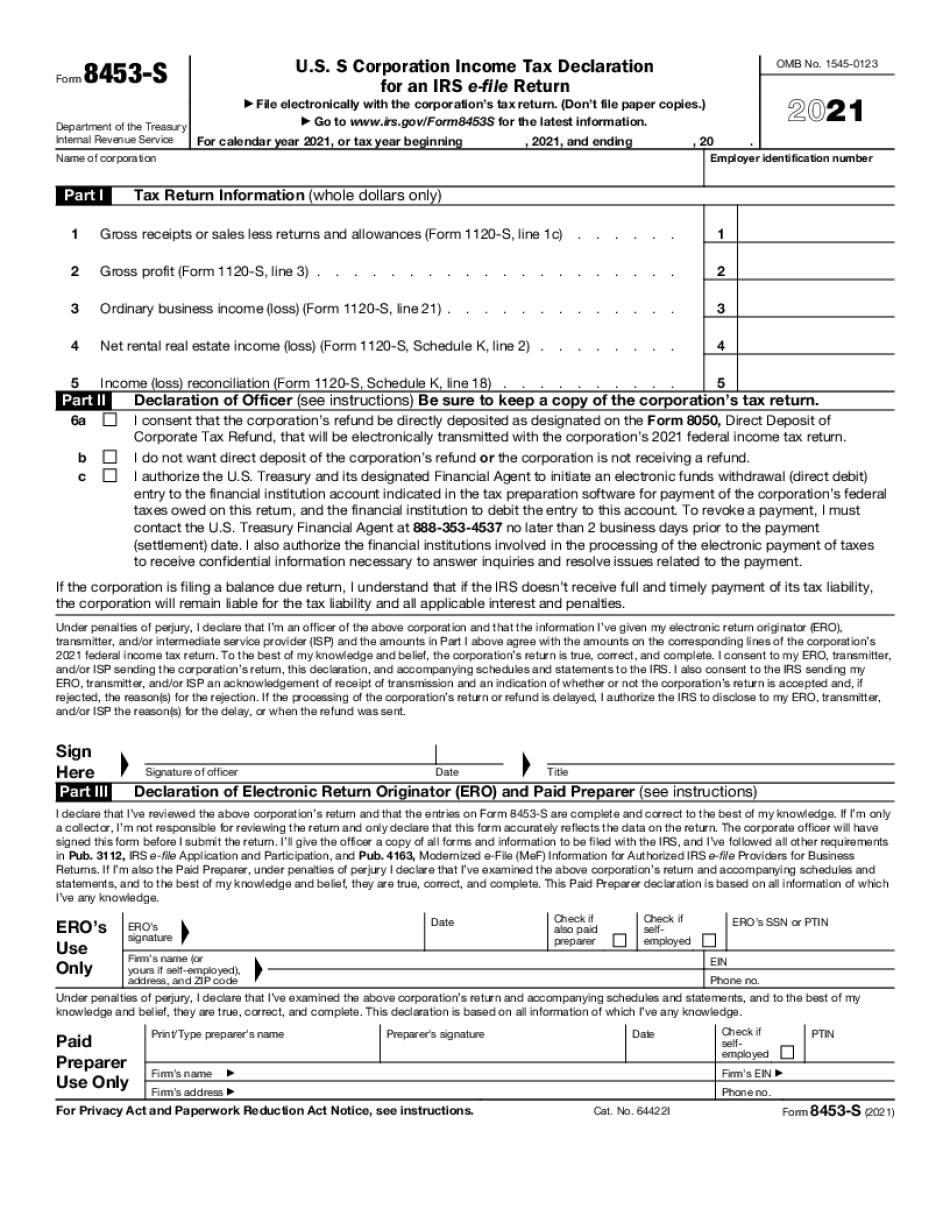

Form 1120 S US Income Tax Return For An S Corporation Fill Online

New Income Tax Slabs Fy 2023 24 Ay 2024 25 2022 23 Rates For

Enhance Your Tax Calculation Process With The Tax Code Address Field

Fix The Tax Code Friday Increased Security Delayed Tax Refunds

