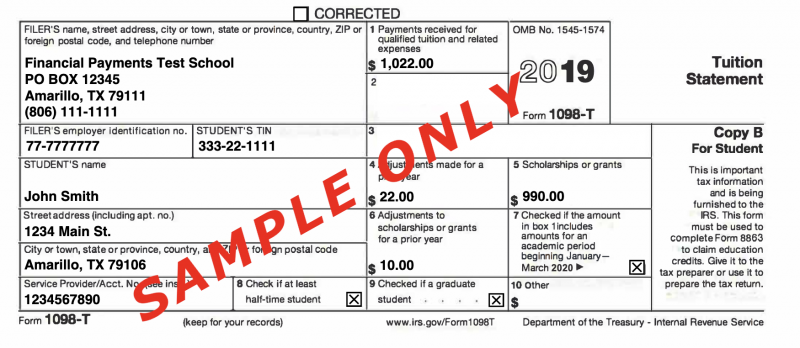

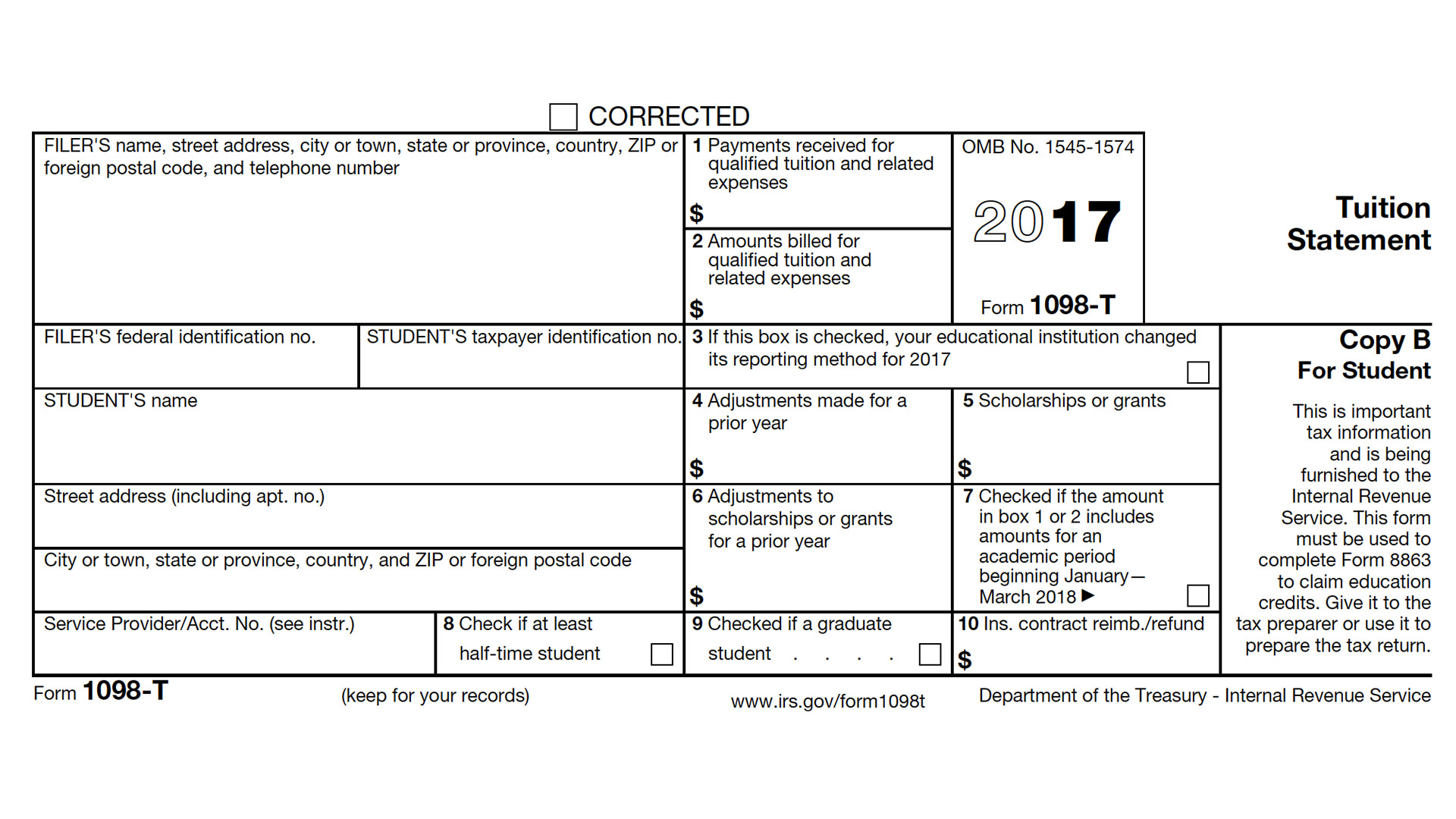

what is 1098 t tax form Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The

Among all of those docs you may notice a tax form called a 1098 T Don t be afraid by this document at all Form 1098 T is a Tuition Statement used to help you understand Form 1098 T Tuition Statement is an American IRS tax form filed by eligible education institutions or those filing on the institution s behalf to report payments received and payments due from the paying student The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses

what is 1098 t tax form

what is 1098 t tax form

https://www.albionpleiad.com/wp-content/uploads/2019/04/1098-t-tax-forms-678x373.jpg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

Why Form 1098 T is important to you It helps you identify eligible college expenses for valuable education credits up to 2 500 So do not discard this form What are the education tax With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the Specific Instructions for Form 1098 T File Form 1098 T Tuition Statement if you are an eligible educational institution You must file for each student you enroll and for whom a reportable

More picture related to what is 1098 t tax form

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Form 1098 T Everything You Need To Know Go TJC

https://go.tjc.edu/wp-content/uploads/2018/01/1098T.jpg

A 1098 T form or tuition statement is an American IRS tax form filed by eligible education institutions to report payments received and payments due from paying students The institution is required to report a form for every Form 1098 T contains helpful instructions and other information you ll need to claim education credits on your federal tax form These credits help offset your out of pocket expenses for tuition and fees books and equipment

Form 1098 T Tuition Statement explained Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any What is IRS Form 1098 T A college or university that received qualified tuition and related expenses on your behalf is required to file Form 1098 T above with the Internal Revenue

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

what is 1098 t tax form - The Form 1098 T is a statement that colleges and universities are required to issue to certain students It provides the total dollar amount paid by the student for what is referred to as