what is 1098 tax form An interest recipient including a recipient of points can designate a qualified person to file Form 1098 and to provide a statement to the payer of record

Learn how they could impact your taxes and when you might be required to file one with the IRS Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the company that services your mortgage loan If you

what is 1098 tax form

what is 1098 tax form

https://www.albionpleiad.com/wp-content/uploads/2019/04/1098-t-tax-forms-678x373.jpg

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Form 1098 is submitted to the IRS by lenders and other businesses to report mortgage interest payments of 600 or more Taxpayers receive a copy as well If you have a mortgage loan you ll get a Form 1098 from the loan company showing the interest expense that you paid in 2006 It may also show the real estate taxes paid if the loan company pays those taxes for you

An interest recipient including a recipient of points can designate a qualified person to file Form 1098 and to provide a statement to the payer of record A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage

More picture related to what is 1098 tax form

1098 T Form 2023 Printable Forms Free Online

https://busfin.osu.edu/sites/default/files/2021-1098-t.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

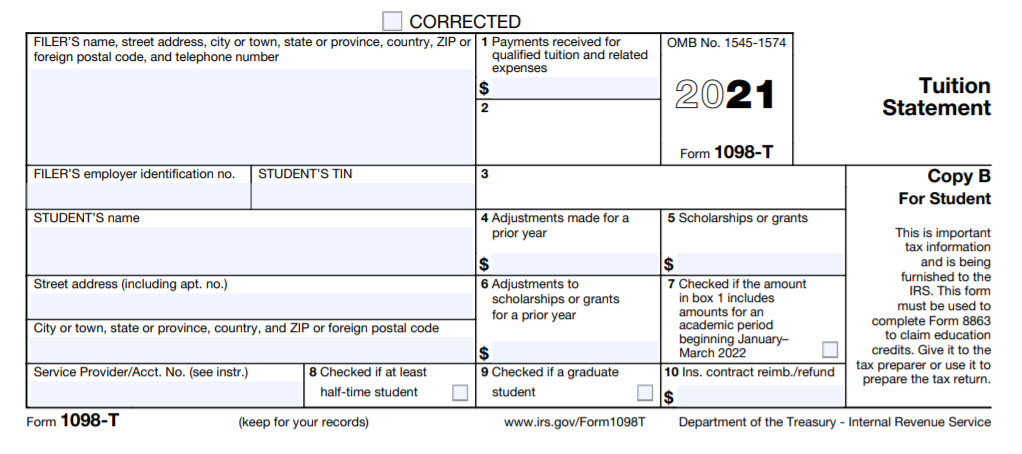

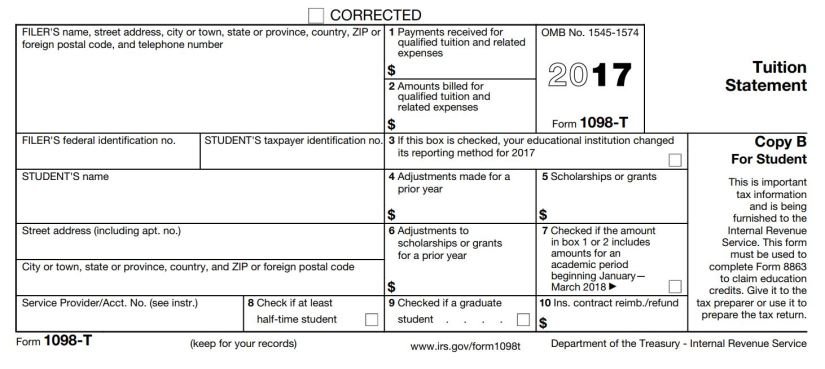

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

Read on to see what you need to report mortgage interest reported on your mortgage interest tax form the 1098 What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send Maintaining accurate tax records is crucial for understanding your business s profitability and providing necessary documentation in case of an audit

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year If you ve gone off to pursue higher education at an eligible educational institution you might find that you ll get a Form 1098 T in the mail if you paid tuition

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

what is 1098 tax form - An interest recipient including a recipient of points can designate a qualified person to file Form 1098 and to provide a statement to the payer of record