what is 1098 t for international students Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for

Students and their families who file income taxes in the United States can use the Form 1098 T as an informational tax document used to determine eligibility for income tax credits based In general a student must receive a Form 1098 T to claim an education credit But an eligible educational institution is not required to provide the Form 1098 T to you in certain

what is 1098 t for international students

what is 1098 t for international students

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

1098T Information Student And Departmental Account Services Lewis

https://www.lclark.edu/live/image/gid/192/width/1260/height/630/crop/1/76439_1098-T.rev.1546985588.jpg

What is the 1098 T form Tuition paying students at eligible colleges or other post secondary institutions should receive a copy of Internal Revenue Service Form 1098 T from their school each year If you re a college student or parent of a college student you may be eligible for an education credit Most students receive a Form 1098 T Tuition Statement from their educational

1098 T Tax Form Most international students are not eligible to claim education tax credits with the U S Internal Revenue Service International students who may be eligible are permanent Full time international students who are considered US residents for tax purposes may request a 1098 T form See information on establishing a presence in the USA to be considered a US resident for tax purposes at IRS

More picture related to what is 1098 t for international students

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

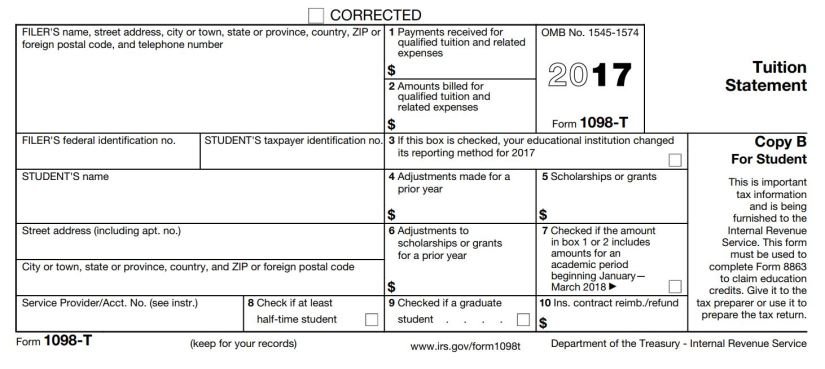

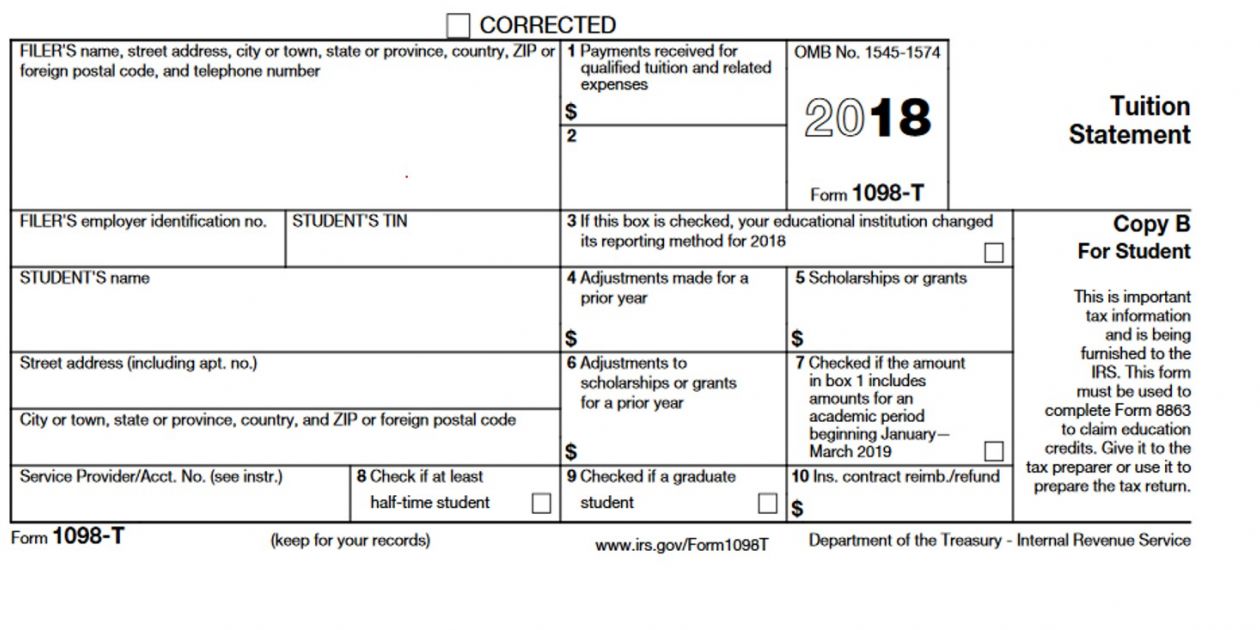

Form 1098 T is a tuition statement unlike the W 2 which is an income statement that reports the amount paid toward qualified tuition and related expenses during a given calendar year 11 rowsWhat is IRS Form 1098 T A college or university that received qualified tuition and related expenses on your behalf is required to file Form 1098 T above with the Internal Revenue Service IRS A copy of Form 1098 T must

In this article we will explain what the 1098 T form is who gets it and when and how it affects your taxes What is Form 1098 T Tuition Statement The 1098 T form serves Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

what is 1098 t for international students - What is the 1098 T form Tuition paying students at eligible colleges or other post secondary institutions should receive a copy of Internal Revenue Service Form 1098 T from their school each year