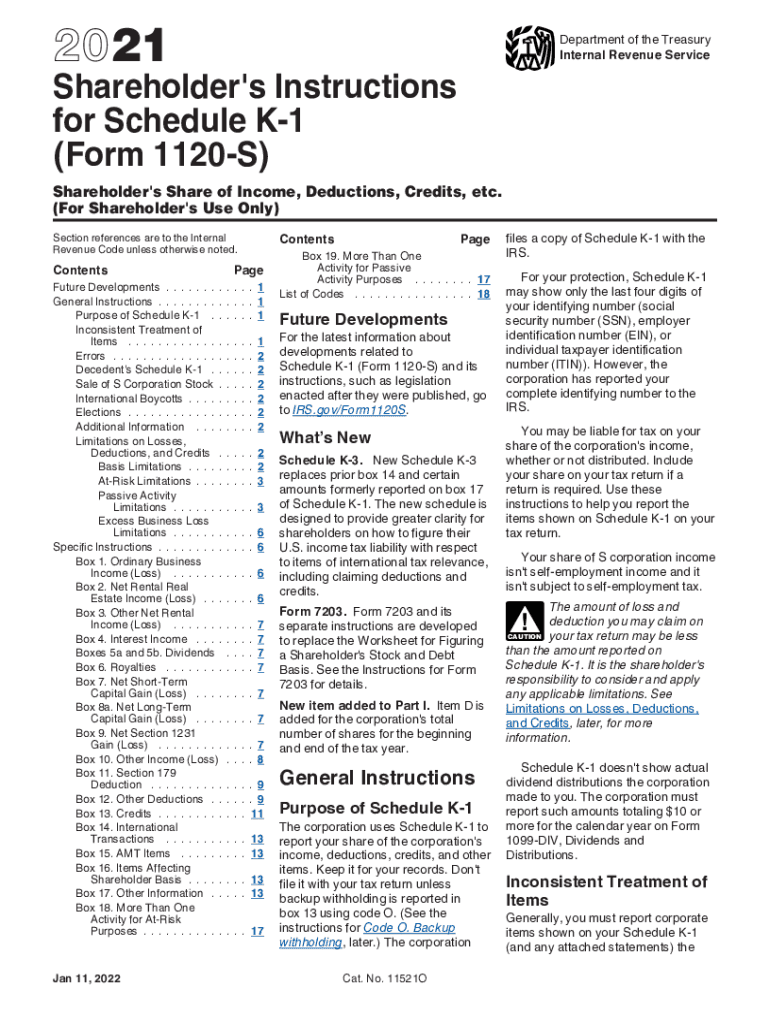

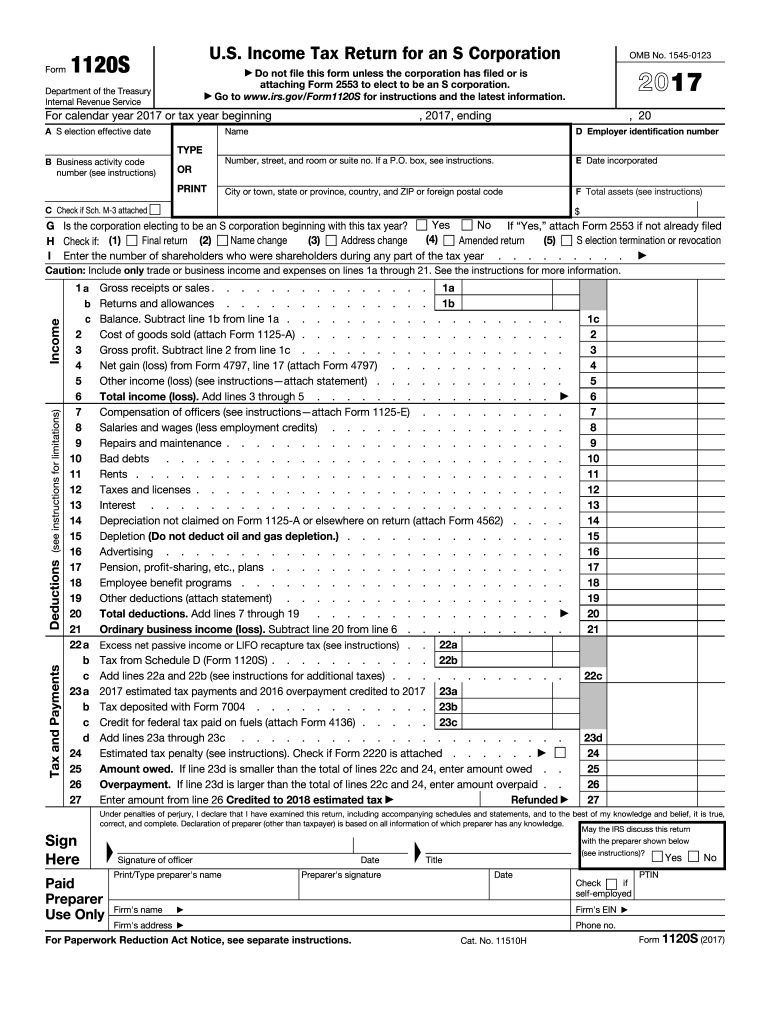

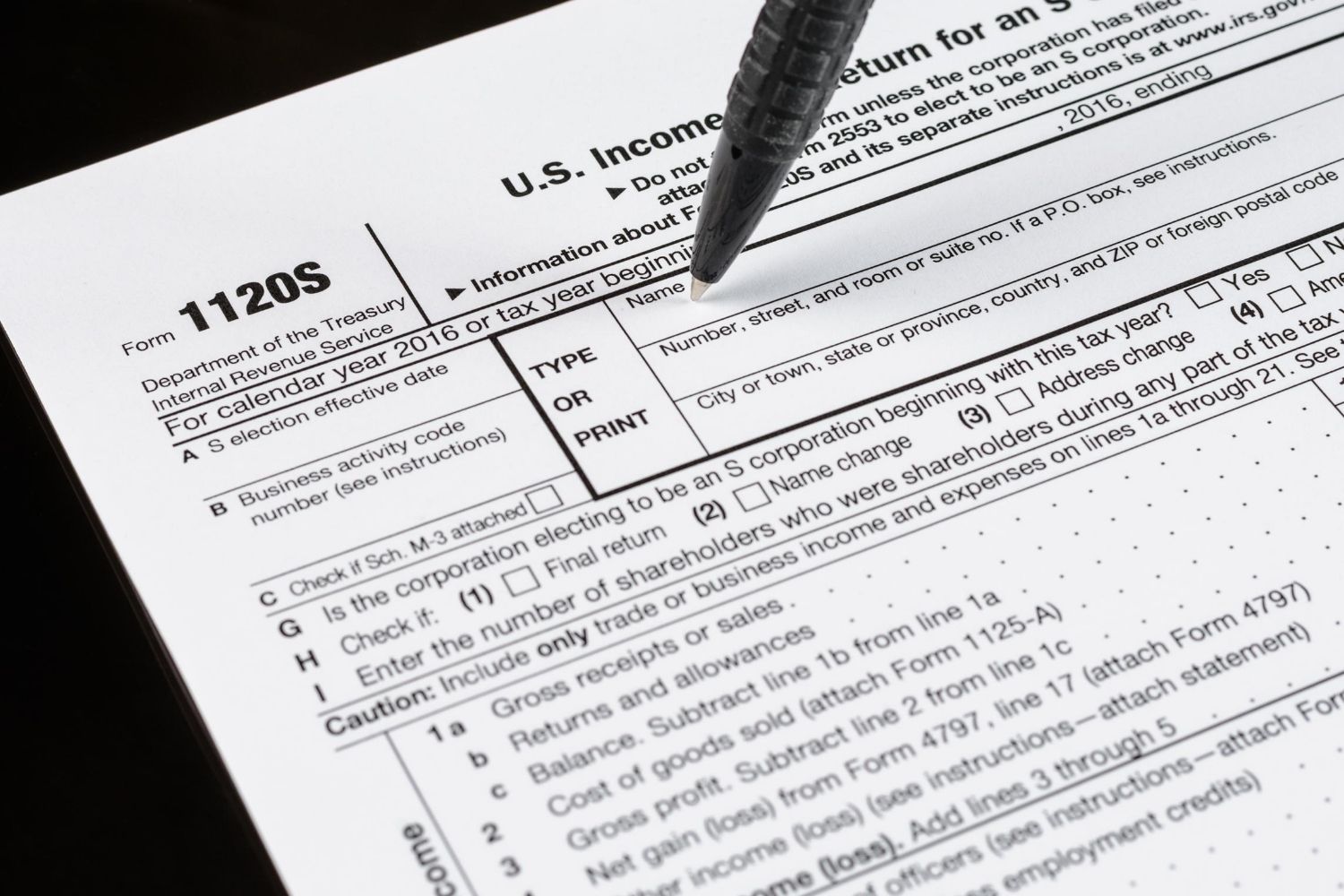

what is 1120 s corporation Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

If the S corporation election was terminated during the tax year and the corporation reverts to a C corporation file Form 1120 S for the S corporation s short year by the due date including IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow

what is 1120 s corporation

what is 1120 s corporation

https://www.pdffiller.com/preview/584/735/584735907/large.png

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/4CNBW9sQAi1ohEXxqWQ61e/700e85f7da67b2af25f0f92385a00819/BenchBlog_TaxTips_HowToCompleteForm1120.png

1120s Form Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/425/425/425425022/large.png

By electing to be treated as an S corporation an eligible domestic corporation can avoid double taxation S corporations are corporations that elect to pass corporate income losses Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it correctly to ensure your business stays compliant

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available IRS Form 1120 S is specifically designed to report the income gains losses deductions credits and other financial information of a domestic corporation or other entity that has elected to be an S Corporation in the United States

More picture related to what is 1120 s corporation

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

Form 1120S S Corporation Income Tax Skill Success

https://www.skillsuccess.com/wp-content/uploads/2020/07/scorp-income-tax-2.jpg

To file taxes S corps use two main forms IRS Form 1120 S the U S Income Tax Return for an S Corporation and Schedule K 1 IRS Form 1120 S is used to report income losses credits and deductions as well as The tax return form for companies that are registered as S Corporations a type of corporation that prevents double taxation at both the corporate and individual levels is called

Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation Department of the Treasury Internal Revenue Service U S Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to

PDF 2014 Form 1120 Tien Tran Academia edu

https://0.academia-photos.com/attachment_thumbnails/40489021/mini_magick20190220-21705-1v9mn4m.png?1550735955

Who Should Use IRS Form 1120 W

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

what is 1120 s corporation - Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it correctly to ensure your business stays compliant