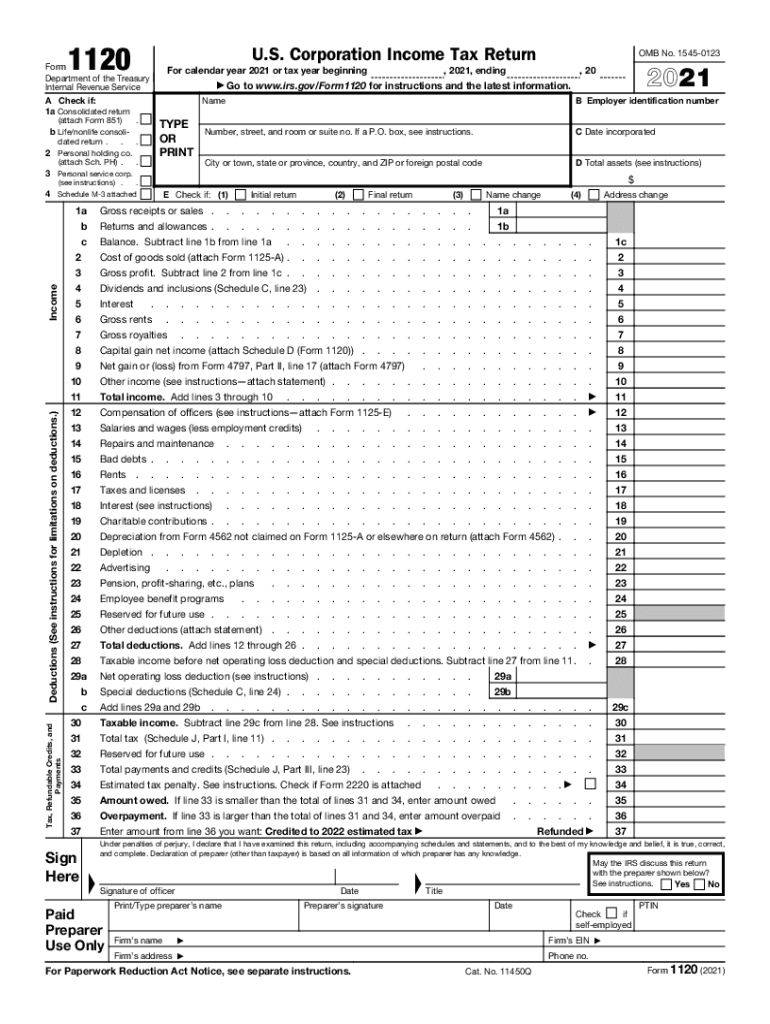

what is 1120 tax For tax years beginning in 2023 corporations filing Form 1120 and claiming the energy efficient commercial buildings deduction should report the deduction on line 25 See the instructions for

