what is 1098 f form used for The appropriate official of a government or governmental entity including a nongovernmental entity treated as a governmental entity must file Form 1098 F Fines

The IRS Form 1098 F is used to report fines penalties and other amounts paid to the government for violating the law If you re a business or individual that has paid these Who Must File The appropriate official of a government or governmental entity including a nongovernmental entity treated as a governmental entity must file Form 1098 F Fines

what is 1098 f form used for

what is 1098 f form used for

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

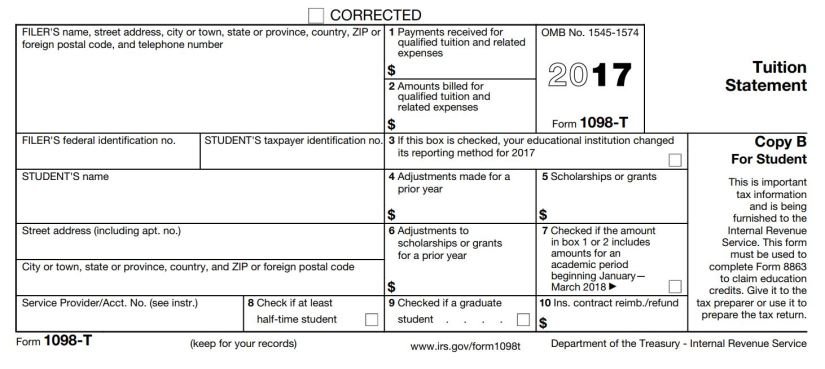

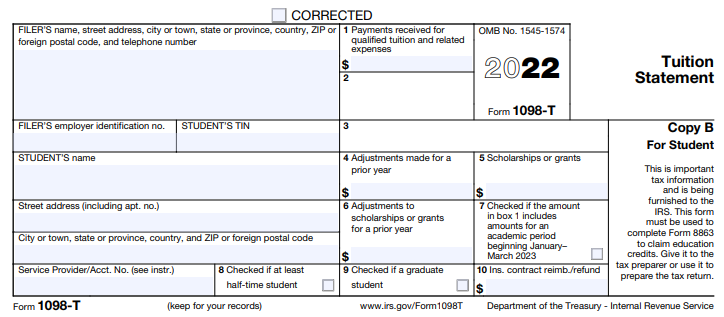

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

The Internal Revenue Service created IRS Form 1098 F to report these payments In this article we ll walk through everything you need to know about IRS IRS has issued new form 2019 Form 1098 F and the instructions to that form The new form is used to comply with a section of the Tax Cuts and Jobs Act TCJA that requires

The instructions to the newly released 2019 IRS Form 1098 F are used to comply with a section of the Tax Cuts and Jobs Act TCJA that requires government Under federal law state government agencies including the Texas Comptroller of Public Accounts must file a Form 1098 F with the IRS to report each final determination

More picture related to what is 1098 f form used for

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest Form 1098 F Fines Penalties and Other Amounts If you paid any court ordered fines penalties restitution or remediation information about your payment is included on this form But these types

Form 1098 Mortgage Interest Statement is an Internal Revenue Service IRS form used by taxpayers to report the amount of interest and related expenses paid A 1098 F form is required for government or governmental entity and certain nongovernmental entities to report certain fines penalties and other amounts

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

1098 T Form 2023 Printable Forms Free Online

https://www.rollins.edu/student-account-services/1098t-information/2022-1098-t.png

what is 1098 f form used for - Under federal law state government agencies including the Texas Comptroller of Public Accounts must file a Form 1098 F with the IRS to report each final determination