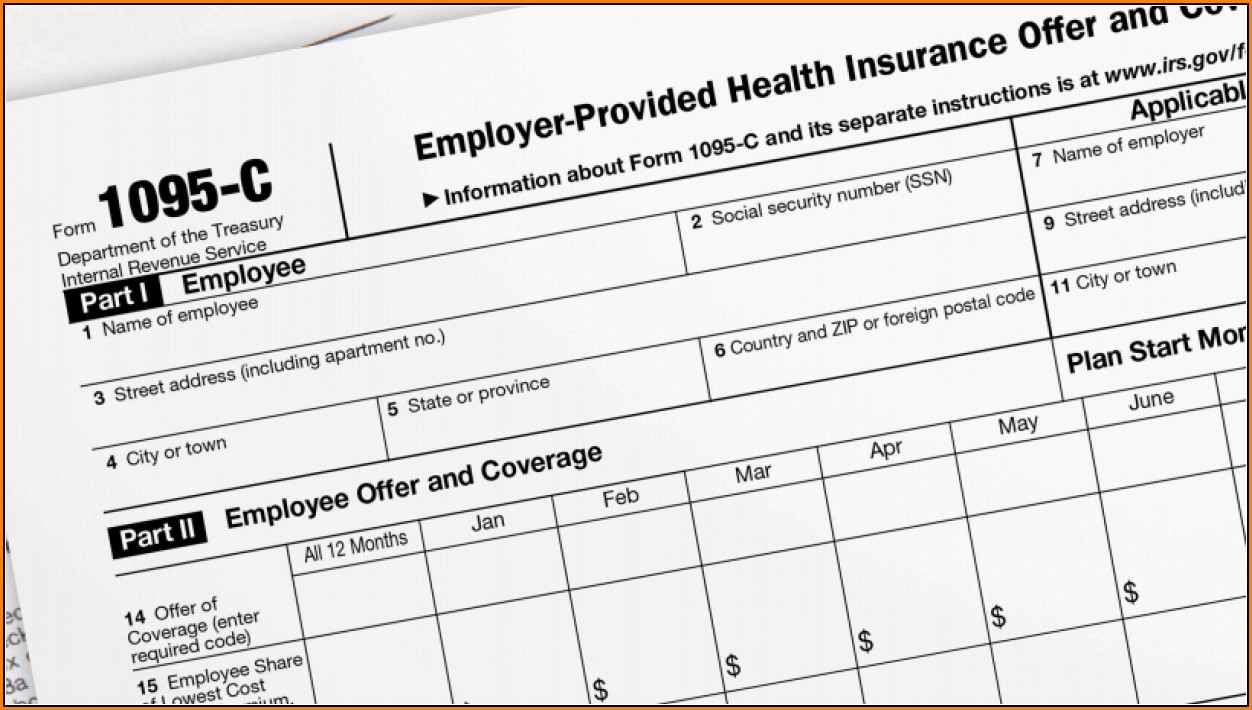

what is 1095 c form 2022 Information about Form 1095 C Employer Provided Health Insurance Offer and Coverage including recent updates related forms and instructions on how to file

Form 1095 C titled Employer Provided Health Insurance Offer and Coverage is a statement of health coverage offered to eligible employees Sending out Tax Year 2022 Forms 1094 B 1095 B 1094 C and 1095 C Affordable Care Act Information Returns AIR Release Memo XML Schemas and Business Rules Version 1 0

what is 1095 c form 2022

what is 1095 c form 2022

https://www.macomptroller.org/wp-content/uploads/img_sidebar_1095c.jpg

1095 C Form Form Resume Examples qdjVaQVJkl

http://www.contrapositionmagazine.com/wp-content/uploads/2018/09/1095-c-form.jpg

Mastering Form 1095 C The Essential Guide The Boom Post

https://blog.boomtax.com/wp-content/uploads/2022/06/Form-1095-C-Image-with-Border.png

IRS Form 1095 C is a form large employers must use to report employee healthcare coverage and requirements Learn how it works and which businesses qualify The Form 1095 C indicates whether you and your eligible dependents were covered and contains information about your Harvard healthcare coverage You will need this

Form 1094 C is used as a transmittal for the purpose of filing Forms 1095 C with the IRS You need to be aware of three deadlines March 2 2022 This is the Employers provide Form 1095 C employee statement to employees and file copies along with Form 1094 C transmittal form to the IRS Form 1095 C is comprised of three

More picture related to what is 1095 c form 2022

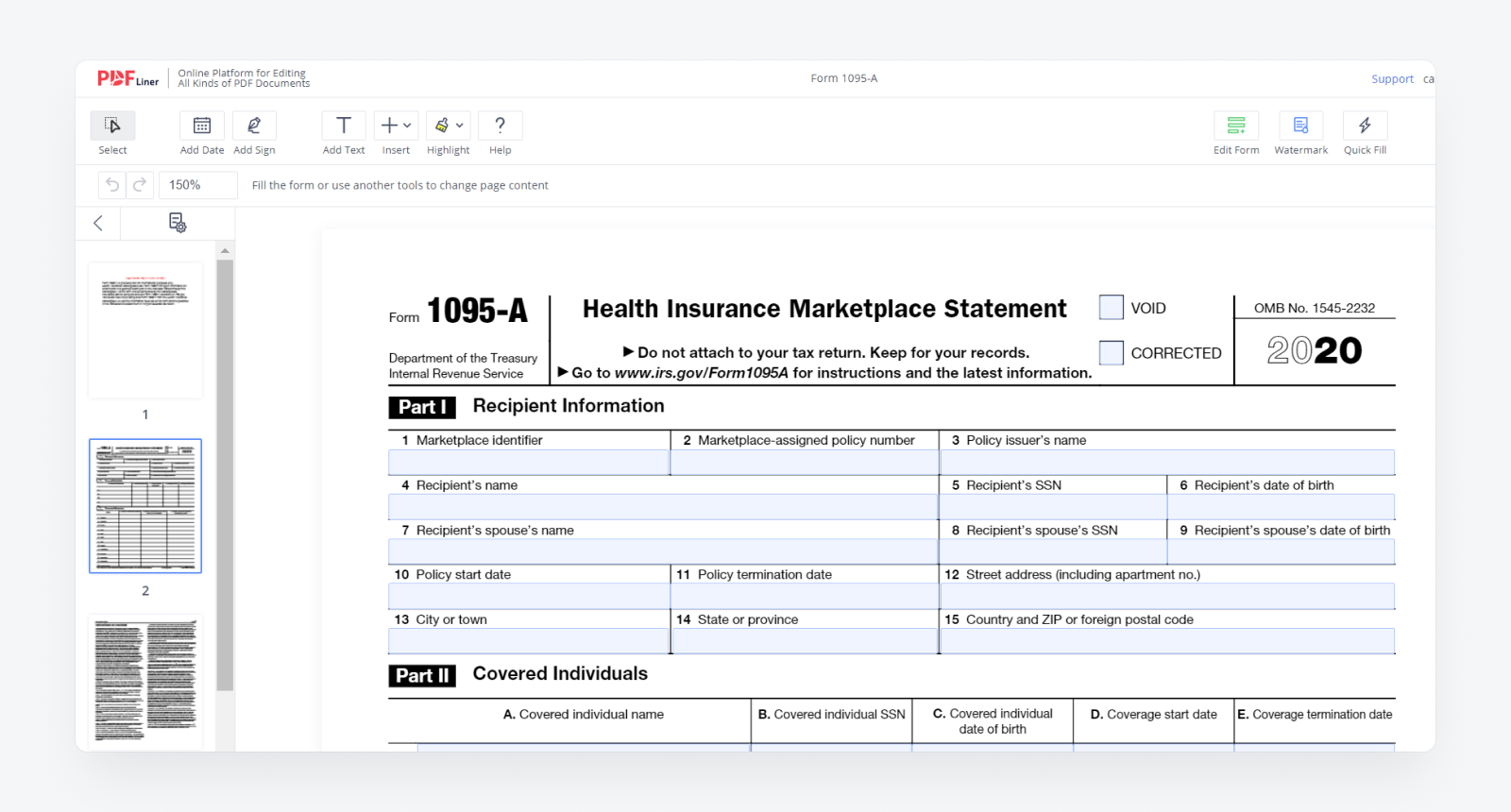

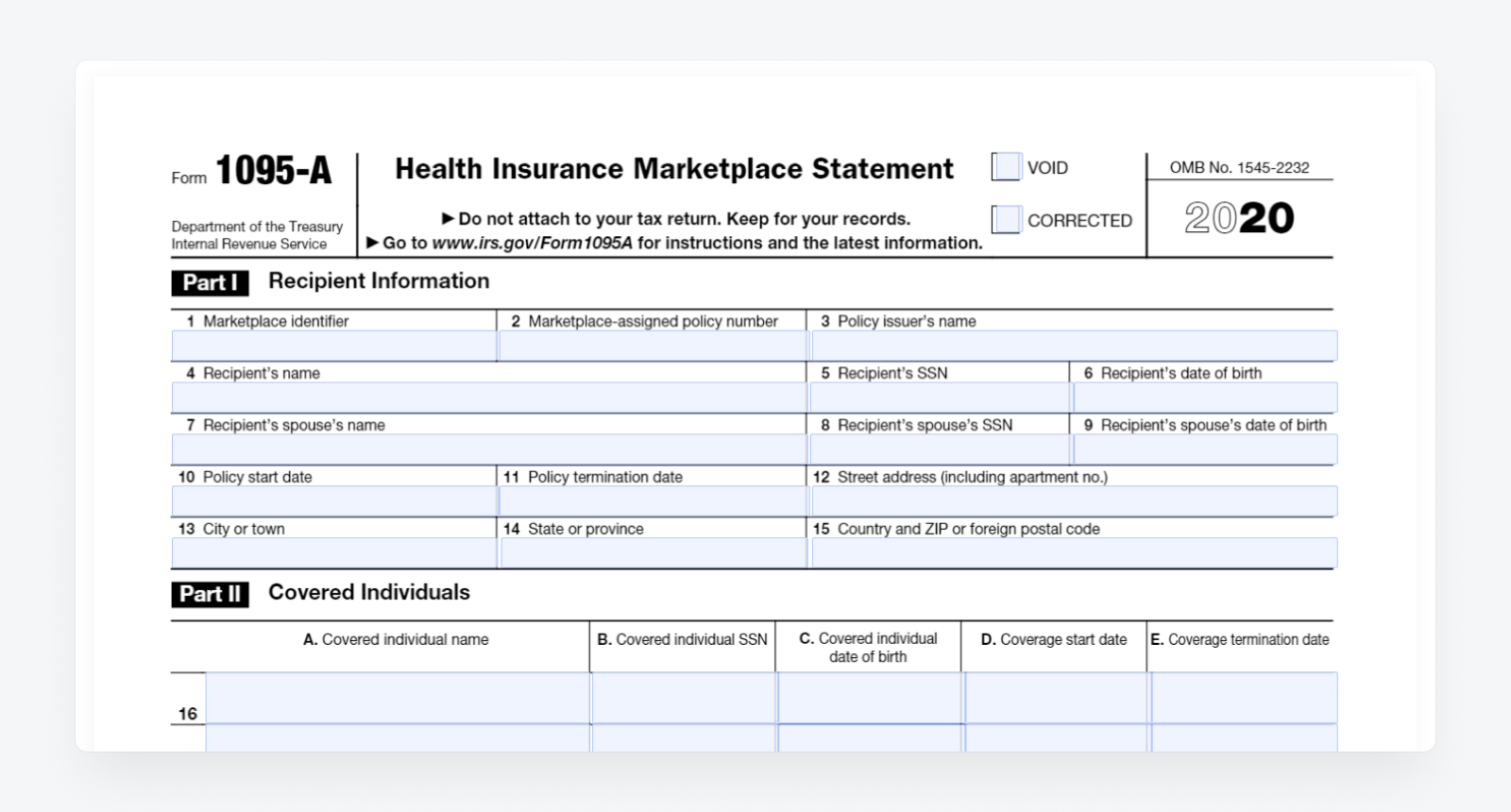

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild6536-3761-4039-a239-346663353333__how-to-fill-out-form.png

What Is Form 1095 B And Is It Necessary To File Taxes GoodRx

https://images.ctfassets.net/4f3rgqwzdznj/1T78IaGMbkkrcYgsE4zKSJ/0e3b9902726a759ddbd03876f4ac4152/filing_out_forms_doctors-1312745201__1_.jpg

Instructions For Form 1095 A And How To Fill Out It PDFliner

https://blog.pdfliner.com/howTo/img/tild3830-3336-4662-b234-616236653764__how-to-get-form-1095.png

The 1095 C form Employer Provided Health Insurance Offer and Coverage Insurance is issued to employees by companies with 50 or more full time employees This form states the health insurance coverage the Form 1094 C must be used to report to the IRS summary information for each Applicable Large Employer ALE Member defined below and to transmit Forms 1095 C to the

Form 1095 A 1095 B and 1095 C are tax forms that are used to report health insurance coverage to enrollees and to the IRS These forms came about as a Both Form 1095 B and Form 1095 C are IRS information returns used by employers to report health coverage information about covered individuals

Sample 1095 1094 ACA Forms

https://www.halfpricesoft.com/aca-1095/images/form_1095B.jpg

Formulario 1095 A Actualizado Septiembre 2023

https://unformulario.com/wp-content/uploads/2022/01/formulario-1095-a.png

what is 1095 c form 2022 - Instead of borrowing form their retirement plan employees could build up savings in an emergency savings accounts and tap these accounts when needed