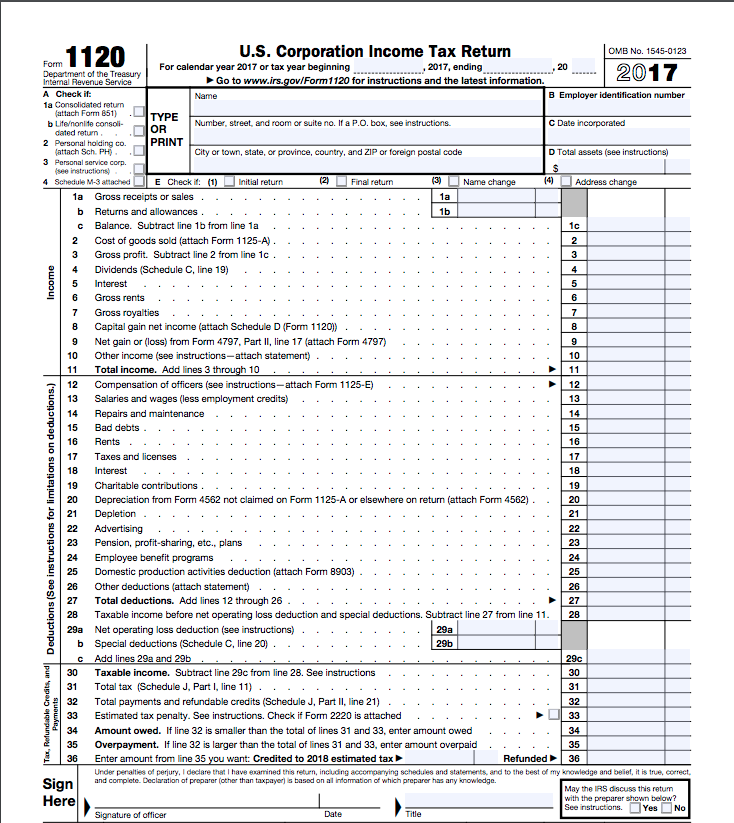

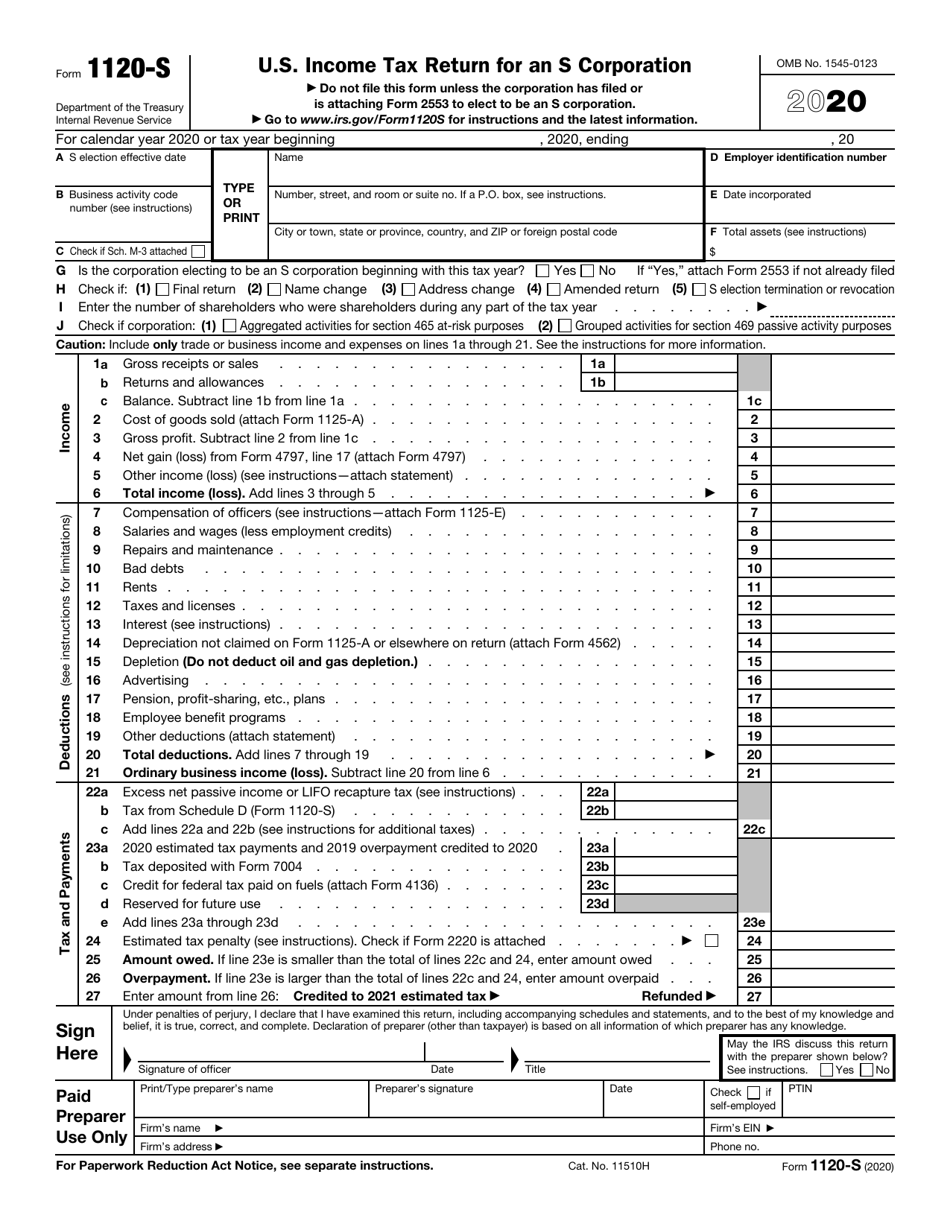

IRS Form 1120 the U S Corporation Income Tax Return is used to report corporate income taxes to the IRS It can also be used to report income for other business entities that have elected to be taxed as corporations such Form 1120 U S Corporate Income Tax Return is the form corporations must use to report income gains losses deductions and credits Business owners also use Form 1120 to figure out their income tax liability

what is 1120 tax

what is 1120 tax

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Schedule-B-Other-Information.png

Tax Form 1120 What It Is How To File It Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/6wUl1N151SGc26O86U2AKg/4656a30dab296bc3f7711449fd9b2dab/IRS_Form_1120.png

IRS Form 1120 S Download Fillable PDF Or Fill Online U S Income Tax

https://data.templateroller.com/pdf_docs_html/2121/21213/2121344/irs-form-1120-s-u-s-income-tax-return-for-an-s-corporation_print_big.png

Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS But what exactly is this 1120 tax form Well it is the tax return that corporations need to file annually to report their income expenses deductions and finally evaluate the amount they owe in taxes These are the

IRS Form 1120 the U S Corporation Income Tax Return is the central filing document for incorporated businesses like corporations and LLCs This document totals the corporation s What is Form 1120 Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes

More picture related to what is 1120 tax

IRS 1120 2021 2022 Fill And Sign Printable Template Online US Legal

https://www.pdffiller.com/preview/579/101/579101667/large.png

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

North Las Vegas Nevada IRS 1120S 2023 Form Fill Exactly For Your City

https://www.pdffiller.com/preview/459/644/459644748/big.png

Form 1120 is a U S Corporation Income Tax Return form It is used to report income gains losses deductions and credits and to determine the income tax liability of a Understanding Form 1120 Form 1120 is used by corporations to report their income gains losses deductions and credits It is also a key element in determining the corporation s tax

Corporations use Form 1120 U S Corporate Income Tax Return to report income gains losses deductions and credits and determine income tax liability All domestic IRS Form 1120 is used for filing returns for corporate income taxes to the IRS In 2018 the corporate tax schedule for a single tax rate of 21 has been removed by The Tax Cuts and

2021 Form IRS 1120 F Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/577/494/577494997/large.png

Free IRS Tax Form 1120 S Template Google Sheets Excel LiveFlow

https://assets-global.website-files.com/61f27b4a37d6d71a9d8002bc/63ec45b850c0540c81facd19_IRS Tax Form 1120-S Template.png

what is 1120 tax - Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS