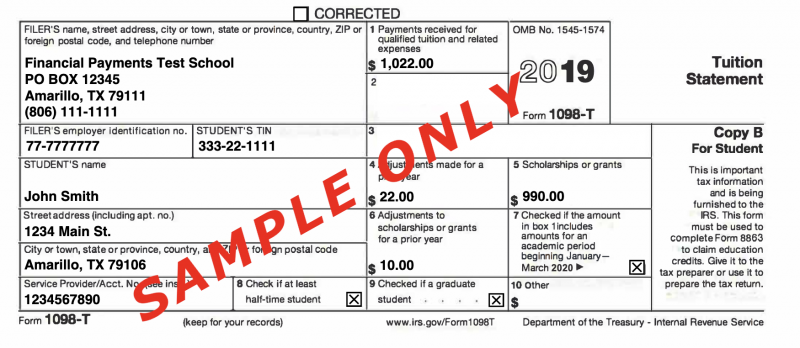

what is 1098 t form for school Schools are supposed to give a Form 1098 T to students by Jan 31 of the calendar year following the tax year in which the expenses were paid Here s what to know about this form and what to do with it when you file your

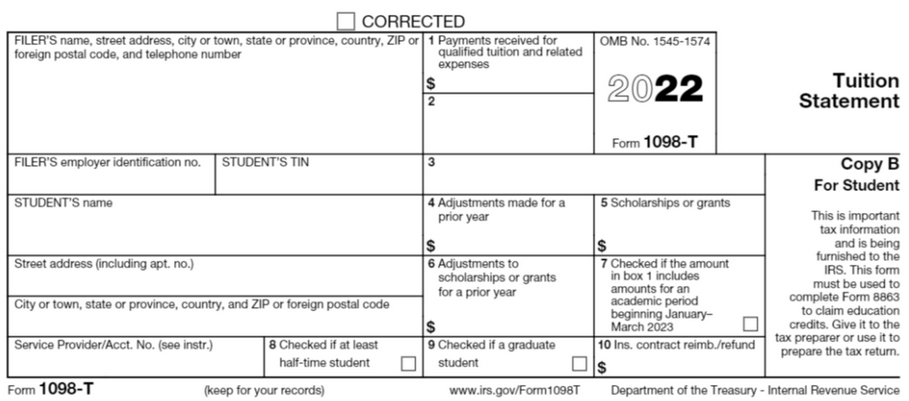

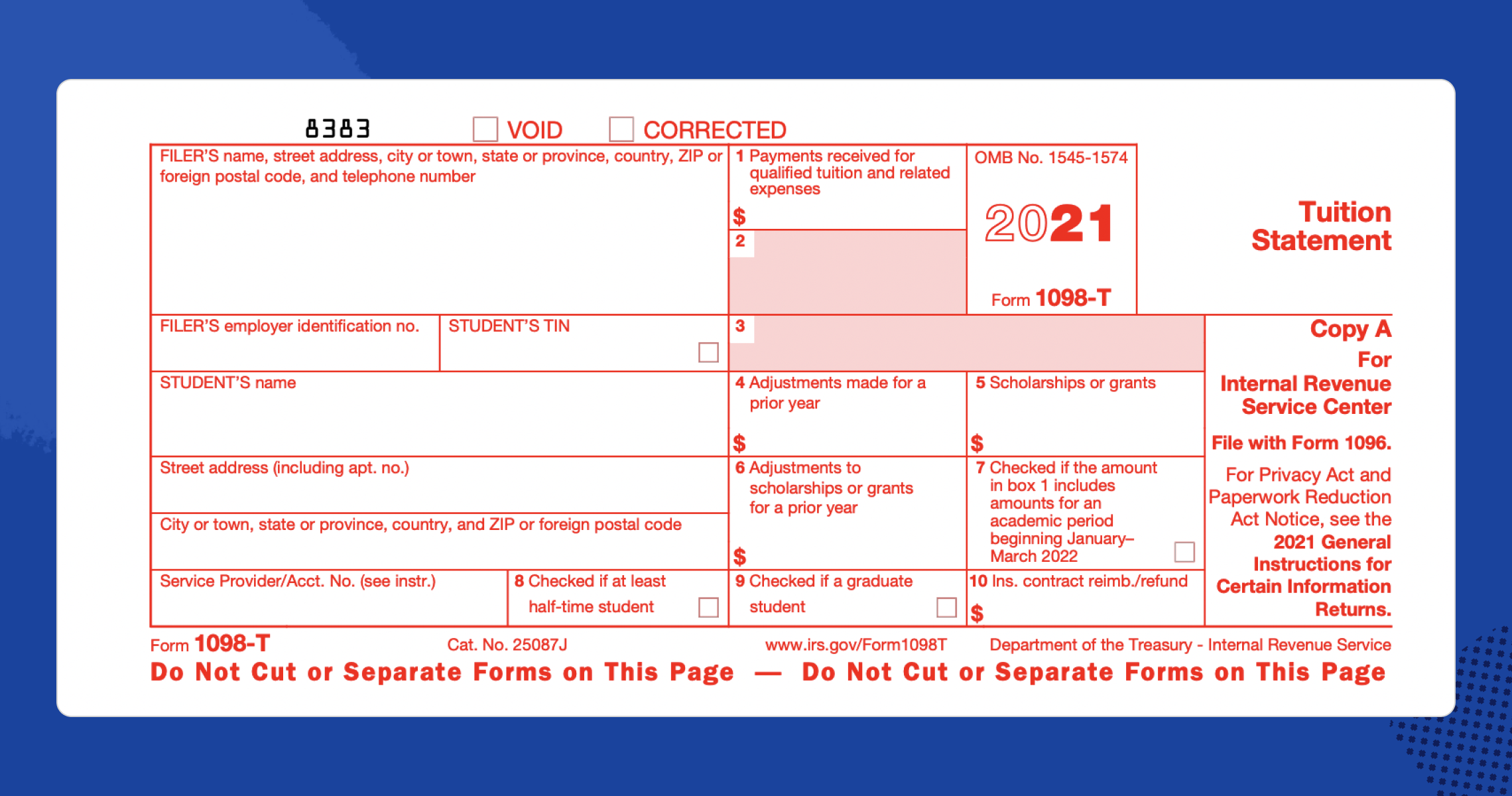

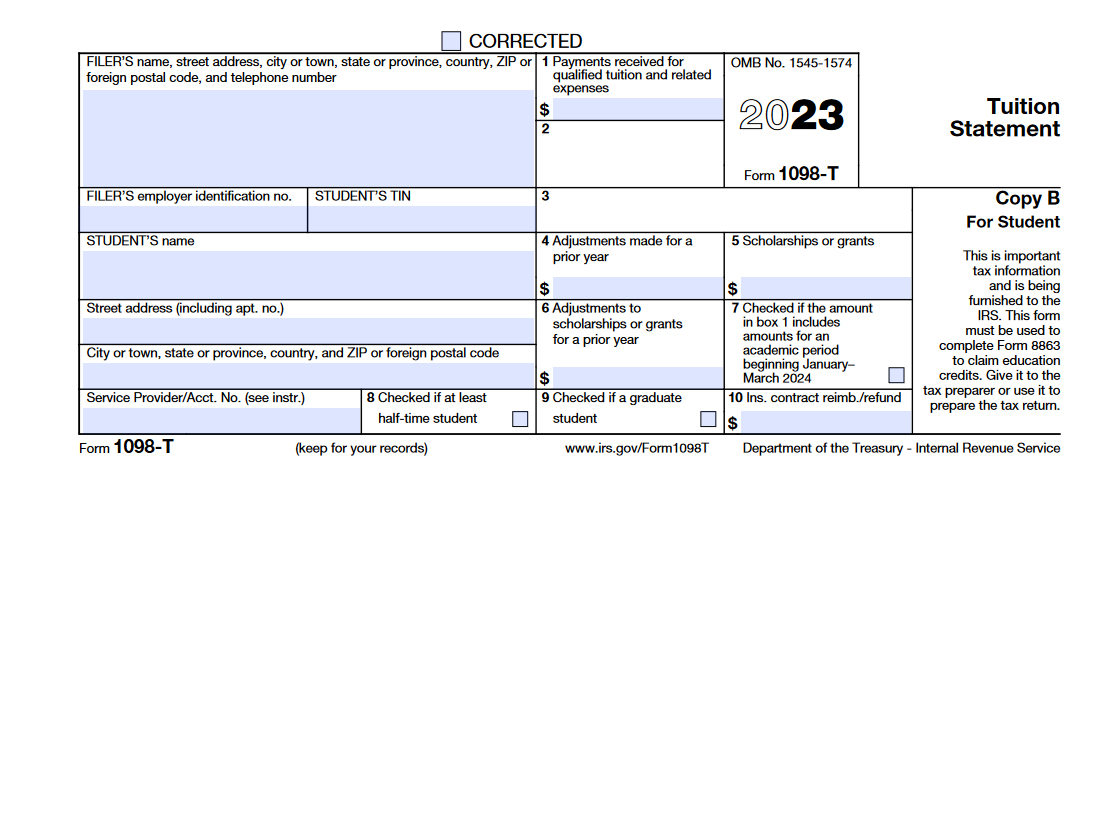

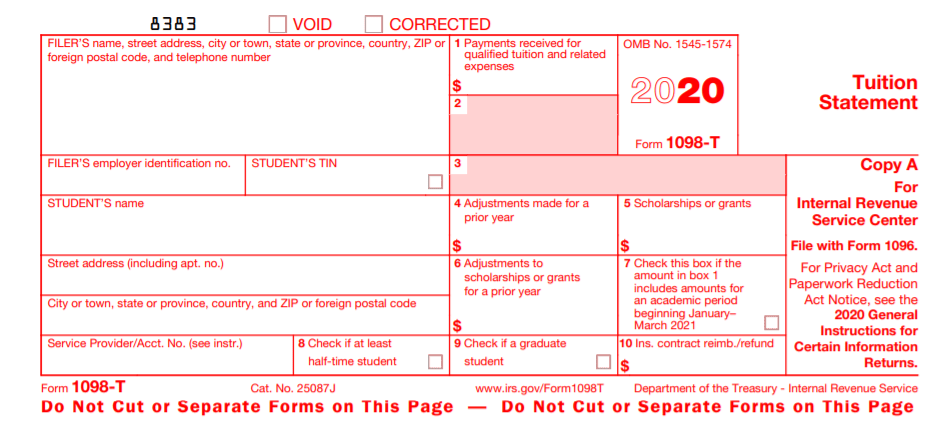

Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The The Form 1098 T is a form provided to you and the IRS by an eligible educational institution that reports among other things amounts paid for qualified tuition and related expenses The form

what is 1098 t form for school

what is 1098 t form for school

https://www.sunywcc.edu/CMS/wp-content/images/taxes-2022.jpg

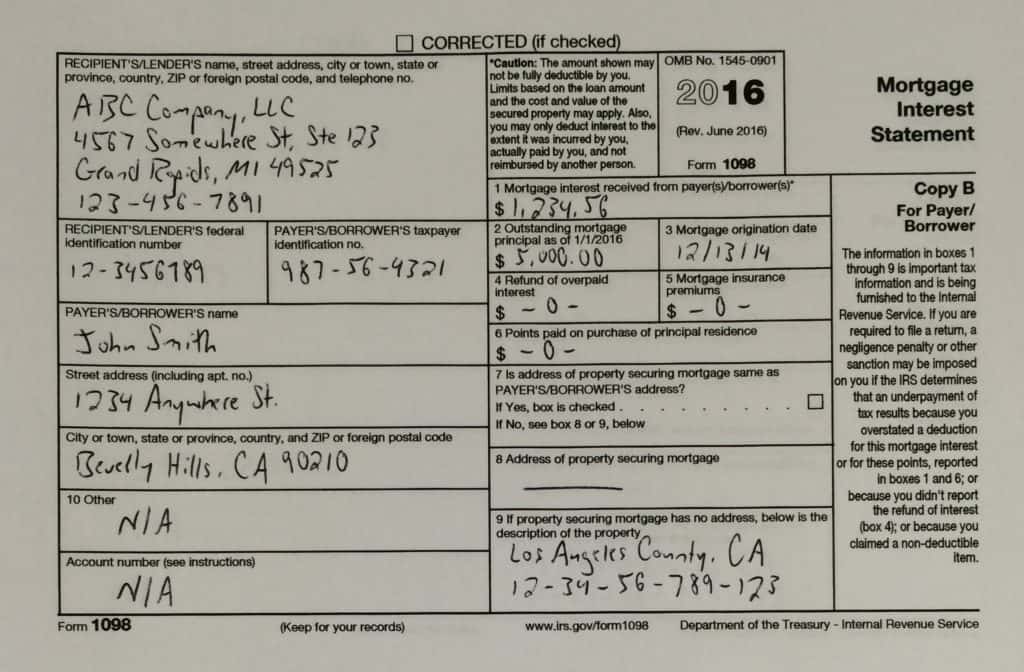

1098 T Form How To Complete And File Your Tuition Statement

https://blog.pdffiller.com/app/uploads/2016/02/1098-T-form-tuition-statement.png

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

