what is 1221 property When section 1231 property is sold at a gain the amount in excess of the property s basis and depreciation receives capital gains treatment which generally means lower tax rates while the amount attributed to

For purposes of this subtitle the term capital asset means property held by the taxpayer whether or not connected with his trade or business but does not include Section 1221 of the Code defines what a capital asset is by listing the types of property excluded from capital asset treatment Timber is a capital asset if it is not held for sale or use in a trade

what is 1221 property

what is 1221 property

https://i.ytimg.com/vi/etCEwYQXdYQ/maxresdefault.jpg

1221 YouTube

https://i.ytimg.com/vi/XJgSz5kivF4/maxresdefault.jpg

ST88 Property Rayaung

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100054629386408

IRC section 1221 a 1 defines a capital asset in a negative fashion It states that all assets are capital assets except those listed in the statute itself For our purposes one asset listed as not Review IRC Section 1221 Capital asset defined Understand what captial assets mean and access expert resources on 26 US Code Sec 1221 with Tax Notes

Section 1221 defines capital asset as property held by the taxpayer whether or not it is connected with the taxpayer s trade or business However property used in a IRC 1221 refers to Section 1221 of the Internal Revenue Code titled Capital asset defined The notion of a capital asset is defined under the tax code allowing individuals and

More picture related to what is 1221 property

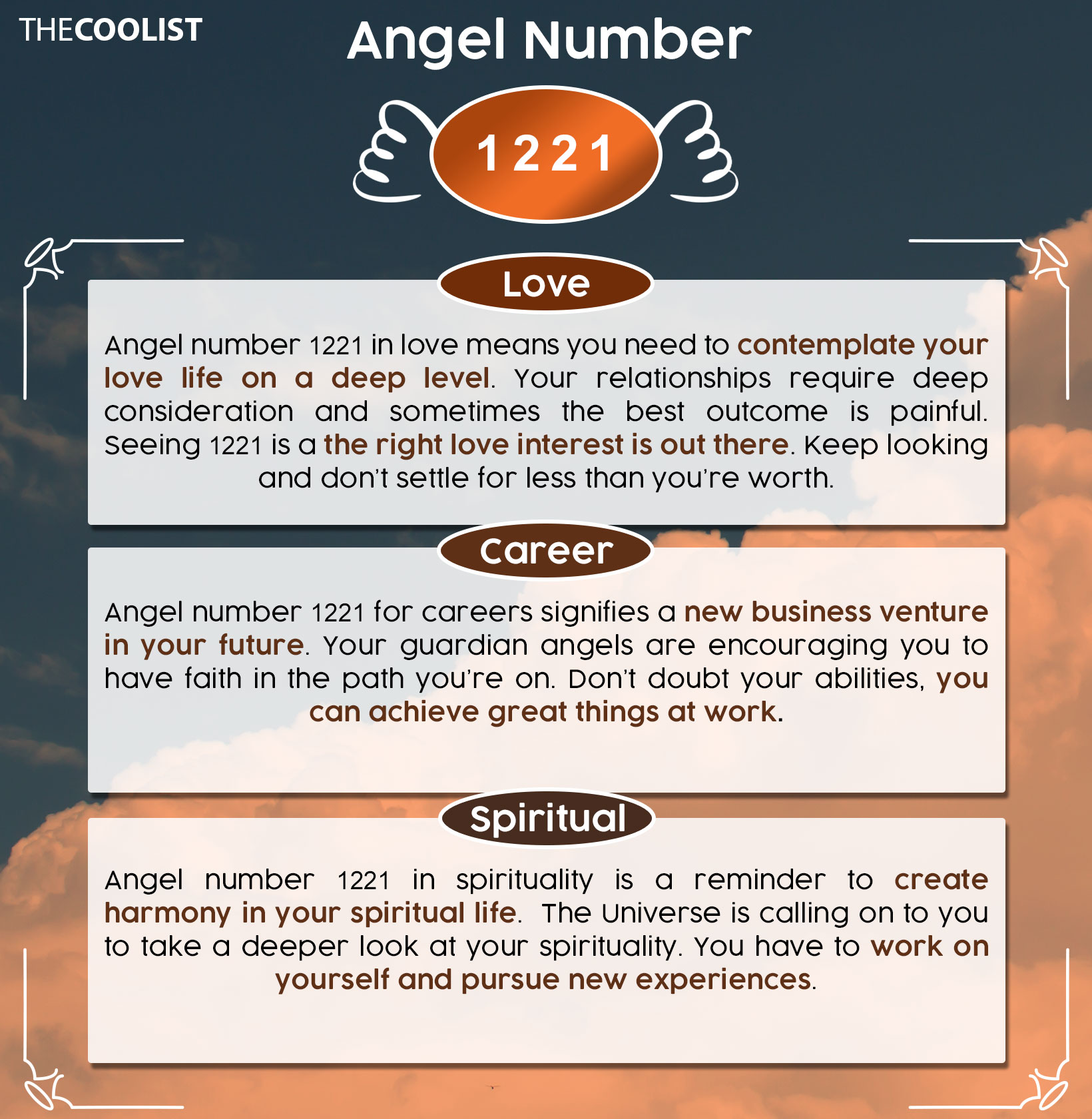

1221 Angel Number Change Optimism And Luck

https://cdn.thecoolist.com/wp-content/uploads/mystic/angel-numbers/1221-chart.jpg

Angel Number 1221 Meaning And Its Significance In Life

https://angelnumber.me/wp-content/uploads/2021/08/1221-Angel-Number-Meaning-768x1152.jpg

SP 1221 Skypad Furniture Inc

https://i2.wp.com/www.skypadfurniture.com/wp-content/uploads/2019/07/SP.1221.png?fit=1200%2C800&ssl=1

For purposes of this section properties and potential gain treated as unrealized receivables under section 751 c shall be treated as separate assets that are not capital assets as defined in In determining whether the income should be classified as ordinary income or capital gain the court evaluated nine criteria 1 the taxpayer s purpose in acquiring the property 2 the

This page will help you understand the terminology and abbreviations used in Finnish property advertisements whether for rental or sale NOTE regarding bedrooms In Finnish 1221 a 1 stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year or property

AGIKgqNSpd6L3 yo6PFtyt9gHGo00p x2lcJfEbmKNvd5Q s900 c k c0x00ffffff no rj

https://yt3.googleusercontent.com/ytc/AGIKgqNSpd6L3_yo6PFtyt9gHGo00p_x2lcJfEbmKNvd5Q=s900-c-k-c0x00ffffff-no-rj

KH 1221 Khaldoon Factory

https://khaldoon.com.sa/wp-content/uploads/2022/04/KH-1221-800x800.png

what is 1221 property - IRC section 1221 a 1 defines a capital asset in a negative fashion It states that all assets are capital assets except those listed in the statute itself For our purposes one asset listed as not