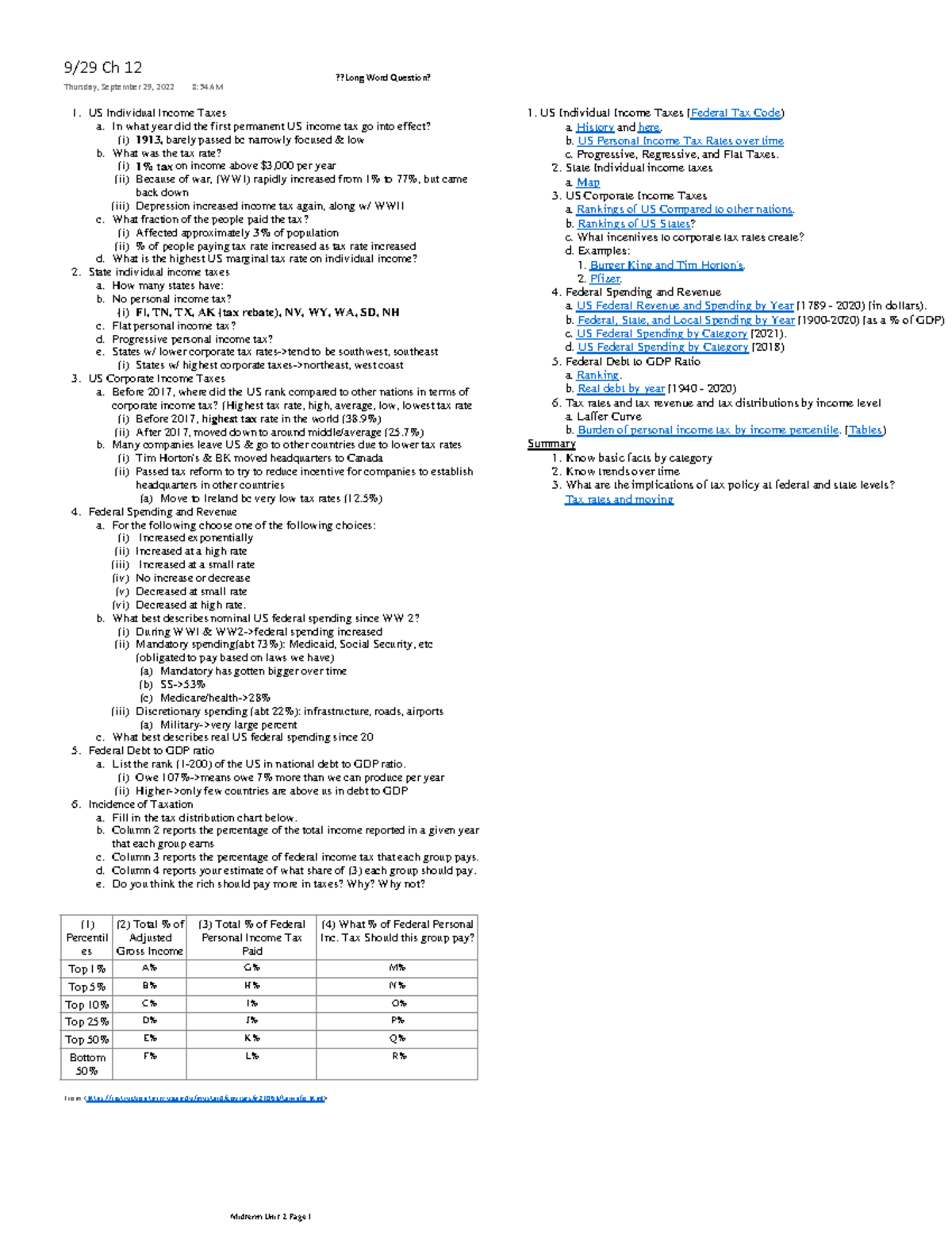

Unit 5 Ch 12 Notes US Individual Income Taxes Federal Tax Code A

Prepare And File Form 2290 E File Tax 2290

Broken Tax Code Legalities

Seven Steps TO Truly Reform THE TAX CODE AND 601 SEVEN STEPS TO TRULY

Taxes Tippinsights