Eligible educational institutions are required to issue students Form 1098 T Tuition Statement some exceptions apply Ask your school if it is an eligible educational institution or See if Michigan Tech is unable to provide tax advice regarding how to use Form 1098 T when filing your tax return You should consult your tax professional to determine whether you meet all the

The 1098 T Tuition Statement form reports tuition expenses you paid for college tuition that might entitle you to an adjustment to income or a tax credit Information on the The Form 1098 T is a statement that colleges and universities are required to issue to certain students It provides the total dollar amount paid by the student for what is referred to as

More picture related to what is 1098 t form for school

1098 T Form Printable Printable Forms Free Online

https://www.handytaxguy.com/wp-content/uploads/2018/12/1098-T-Tuition-Statement-Image.png

Form 1098 T Quickly Securely File Tuition Statement Return

https://d2rcescxleu4fx.cloudfront.net/images/1098-T.webp

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

Students receive a form 1098 T that is generated by the university in order to claim certain educational credits While Cornell staff are not legally able to provide tax advice because each student s circumstances will be different we can In January of each year The New School provides a 1098 T Tax Form to all eligible students who had qualified tuition and other related educational expenses billed to them during the previous

For the 2012 tax year a students 1098 T may include amounts billed for Spring 2012 Summer 2012 Fall 2012 and Spring 2013 depending on when the student registered for courses In Form 1098 T contains helpful instructions and other information you ll need to claim education credits on your federal tax form These credits help offset your out of pocket expenses for

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

what is 1098 t form for school - Form 1098 T is an IRS form issued to qualified students by a school to report for each student the payments received for all qualified tuition and related expenses made during a calendar