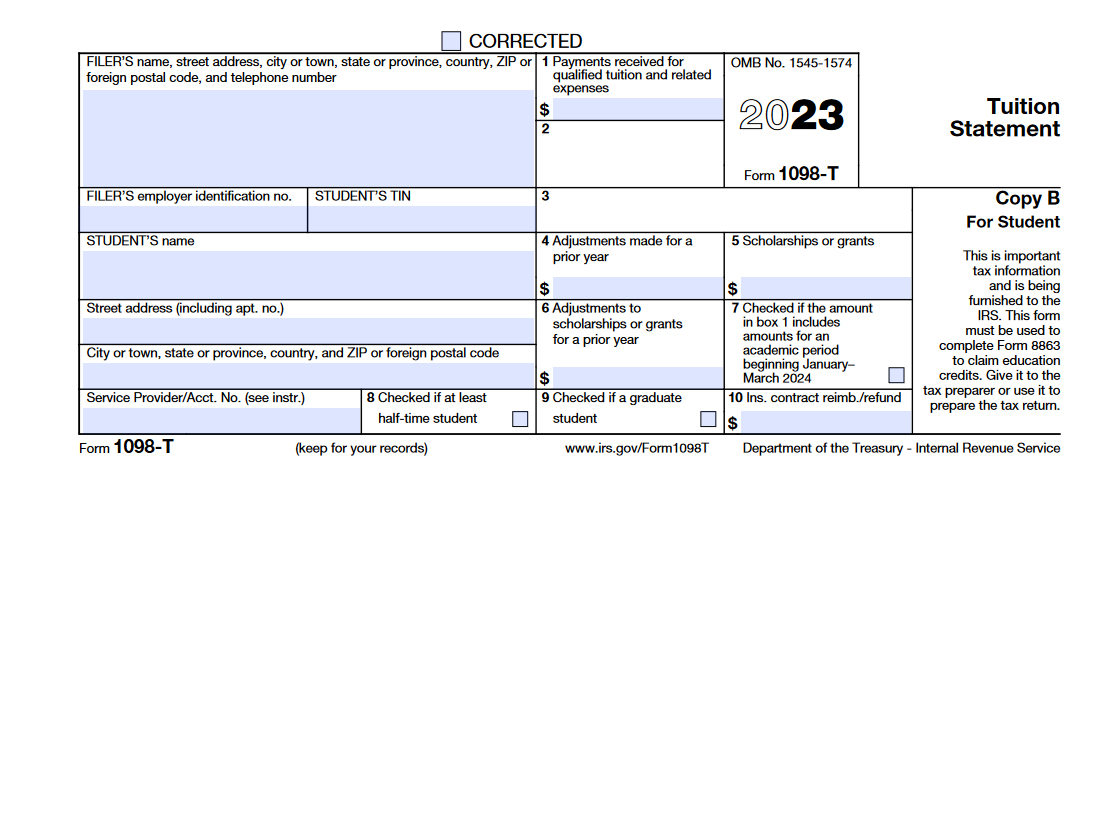

what is 1098 t tuition statement Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year

A form 1098 T Tuition Statement is used to help figure education credits and potentially the tuition and fees deduction for qualified tuition and related expenses paid during the tax year The To claim the lifetime learning credit complete Form 8863 and submitting it with your Form 1040 or 1040 SR

what is 1098 t tuition statement

what is 1098 t tuition statement

https://www.highline.edu/wp-content/uploads/2022/01/1098-t-7.png

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

As tax season approaches you may have already started receiving multiple documents to hand over to your tax preparer Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment and

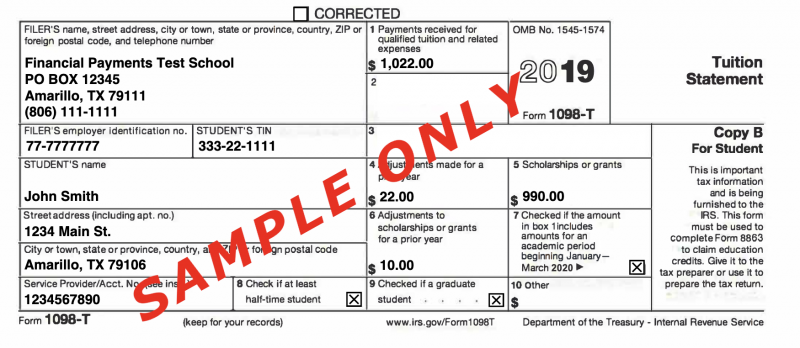

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the Box 7 The school will check this box if some of the tuition you paid in the tax year applied to an academic period that starts in the first quarter of the following year

More picture related to what is 1098 t tuition statement

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

Form 1098 T Quickly Securely File Tuition Statement Return

https://d2rcescxleu4fx.cloudfront.net/images/1098-T.webp

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

University X does not award Sarah credit toward a postsecondary degree on an academic transcript for the completion of the course but gives Sarah a certificate of attendance upon 11 rowsWhat is IRS Form 1098 T A college or university that received qualified tuition and related expenses on your behalf is required to file Form 1098 T above with the Internal Revenue Service IRS A copy of Form 1098

Discover answers to commonly asked questions about the 1098 T form and education related tax benefits The 1098 T also called your Tuition Statement is a form sent by us that helps you and the IRS determine if you re eligible to claim educational related tax credits like the American

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T Form How To Complete And File Your Tuition Statement

https://blog.pdffiller.com/app/uploads/2016/02/1098-T-form-tuition-statement.png

what is 1098 t tuition statement - As tax season approaches you may have already started receiving multiple documents to hand over to your tax preparer