what is 1098t used for Learn how to file Form 1098 T which reports the amounts paid for qualified tuition and related expenses by eligible educational institutions or insurers Find the current

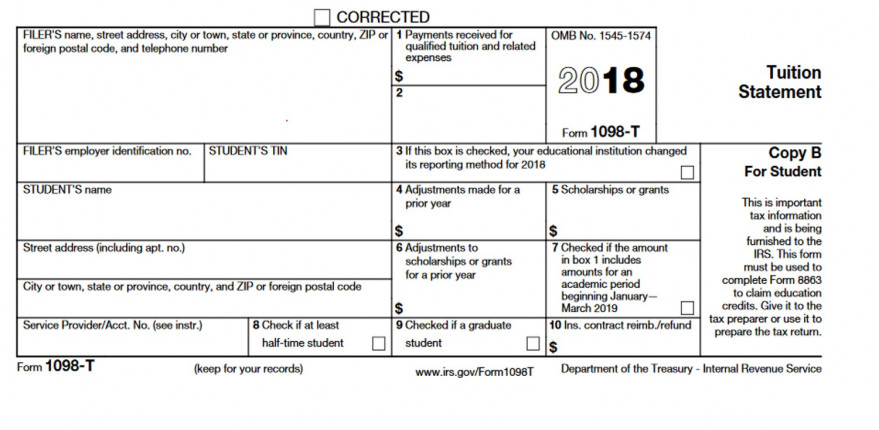

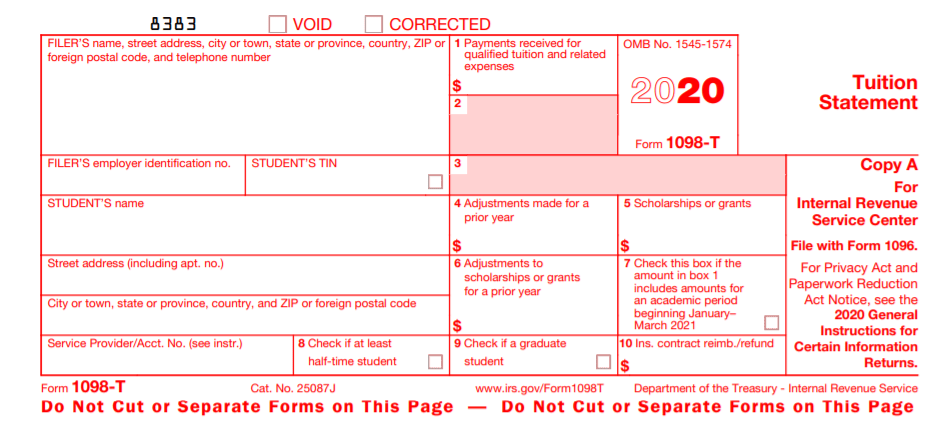

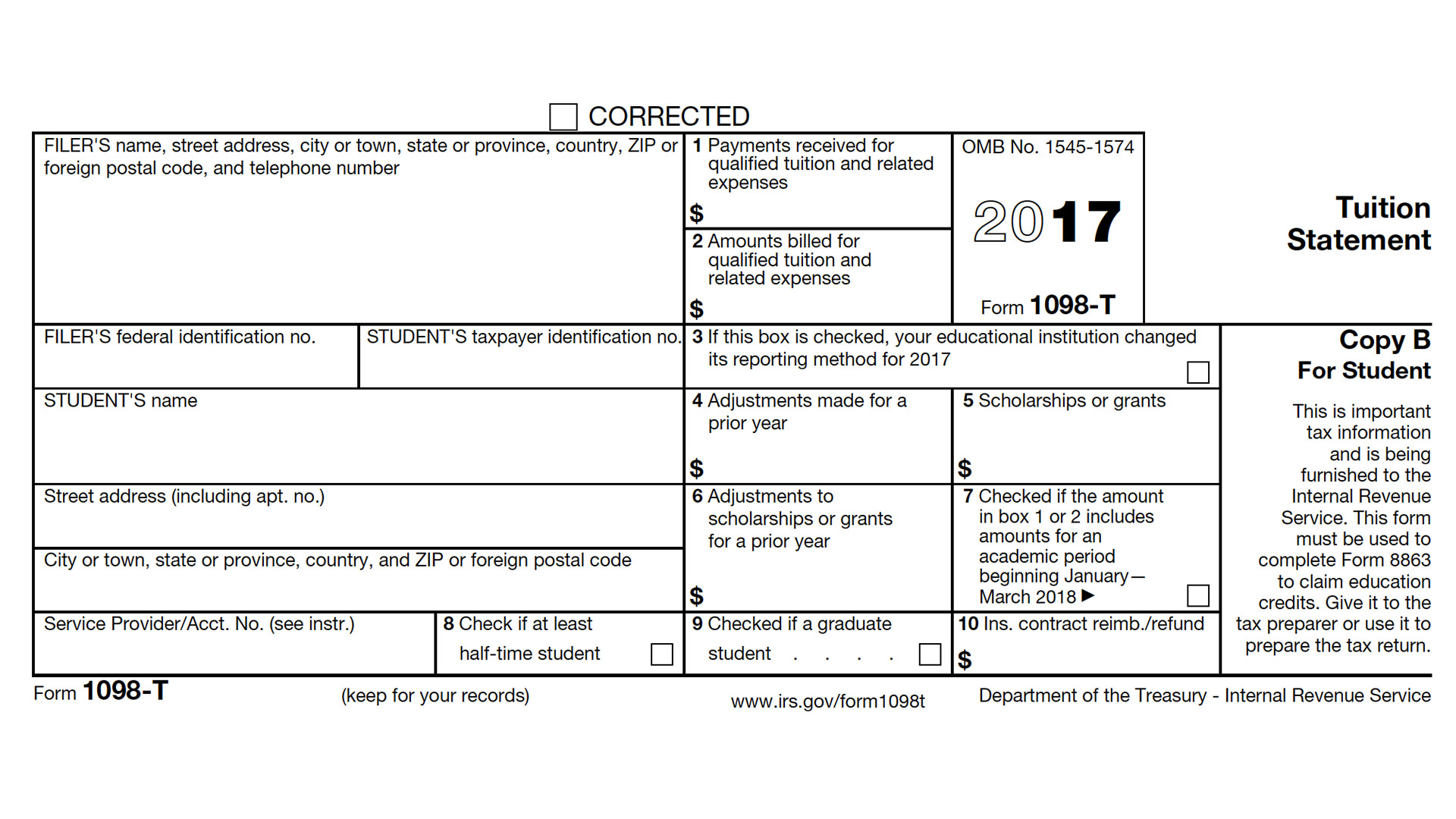

Form 1098 T is a Tuition Statement that shows your educational expenses and eligibility for tax credits Learn what boxes to look at who qualifies and when to receive it from The 1098 T form is a tax form that shows your qualified education expenses for the year You may use it to claim education credits or deductions on your income taxes but you need to

what is 1098t used for

what is 1098t used for

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098T Information Student And Departmental Account Services Lewis

https://www.lclark.edu/live/image/gid/192/width/879/height/430/76439_1098-T.rev.1546985588.jpg

Form 1098 T reports the qualified tuition and expenses you or your parents paid to your school during the tax year Learn what information is on the form when you should receive it and how it affects your education credits Form 1098 T helps you identify eligible college expenses for valuable education credits up to 2 500 Learn how to claim the AOTC or the LLC and what to do if you got a Pell Grant or

Learn how to claim the American opportunity tax credit AOTC or the lifetime learning credit LLC for higher education expenses Find out what expenses qualify who is eligible and what Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the

