what is 1120 tax form For tax years beginning in 2023 corporations filing Form 1120 and claiming the energy efficient commercial buildings deduction should report the deduction on line 25 See the instructions

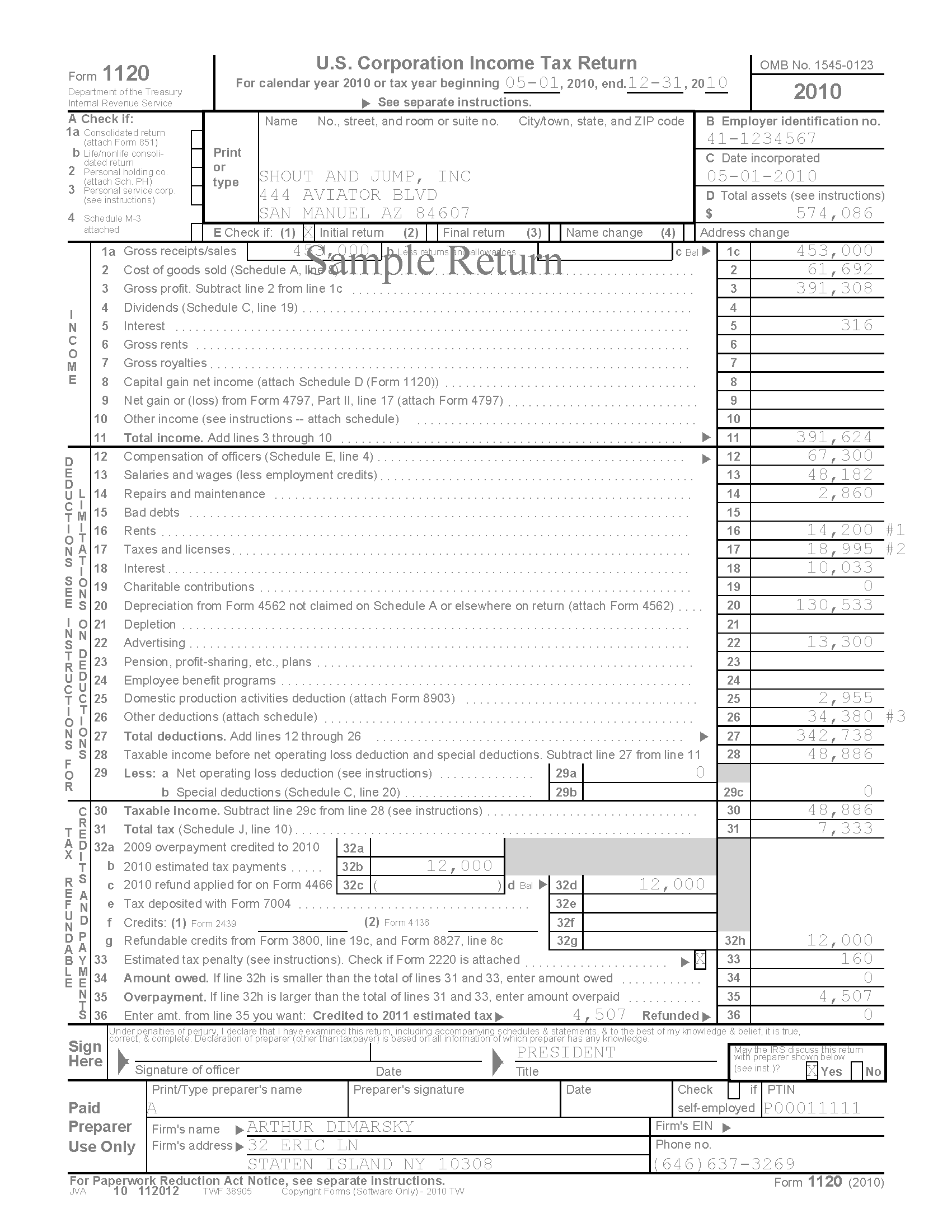

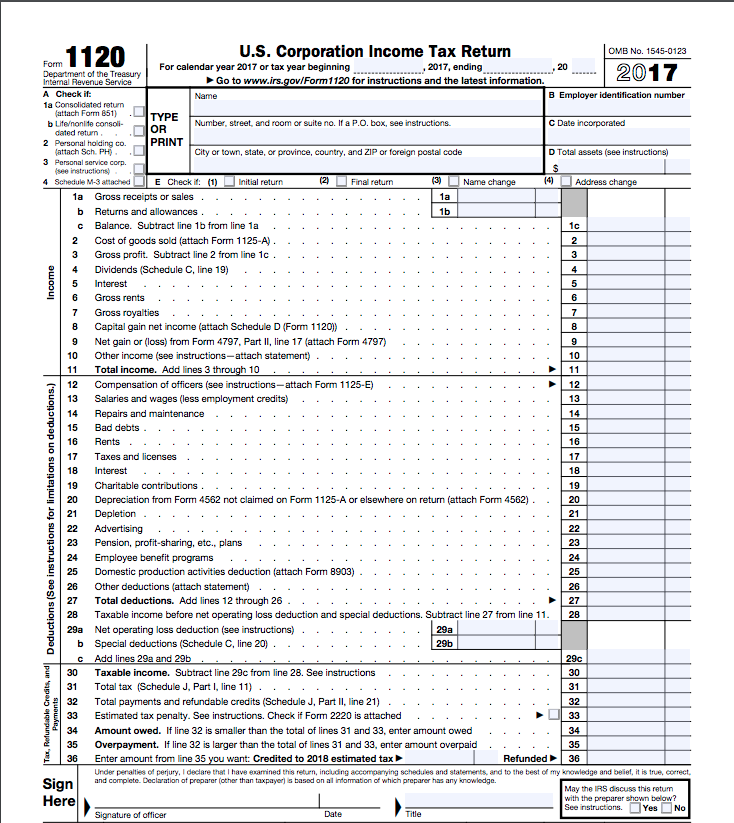

But what exactly is this 1120 tax form Well it is the tax return that corporations need to file annually to report their income expenses deductions and finally evaluate the amount they owe in taxes These are the Form 1120 is the tax form that corporations file to report their income and pay taxes for a year It has three sections income deductions and tax computation

what is 1120 tax form

what is 1120 tax form

https://www.pdffiller.com/preview/577/494/577494997/large.png

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

IRS Form 1120 What Is It

https://www.thebalancemoney.com/thmb/-wWRc3-qPvbfC-d8ZzAm86DCMq4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it What is Form 1120 Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in

Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any

More picture related to what is 1120 tax form

Form 1120 Schedule L Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/6/954/6954867/large.png

How Do I Fill Out Form 1120S Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-L-1024x777.png

Services For CPA Tax Preparers Returns

http://servicesfortaxpreparers.com/wp-content/uploads/2011/08/Pages-from-1120-SAMPLE.png

Form 1120 is a U S Corporation Income Tax Return form It is used to report income gains losses deductions and credits and to determine the income tax liability of a All domestic corporations must file 1120 form Even if a domestic corporation had no income it must report its income gains losses deductions and credits on Form 1120 to determine its income tax liability For businesses that are

All domestic C corporations C corps must file IRS Form 1120 U S Corporation Income Tax Return every year they are in business even if they don t have any taxable Corporations use Form 1120 U S Corporate Income Tax Return to report income gains losses deductions and credits and determine income tax liability All domestic corporations regardless of if they have taxable income or

How To File A Zero Business Tax Return

https://images.ctfassets.net/ifu905unnj2g/6wUl1N151SGc26O86U2AKg/4656a30dab296bc3f7711449fd9b2dab/IRS_Form_1120.png

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

what is 1120 tax form - IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it