More picture related to what is 1098t used for

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

Form 1098 T Quickly Securely File Tuition Statement Return

https://d2rcescxleu4fx.cloudfront.net/images/1098-T.webp

1098 T Form Printable Printable Forms Free Online

https://www.handytaxguy.com/wp-content/uploads/2018/12/1098-T-Tuition-Statement-Image.png

1098 T forms are issued by the university to students that made a payment for qualified tuition and fees during a given calendar year This form is to be used by the student to determine Learn what the IRS Form 1098 T is when and how to access it and how to use it for your tax returns Find answers to common questions about qualified tuition and related expenses

A form 1098 T Tuition Statement is used to help figure education credits and potentially the tuition and fees deduction for qualified tuition and related expenses paid during the tax year Learn how to use Form 1098 T a tuition statement from your college and Form 1099 Q a 529 distribution statement to claim education tax credits or report nonqualified

1098 Form 2023 Printable Forms Free Online

https://www.pvamu.edu/fmsv/wp-content/uploads/sites/37/1098-T-2023-image_cropped.png

Form 1098 T Everything You Need To Know Go TJC

https://go.tjc.edu/wp-content/uploads/2018/01/1098T.jpg

what is 1098t used for - Learn how to claim the American opportunity tax credit AOTC or the lifetime learning credit LLC for higher education expenses Find out what expenses qualify who is eligible and what